Fictitious assets are not actually assets. They are expenses/losses not written off in the year in which they are incurred. They do not have any physical presence. Their expense is spread over more than one accounting period. A part of the expense is amortized/written off every year against the compRead more

Fictitious assets are not actually assets. They are expenses/losses not written off in the year in which they are incurred. They do not have any physical presence. Their expense is spread over more than one accounting period.

A part of the expense is amortized/written off every year against the company’s earnings. The remaining part (which is yet to be written off) is shown as an asset in the balance sheet. They are shown as assets because these expenses are expected to give returns to the company over a period of time.

Here are some examples of fictitious assets:

- Preliminary expenses.

- Promotional expenses.

- Loss incurred on the issue of debentures.

- Underwriting commission.

- Discount on issue of shares.

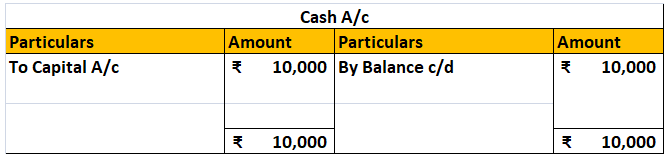

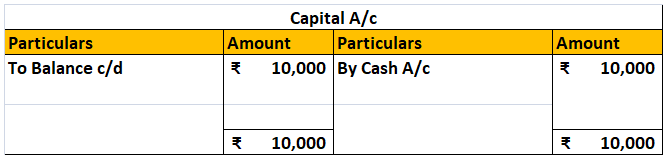

To make it simple I’ll explain the accounting treatment of preliminary expenses with an example.

The promoters of KL Ltd. paid 50,000 as consultation fees for incorporating the company. The consultation fee is a preliminary expense as they are incurred for the formation of the company. The company agreed to write off this expense over a period of 5 years.

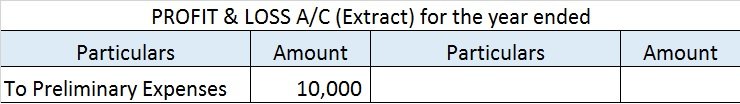

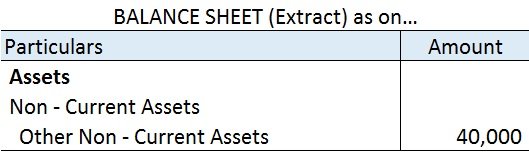

At the end of every year, the company will write off 10,000 (50,000/5) as an expense in the Profit & Loss A/c.

The remaining portion i.e. 40,000 (50,000 – 10,000) will be shown on the Assets side of the Balance Sheet under the head Non – Current Assets and sub-head Other Non – Current Assets.

Here are the financial statements of KL Ltd.,

Note: As per AS 26 preliminary expenses are fully written off in the year they are incurred. This is because such expenses do not meet the definition of assets and must be written off in the year of incurring.

Source: Some fictitious assets examples are from Accountingcapital.com & others from Wikipedia.

See less

Debtors and Creditors Points of Distinction Debtors Creditors Meaning A debtor is a person or entity that owes money to the other party (the other party is also known as the creditor). A creditor is a person or entity to whom money is owed or who lends money. Nature The debtors will have a debit balRead more

Debtors and Creditors

Example:

Mr. A purchases raw materials from its supplier Mr. D on credit.

Here for Mr. D, Mr. A will be a debtor because the amount is receivable from him.

Similarly, for Mr. A, Mr. D will be his creditor because the amount is payable to him.

Profit and Gain

Profit = Total Income-Total Expenses

Net profit

Operating profit

Capital gain

Long term capital gain

Short term capital gain

Example: A company’s sales for the period are $60,000 and expenses incurred are $40,000. Here the profit calculated will be $20,000 because revenue exceeds expenses.

Profit = Total Income-Total Expenses

= 60,000 – 40,000

= $20,000

Mr. X owned land worth $10,00,000 and after 10 years he sold it at a current market value of $14,00,000. So the gain he earned is $4,00,000. This gain of $4,00,000 will be termed as a capital gain since land is a capital asset.

See less