Let us first understand what working capital is. Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern. It also represents the exceRead more

Let us first understand what working capital is.

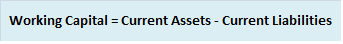

Working capital means the funds available for the day-to-day operations of an enterprise. It is a measure of a company’s liquidity and short term financial health. They are cash or mere cash resources of a business concern.

It also represents the excess of current assets, such as cash, accounts receivable and inventories, over current liabilities, such as accounts payable and bank overdraft.

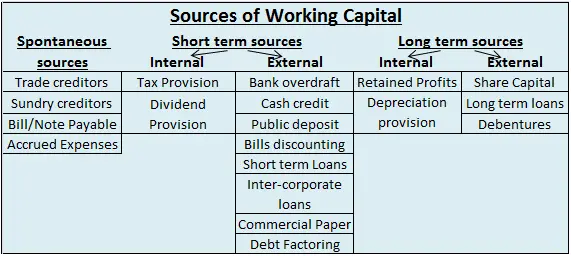

Sources of Working Capital

Any transaction that increases the amount of working capital for a company is a source of working capital.

Suppose, Amazon sells its goods for $1,000 when the cost is only $700. Then, the difference of $300 is the source of working capital as the increase in cash is greater than the decrease in inventory.

Sources of working capital can be classified as follows:

Short Term Sources

- Trade credit: Credit given by one business firm to the other arising from credit sales. It is a spontaneous source of finance representing credit extended by the supplier of goods and services.

- Bills/Note payable: The purchaser gives a written promise to pay the amount of bill or invoice either on-demand or at a fixed future date to the seller or the bearer of the note.

- Accrued expenses: It refers to the services availed by the firm, but the payment for which is yet to be done. It represents an interest-free source of finance.

- Tax/Dividend provisions: It is a provision made out of current profits to meet the tax/dividend obligation. The time gap between provision made and payment of actual payment serves as a source of short-term finance during the intermediate period.

- Cash Credit/Overdraft: Under this arrangement, the bank specifies a pre-determined limit for borrowings. The borrower can withdraw as required up to the specified limits.

- Public deposit: These are unsecured deposits invited by the company from the public for a period of six months to 3 years.

- Bills discounting: It refers to an activity wherein a discounted amount is released by the bank to the seller on purchase of the bill drawn by the borrower on their customers.

- Short term loans: These loans are granted for a period of less than a year to fulfil a short term liquidity crunch.

- Inter-corporate loans/deposits: Organizations having surplus funds invest with other organizations for up to six months at rates higher than that of banks.

- Commercial paper: These are short term unsecured promissory notes sold at discount and redeemed at face value. These are issued for periods ranging from 7 to 360 days.

- Debt factoring: It is an arrangement between the firm (the client) and a financial institution (the factor) whereby the factor collects dues of his client for a certain fee. In other words, the factor purchases its client’s trade debts at a discount.

Long Term Sources

- Retained profits: These are profits earned by a business in a financial year and set aside for further usage and investments.

- Share Capital: It is the money invested by the shareholders in the company via purchase of shares floated by the company in the market.

- Long term loans: These loans are disbursed for a period greater than 1 year to the borrower in his account in cash. Interest is charged on the full amount irrespective of the amount in use. These shareholders receive annual dividends against the money invested.

- Debentures: These are issued by companies to obtain funds from the public in form of debt. They are not backed by any collateral but carry a fixed rate of interest to be paid by the company to the debenture holders.

Another point I would like to add is that, although depreciation is recorded in expense and fixed assets accounts and does not affect working capital, it still needs to be accounted for when calculating working capital.

See less

Let us begin with a short explanation of what opening balance is: The opening balance is the amount of funds that are bought forward from the end of one accounting period to the beginning of a new accounting period. In a firm’s account, the first entry done is of the opening balance. It can either hRead more

Let us begin with a short explanation of what opening balance is:

The opening balance is the amount of funds that are bought forward from the end of one accounting period to the beginning of a new accounting period.

In a firm’s account, the first entry done is of the opening balance. It can either have a debit balance or a credit balance depending upon whether the firm has a negative or positive balance.

Opening balance of a ledger

Opening balance is the first entry of the ledger account at the beginning of an accounting period.

In the case of a newly started business, there will be no closing balances and as such there will be no balances to be carried forward. In such a case, the investment and capital of the business will be entered as an opening balance for the current accounting period.

So the first and foremost part is to identify on which side of the ledger i.e. the debit side or the credit side the opening balance is to be entered.

For Example, A trial balance is given which represents the debit and credit balances, accordingly, I will prepare different ledger accounts to make it simpler.

As the Furniture is an Asset account, the opening balance will be on the debit side of the ledger account.

As Sundry creditor is a credit account, we put the opening balance on the credit side.

As the Capital is a credit account, we put the opening balance on the credit side.

As Wages is a debit account, we put the opening balance on the debit side.

As the Discount received is a credit account, we put the opening balance on the credit side.

Exception

Drawing Account.

Drawing account is an exception to this topic. It is considered a contra account to the owner’s capital account because it reduces the value of the owner’s equity. Drawings, therefore, have no opening balance.

Contra Entry.

Contra entry involves transactions of cash and bank. Any entry which involves both the cash and bank is contra entry.

For example, we deposit cash 5000 into the bank.

Accounting entry for this transaction would be

In this case, the ledger entry would be

As the bank account has a debit balance, the opening balance would come on the debit side.

As the cash account has a credit balance, the opening balance would come on the credit side.

Alternatively, If we withdraw cash 5000 from the bank.

Accounting entry would be

In this case, the ledger entry would be

As the Cash account has a debit balance, the opening balance would come on the debit side.

As the Bank account has a credit balance, the opening balance would come on the credit side.

See less