Ledger is the book where the transaction related to a particular account is recorded. For example, the Sales ledger will only record the transactions related to sales. Ledgers in Tally also serve the same purpose. Posting in the ledger is automatically done when the transactions are entered in the vRead more

Ledger is the book where the transaction related to a particular account is recorded. For example, the Sales ledger will only record the transactions related to sales.

Ledgers in Tally also serve the same purpose. Posting in the ledger is automatically done when the transactions are entered in the vouchers.

Now, if you want to delete a ledger, you can easily do by following some simple steps.

I have shared the steps of deleting a ledger in Tally Prime and Tally ERP 9 both.

Deleting a ledger in Tally Prime

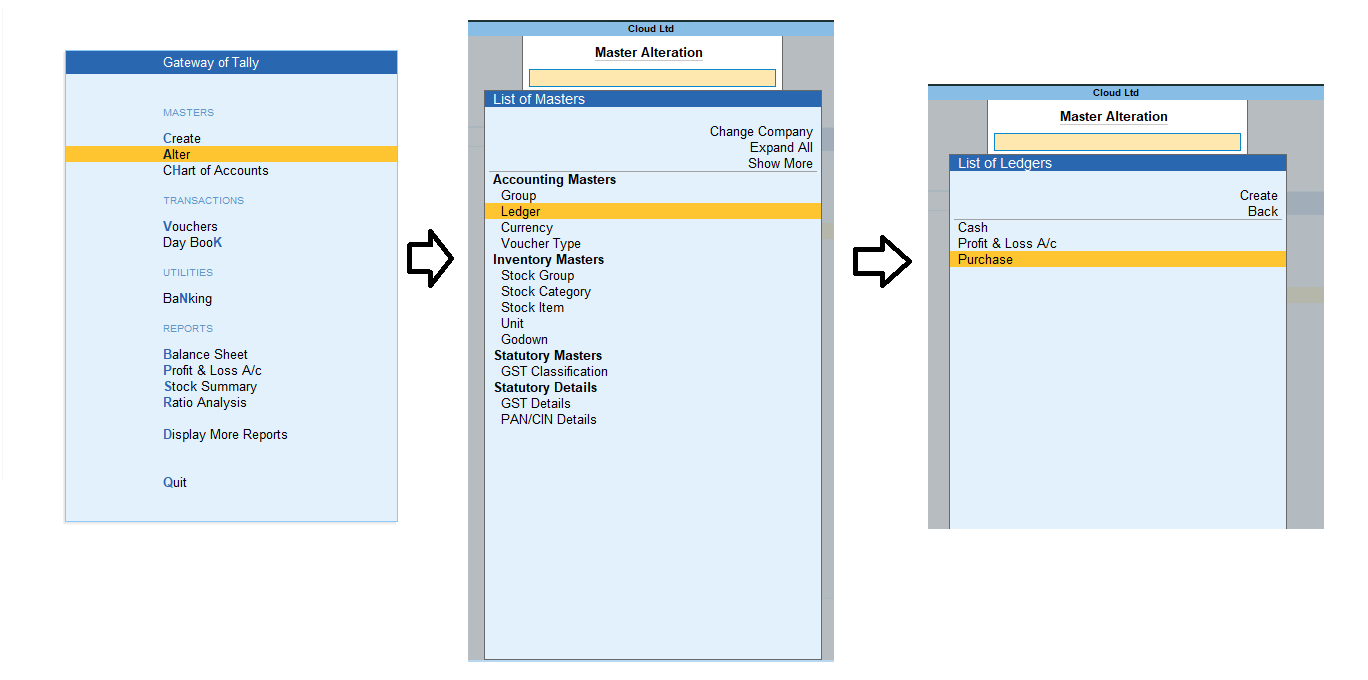

To delete a ledger in Tally Prime, the steps are as follows:

Gateway of Tally → Alter → Ledger → Click on the ledger you want to delete.

Upon clicking the ledger, the ledger alteration menu will open.

