Miscellaneous expenditure in the balance sheet The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as MiRead more

Miscellaneous expenditure in the balance sheet

The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as Miscellaneous expenditure.

Miscellaneous expenditure are those expenses that are not categorized as Operating expenses i.e. these are not classified as manufacturing, selling, and administrative expenses.

For example, BlackRock has spent 5,00,000 which will be written of in 5 consecutive years as an Advertisement expense. During the current financial year, only 1,00,000 will be written off and the rest will be carried to the next year and year thereafter.

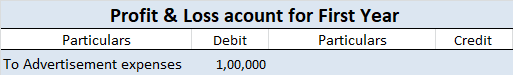

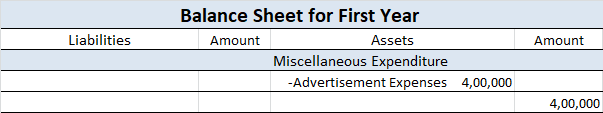

Treatment in the first year:

- 1,00,000 which is written off during the current financial year will be shown on the debit side of the Profit and Loss account.

- 4,00,000 which is carried forward will be shown on the assets side of the balance sheet as miscellaneous expenditure because all assets and expenses have a debit balance.

Treatment in the second year:

- 1,00,000 which is written off during the current financial year will be shown on the debit side of the Profit and Loss account.

- 4,00,000 which is carried forward will be shown in the assets side of the balance sheet as a miscellaneous expenditure.

The same will be done in the third, fourth, and fifth years.

Conclusion

Deferred revenue expenditure is also a long-term expenditure the benefit of which cannot be derived within the same year. So the amount that is written off during the current year is shown on the debit side of the profit and loss account and the amount which is not written off during the current financial year is shown on the assets side under the head Miscellaneous expenditure.

See less

Classified under advance income, Interest received in advance is unearned income that pertains to the following accounting period but is received in the current period. Such interest is not related to the current accounting period and the related benefits for such income are yet to be provided. HencRead more

Classified under advance income, Interest received in advance is unearned income that pertains to the following accounting period but is received in the current period. Such interest is not related to the current accounting period and the related benefits for such income are yet to be provided. Hence, it is a liability for the concern.

The treatment of such advance interest is based on the Accrual concept of accounting.

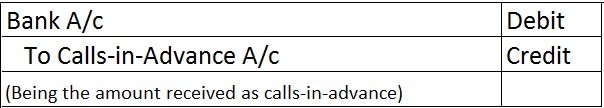

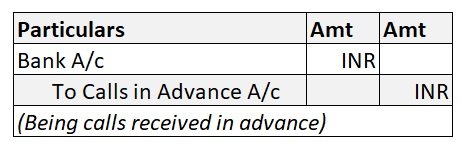

The journal entry for interest received in advance is:

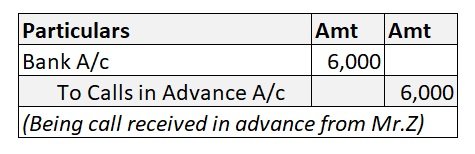

Now suppose, a firm Star shine receives interest on loan of 5,00,000 @ 7% p.a. extended to another firm. In the current accounting period, Star shine receives 50,000 as interest, excess being advance for the following year. Then the following journal entries should be passed:

Cash received in form of interest is debited (Debit what comes in) and interest account is credited because of an increase in interest income (credit all incomes and gains).

Interest account is debited because we have to decrease the interest income since 15,000 relates to the next accounting year. Interest received in advance is credited because such interest of 15,000 is not yet earned and is a liability for the concern.

See less