The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received. The journal entry is: An entity may receive cash in the following evRead more

The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received.

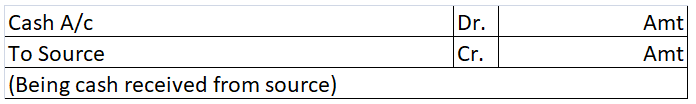

The journal entry is:

An entity may receive cash in the following events:

- Sales of goods or provision of services

- Payment from account receivables

- Sale of assets.

- Withdrawal of cash from the bank

- Introduction of additional capital in the business

- Subscription or donation received in case of non-profit oriented concerns.

- Other income in cash

This list is not exhaustive. There may be many such events. However, the cash account will be always debited.

Rules of accounting applicable on the cash account

As per the golden rules of accounting, the cash account is a real account as represents an asset. For real accounts, the rule, “Debit the receiver and credit the giver” applies.

Hence, when cash is received, cash is debited and the source (giver) is credited.

As per modern rules of accounting, the cash account is an asset account. Assets accounts are debited when increased and credited when decreased.

Hence, at receipt of cash, cash is debited as cash is increased.

See less

Miscellaneous expenditure in the balance sheet The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as MiRead more

Miscellaneous expenditure in the balance sheet

The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as Miscellaneous expenditure.

Miscellaneous expenditure are those expenses that are not categorized as Operating expenses i.e. these are not classified as manufacturing, selling, and administrative expenses.

For example, BlackRock has spent 5,00,000 which will be written of in 5 consecutive years as an Advertisement expense. During the current financial year, only 1,00,000 will be written off and the rest will be carried to the next year and year thereafter.

Treatment in the first year:

Treatment in the second year:

The same will be done in the third, fourth, and fifth years.

Conclusion

Deferred revenue expenditure is also a long-term expenditure the benefit of which cannot be derived within the same year. So the amount that is written off during the current year is shown on the debit side of the profit and loss account and the amount which is not written off during the current financial year is shown on the assets side under the head Miscellaneous expenditure.

See less