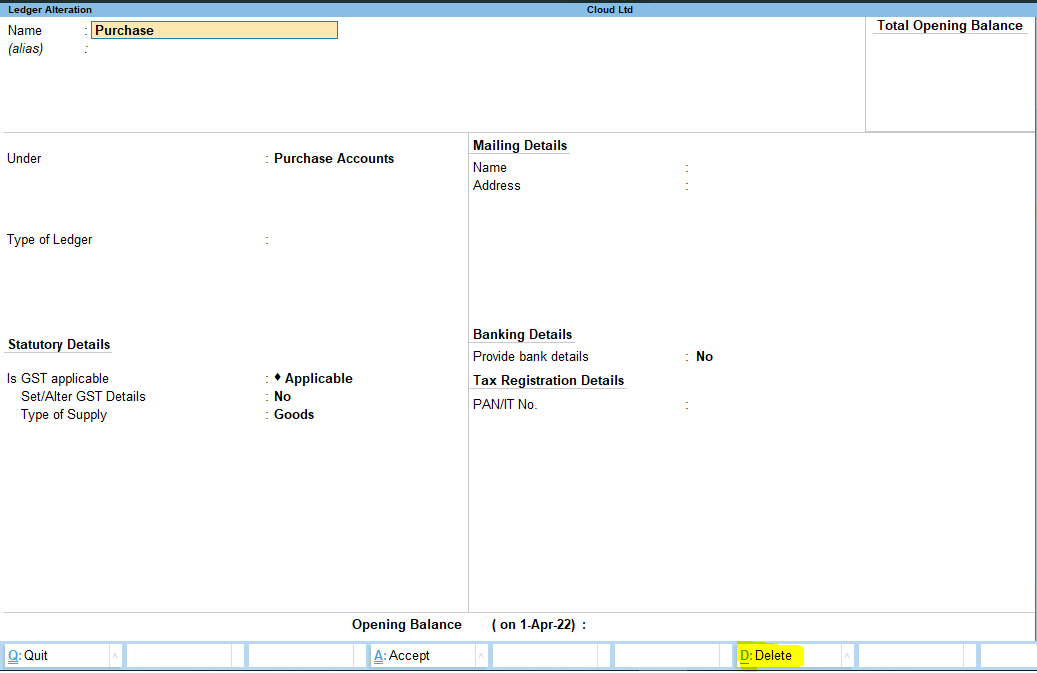

At the bottom, there is a ‘Delete’ option. Either click on it or simply press Alt + D and click on ‘Yes’. Your ledger will be deleted.

