Net credit sales can be defined as the total sales made by a business on credit over a given period of time less the sales returns and allowances and discounts such as trade discounts. Net Credit Sales = Gross Credit Sales – Returns – Discounts – Allowances. Credit sales can be calculated from the ARead more

Net credit sales can be defined as the total sales made by a business on credit over a given period of time less the sales returns and allowances and discounts such as trade discounts.

Net Credit Sales = Gross Credit Sales – Returns – Discounts – Allowances.

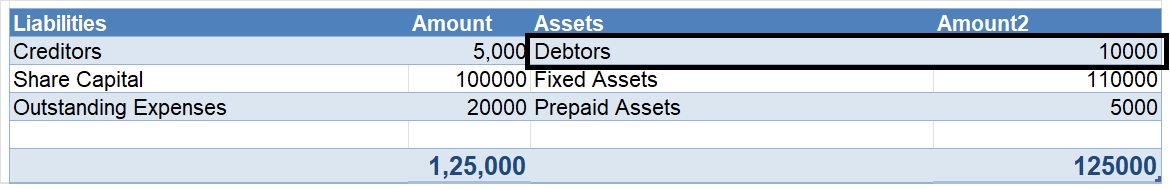

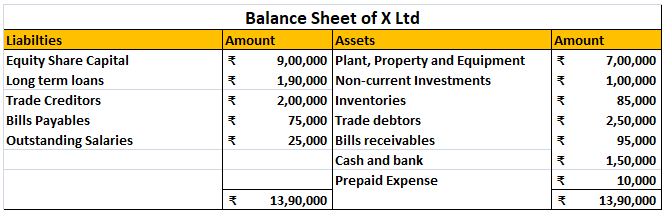

Credit sales can be calculated from the Accounts receivable/ Bills Receivable/ Debtors figure in the Balance Sheet. It will be normally shown under the Current Assets head in the Balance Sheet.

Credit sales = Closing debtors + Receipts – Opening debtors.

Alternatively, you may observe the bills receivable ledger account to locate the figure of credit sales.

Net Credit Sales and related terms

Before we try to understand the concept of net credit sales with an example, let us discuss the term sales return. Sales return means the goods returned by the customer to the seller. It may be due to defects or any other reasons.

Now let us take an example. John is a retail businessman. He sells smartphones. He buys 100 smartphones from Vivo on credit. The smartphones are worth ₹1.5 lahks. He then returns smartphones worth 20,000 rupees to Vivo. He also gets an allowance of rupees 5,000 from Vivo.

In the above example, the credit sales of Vivo are of rupees 1.5 lakh. The net credit sales is of

1.5 lakh – 20,000 – 5, 000 = 1.25 lakh rupees.

Importance of Net Credit Sales

- Net Credit Sales figure together with the accounts receivable figure acts as an indicator of the credit policy of the company.

- It offers insights into the ability of the company to meet short-term cash obligations.

- The credit policy also affects the total current assets that the company has in the manifestation of Accounts Receivable

Advantages and Disadvantages of Credit Sales.

Advantages

- Increased Sales – The credit Policy facilitates increased sales for the company. The company can attract more customers with a liberal credit policy. For example, Apple got more customers when it started to sell its products on an EMI basis.

- Customer Loyalty / Retention- Regular customers can be retained and made to feel honored by offering them more liberal credit terms.

Disadvantages

- Delay in Cash Collection – Credit Sales imply that the company would get cash on a delayed basis. This money could have otherwise been put to use for some other profitable venture or could have borne interest for the company

- Collection Expenses– The company had to incur additional expenditures for collecting money from debtors.

- Risk of Bad Debts – With credit sales, there is always the risk that the buyer may become bankrupt and may not be able to pay the money due to the seller.

A cheque that has been issued but yet not presented to the bank for payment is known as an unpresented cheque Generally what happens is when a cheque is issued to a party or say, creditor, the business immediately records them in the bank column of the cash book but the creditor might not present thRead more

A cheque that has been issued but yet not presented to the bank for payment is known as an unpresented cheque

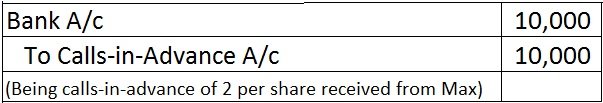

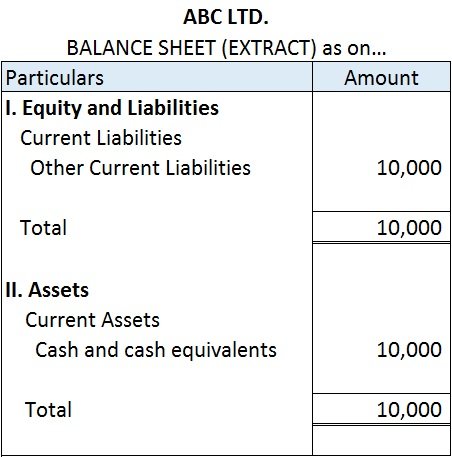

Generally what happens is when a cheque is issued to a party or say, creditor, the business immediately records them in the bank column of the cash book but the creditor might not present them immediately to the bank for payment on the same date. The bank will only debit the account when it will be presented to it, therefore as long as the cheque remains unpresented there will be a difference in both the books i.e cash book and passbook.

Let me give you a short example of the above treatment

Suppose on 27th January, in the books of Mr. Shyam, the balance of the bank column as per the cash book is Rs 10,000. He received a cheque of Rs 5,000 from Mr. Hari, one of his debtors, which was sent to the bank for collection. The amount of the cheque was not collected by the bank until 31st January. Due to this, there arises a difference of Rs 5,000 in the cash book and pass book of Mr. Shyam.

Following will be the entry in Mr. Shyam cash book and passbook

In the books of Mr. Shaym

Cash book (bank column only)

Mr. Shyam

Bank Statement

How it is treated in the bank reconciliation statement?

There lies a temporary difference in both the books as the represented cheques will eventually be presented. Therefore we will not alter the cash book. The bank statement shows the greater amount of Rs 5,000 as compared to the cashbook, therefore we will debit the amount of unpresented cheque which will eventually make it balance to the level of bank statement.

See less