Capital Expense Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in natureRead more

Capital Expense

Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in nature.

Revenue Expenses

Revenue expenses are incurred to carry on operations of an entity during an accounting period. Such expenses help in maintaining the revenue earning capacity of the business and are recurring in nature.

These include ordinary repair and maintenance costs necessary to keep an asset working without any substantial improvement that leads to an increase in the useful life of the asset.

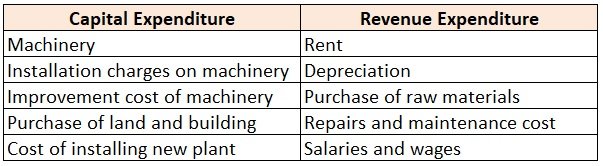

Suppose, company Takeaway ltd. purchases machinery for 50,000 and pays installation charges of 10,000. Salary of 15,000 is paid to the employees and existing machinery is painted costing 8,000. Here, the cost of machinery 50,000 and installation charges of 10,000 are treated as capital expenditure and the salary of 15,000 and painting cost of 8,000 is treated as revenue expenditure.

Identification

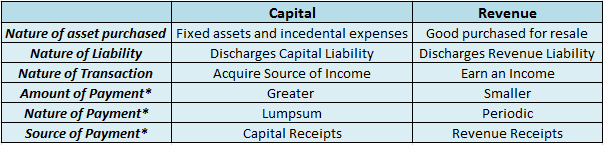

Points to categorize an expenditure as Capital or Revenue are as follows:

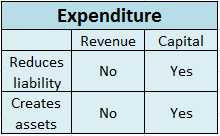

- An expenditure that neither creates assets nor reduces liability is categorized as revenue expenditure. If it creates an asset or reduces a liability, it is categorized as capital expenditure.

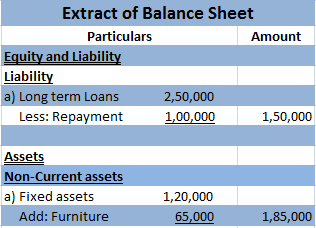

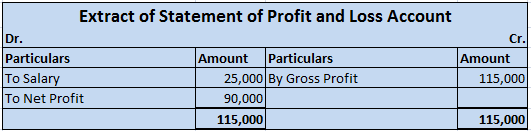

For example, a company Motors ltd. purchases furniture for 65,000, repays loans amounting to 1,00,000 and pays salary of 25,000.

Here the company creates an asset of 65,000 and reduces liability by 1,00,000 as shown below and therefore is considered as capital expenditure.

However, payment of salaries neither creates assets nor reduces liability. It only reduces profits and therefore is considered as revenue expenditure.

- Usually, the amount of capital expenditure is larger than that of revenue expenditure. But it is not necessary that if the amount is small it is revenue expenditure and if the amount is large, it is a capital expenditure.

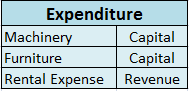

For example, a company Stars ltd purchases machinery for 1,20,000, furniture for 35,000 and has a rental expense of 80,000.

Here, the purchase of machinery is capital expenditure since it results in higher expense. However, the purchase of furniture cannot be regarded as a revenue expense and payment of rent cannot be regarded as a capital expense only because the rental expense is higher than the amount expended for the purchase of furniture.

- Usually, capital expenditure is not frequent and is made at a time, in lump sum. On the other hand, revenue expenditure is paid periodically. However, it is possible that capital expenditure is paid in installments.

For example, a company Caps ltd. purchases land for 1,00,00,000 on an equal monthly installment basis. Then such payments cannot be considered as revenue expense only because the payments are recurring. Since the installments are paid in lieu of the purchase of land which is a long term asset, the payments will be considered as capital expenditure.

- Mostly capital expenditures are met out of capital whereas revenue expenditures are met out of revenue receipts. However, payments can be made vice-versa.

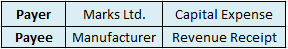

- If an expenditure is incurred by the payer as a capital expenditure, it will remain a capital expenditure even if the amount may be revenue receipt in the hands of the payee.

For example, a company Marks Ltd. purchases machinery directly from the manufacturer for 50,000. For the manufacturer, the proceeds from the sale of machine are revenue in nature but the amount expended by Marks Ltd. will be categorized as capital expenditure.

Following conclusion can be inferred from the above explanation:

*Such transactions may or may not hold true as explained above.

See less

Let me first explain the meaning of both the terms CapEx and OpEx Capital expenditure (in short CapEx) is basically incurred for Fixed assets like building, furniture, machinery, etc., or an intangible asset like Goodwill, patent, etc. This expenses are incurred in order to acquire a new asset or imRead more

Let me first explain the meaning of both the terms CapEx and OpEx

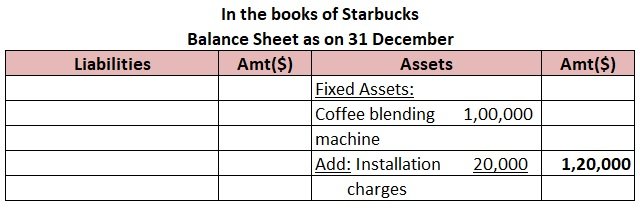

Capital expenditure (in short CapEx) is basically incurred for Fixed assets like building, furniture, machinery, etc., or an intangible asset like Goodwill, patent, etc. This expenses are incurred in order to acquire a new asset or improve an existing one or maintain the asset in use.

Capital expenditure is commonly found in the Cash flow statement under Investing activities as Investment in plant, machinery, equipment, etc.

Operating Expenditure (in short OpEx) are day-to-day expenses incurred by a firm in order to carry its normal business.

Expenses such as rent, advertisement, inventory costs, etc.

Operating Expenses are shown in the income statement of the company as expenses incurred during the period.

For Example: If a company purchases a printer, the printer would be a capital expenditure and the papers used for the printer would be operating expenditure.

Difference between CapEx and OpEx

Example 1: A company wants to lease machinery instead of buying it, in this case buying machinery would be capital expenditure, and leasing the machinery would be an Operating expense.

Example 2: Buying machinery would cost a company for 50000 and leasing the same would cost 35000. So in this case leasing will be more preferred by a company which means operating expenditure would be preferred instead of a capital expenditure.

From the point of view of tax treatment operating expenditure is more preferred over Capital expenditure because the expenses incurred during the year are deducted during the same year which reduces the tax levied on net income.

Some real Examples from the Company Amazon

This is the cash flow statement of Amazon, where the investing activities shows the capital expenditure incurred by the company during the years.

This is the income statement of Amazon, it shows the operating expenditure incurred by the company during the year.

See less