Deleting a ledger in Tally ERP 9

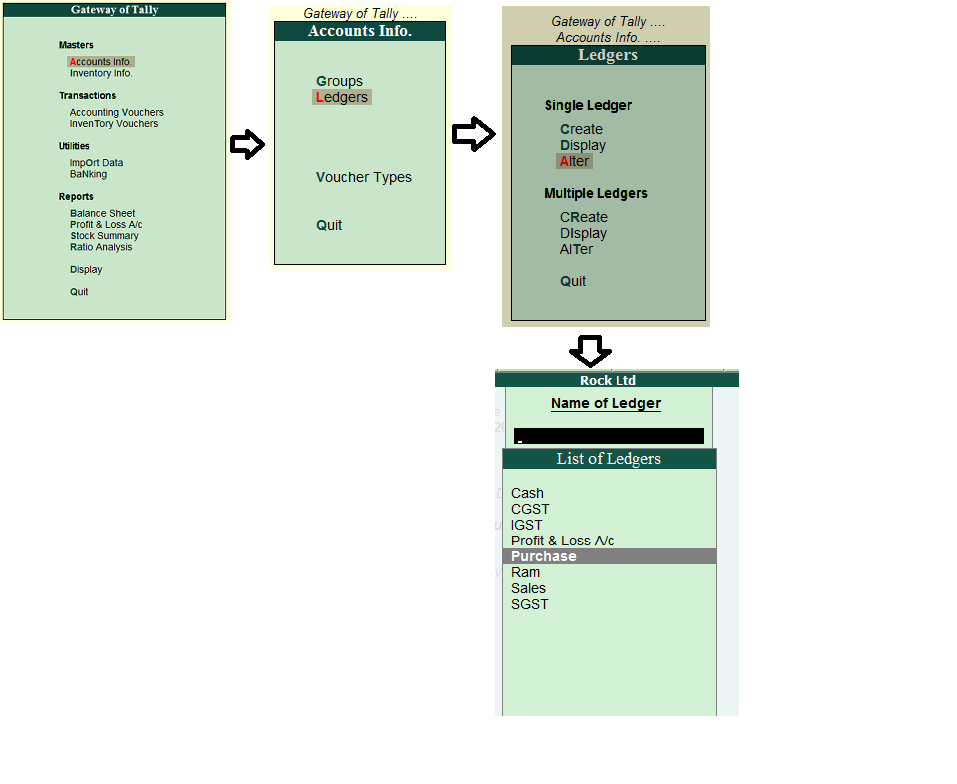

To delete a ledger in Tally ERP 9, the steps are as follows:

Gateway of Tally → Accounts Info → Ledger → Alter → Select the ledger you want to delete.

Steps are almost similar in both versions of Tally. Little difference is there due to the different interfaces of the two versions.

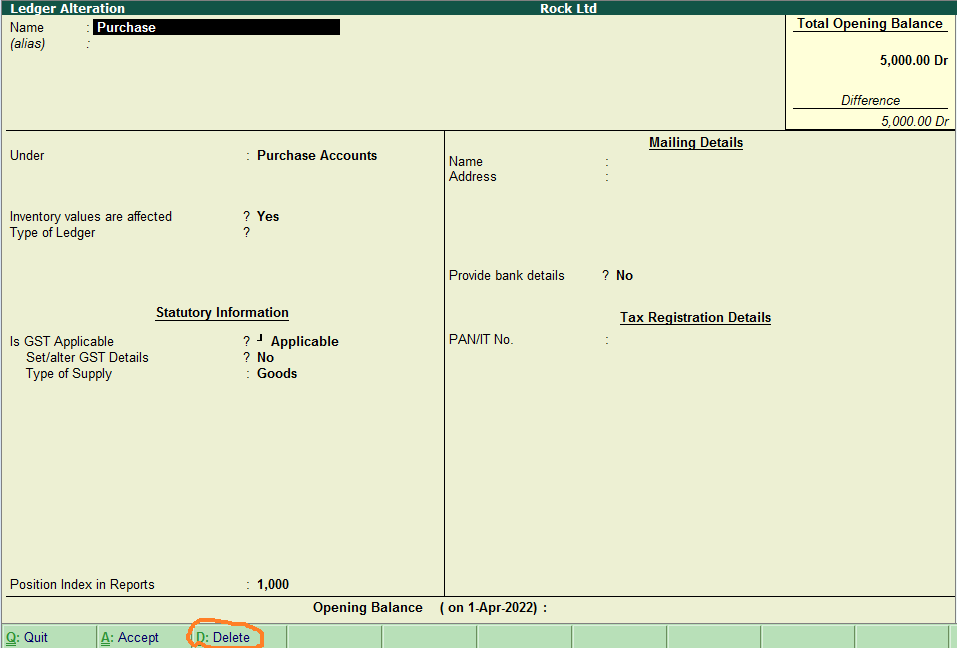

Just like Tally Prime, you can click on the ‘Delete’ option at the bottom or press Alt + D to delete the ledger.

The journal entry for the dividend collected by the bank is as follows: Bank A/c Dr. Amt To Dividend Received A/c Amt Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below. The logRead more

The journal entry for the dividend collected by the bank is as follows:

Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below.

The logic behind the journal entry

This can be explained through the following rules of accounting:

Golden rules of accounting

A bank account is a real account and the golden rule of accounting for the real account is, “Debit what comes in and credit what goes out”

Hence, the bank account is debited as the money is coming into the bank.

Dividend is an income hence dividend received is a nominal account. The golden rule of accounting for a nominal account is “Debit all expenses and losses and credit all income and gains”

Hence, the dividend received account is credited as income.

Modern rules of accounting

As per modern rules of accounting, a bank account is an asset account.

The asset account is debited when increased and credited when decreased.

Hence, the Bank account is debited here as it is increased.

A dividend received account is an income account.

The income account is credited when increase and debited when decreased.

Hence, the dividend received account is credited here as it is increased.

Treatment in the financial statements

Since the dividend received is an income; it is shown on the credit side of the Statement of profit and loss.

The bank account is an asset so it will be shown on the balance sheet.

See less