The correct option is Option C: Journal Entries. Journal entries are the primary entries in the books of accounts and they are passed when any transaction or event takes place. Every journal entry has a dual effect i.e. two or more accounts are affected. For example, When cash is introduced in the bRead more

The correct option is Option C: Journal Entries.

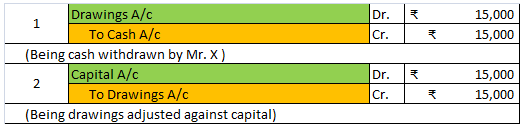

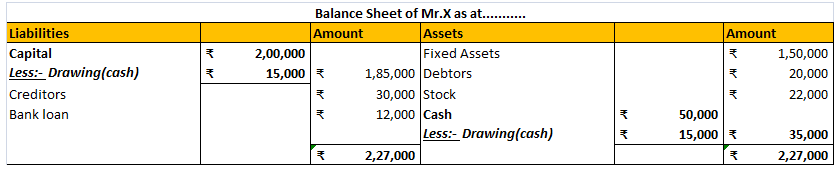

Journal entries are the primary entries in the books of accounts and they are passed when any transaction or event takes place. Every journal entry has a dual effect i.e. two or more accounts are affected.

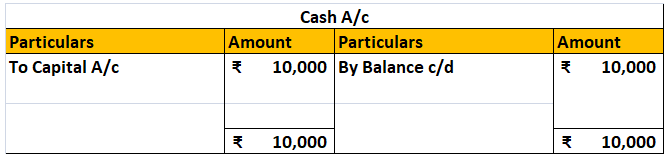

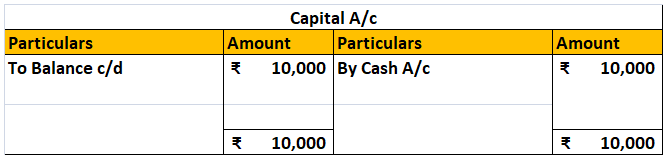

For example, When cash is introduced in the business, the journal entry passed is:

Cash A/c Dr. ₹10,000

To Capital A/c ₹10,000

The accounts affected here are Cash A/c and Capital A/c.

Cash A/c gets debited by ₹10,000,

and Capital A/c get credited by ₹10,000.

All the processes of accounting are conducted in an ordered manner known as the accounting cycle.

The first step in an accounting cycle is to identify the transactions and events which are monetary in nature.

The second step is to record the identified transactions in form of journal entries.

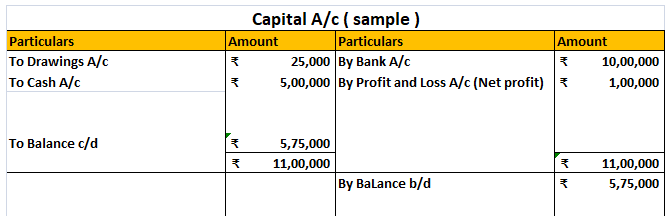

And the third step is to make postings in the general ledger accounts as per the journal entries.

Hence, the preparation of the ledger is the third step in the accounting cycle and is prepared from the journal entries.

See less

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you alreadRead more

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you already paid on purchase and pay only the balance amount.

EXAMPLE

Suppose Ashok purchased goods worth Rs 100 while paying tax at 10%, that is Rs 10. He now sold the goods for Rs 200, with a tax payable of Rs 20. Now, Ashok can avail input tax credit of Rs 10 that he already paid for the purchase and hence the net tax payable is Rs 10 (20-10).

METHOD OF UTILISATION OF ITC

The central government collects CGST, SGST, UTGST or IGST based on whether the transactions are done intrastate or interstate.

The amount of input tax credit on IGST is first used for paying IGST and then utilised for the payment of CGST and SGST or UTGST. Similarly, the amount of ITC relating to CGST is first utilised for payment of CGST and then for the payment of IGST. It is not used for the payment of SGST or UTGST. Meanwhile, the amount of ITC relating to SGST is utilised for payment of SGST or UTGST and then for the payment of IGST. Such amounts are not used for payment of CGST.

We can see how Input Tax Credit is used from the below example and table:

See less