When a firm grants an extra amount of reward to its employees based on their performance, it is termed a bonus. An accrued bonus is contingent on performance. Bonus accruals are recorded in the books so that inaccuracies can be avoided in the financial statements. Such bonuses may be given as a singRead more

When a firm grants an extra amount of reward to its employees based on their performance, it is termed a bonus. An accrued bonus is contingent on performance. Bonus accruals are recorded in the books so that inaccuracies can be avoided in the financial statements.

Such bonuses may be given as a single flare amount or as a percentage of their salaries. These bonuses can be given quarterly or annually or in any manner in which the firm decides.

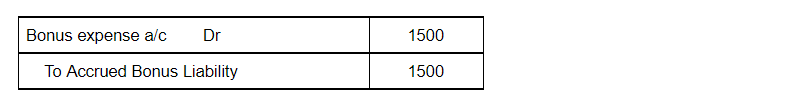

If the bonus is accrued to its employees at 5% of their salary of Rs 30,000, then the accrual bonus can be shown in the journal as follows:

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

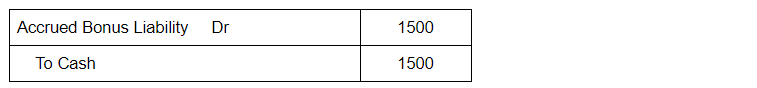

When it is time to pay such bonus amounts to its employees, then they can be journalised as:

In this case, the accrued bonus liability is eliminated and hence debited because according to the rule of accounting, “ Decrease in liability is debited” whereas cash account is credited since “the decrease in the asset is credited.”:

Failing to accrue these bonuses will lead to an overstatement of revenues in the financial statements and hence result in inaccurate data. If employees do not meet the required performance targets, then a bonus will not be given and hence the entries will be reversed.

See less

To begin with, let me first give you a small explanation of what Contingent assets are A contingent asset is a potential asset or economic benefit that does not exist currently but may arise in the near future. Such an asset arises from an uncertain and unpredictable event. To make it clear with anRead more

To begin with, let me first give you a small explanation of what Contingent assets are

A contingent asset is a potential asset or economic benefit that does not exist currently but may arise in the near future. Such an asset arises from an uncertain and unpredictable event.

To make it clear with an example: String Co. filed a lawsuit against a competitor company Weave Tech Co. for infringing on company ABC’s patent. Even if it is probable (but not certain) that Strings Co. will win the lawsuit, it is a contingent asset.

As such, it will not be recorded in Strings Co. general ledger accounts until the lawsuit is settled.

At most the Strings Co. can do is, prepare a note disclosing the fact that it has filed the lawsuit the outcome of which is uncertain.

Disclosing Contingent Assets

For Example, The court orders for reimbursement to Strings Co. say 1,00,000 for the damages, but it has not yet received the money. Although it is virtually certain that the company will receive the money in the near future, it will be treated as an asset and can be disclosed in the balance sheet on the assets side.

For Example, Strings Co. filed a lawsuit against a competitor company Weave Tech for infringing on Strings Co. patent. Even if it is probable (but not certain) that Strings Co. will win the lawsuit, it is a contingent asset.

As such, it will not be recorded in Strings company’s general ledger until the lawsuit is settled.

At most the Strings Co. can do is, prepare a note disclosing the fact that it has filed the lawsuit the outcome of which is uncertain.

In this case, the disclosure of it is not permitted.

See less