A. Cash Book B. Statement C. Journal D. None of These

Fluctuating Capital Fluctuating capital is a capital that is unstable and keeps changing frequently. In the fluctuating capital, the capital of each partner changes from time to time. In partnership firms, each partner will have a separate capital account. Any additional capital introduced during thRead more

Fluctuating Capital

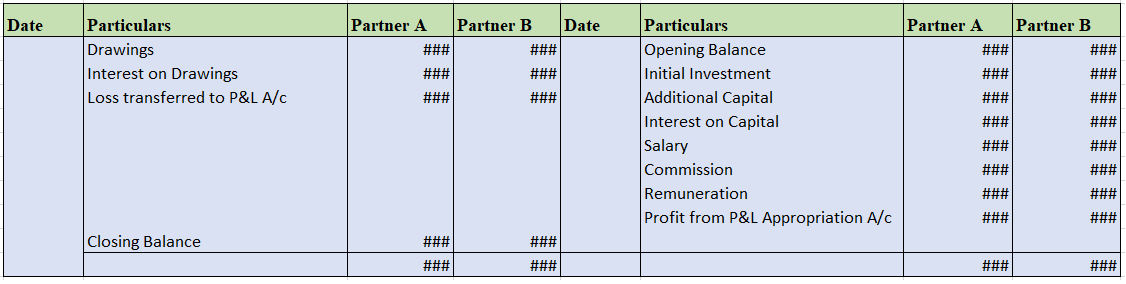

Fluctuating capital is a capital that is unstable and keeps changing frequently. In the fluctuating capital, the capital of each partner changes from time to time. In partnership firms, each partner will have a separate capital account. Any additional capital introduced during the year will also be credited to their capital account. In the fluctuating capital method, only one capital a/c is maintained i.e no current accounts like in the fixed capital a/c method. Therefore, all the adjustments like interest on capital, drawings, etc. are completed in the capital a/c itself.

It is most commonly seen in partnership firms and it is not essential to mention the Fluctuating Account Method in the partnership deed.

- All the adjustments resulting in a decrease in the capital will be debited to the partner’s capital, such as drawings made by each partner, interest on drawings, and share of loss.

- Similarly, the activities or adjustments that lead to an increase in the capital are credited to the partner’s capital account, such as interest on capital, salary, the share of profit, and so on.

Fluctuating Capital Account Format

See less

The correct option is A) Cash book let's understand what is petty cash book: A petty cash book is a cash book maintained to record petty expenses. Petty expenses, mean small or minute expenses for which the payment is made in coins or a few notes or which are smaller denominations like tea or coffeeRead more

The correct option is A) Cash book

let’s understand what is petty cash book:

Generally, the petty cashbook is prepared as per the Imprest system. As per the Imprest system, the petty expenses for a period (month or week) are estimated and a fixed amount is given to the petty cashier to spend for that period.

At the end of the period, the petty cashier sends the details to the chief cashier and he is reimbursed the amount spent. In this way, the debit balance of the petty cashbook always remains the same.

The petty cash book has two columns in which

Balance of Petty cash book

The balance of petty cash book is never closed and their balances are carried forward to the next accounting period which is considered one of the most significant qualities of an asset whereas Income doesn’t have any opening balance and their balances get closed at the end of every accounting year.

A petty cash book is placed under the head current asset in the balance sheet. The Closing Balance of the petty cash book is computed by deducting Total expenditure from the Total cash receipt (as received from the head cashier).

Format for petty cash book

Only small denominations are recorded in the petty cash book. It varies with the type, quantity, and need of a business. It involves cash and checks.

Conclusion

A simple petty cash book is a type of cash book because it records the small expenses which involve small transactions in the ordinary daily business.

A petty cash book is not as important as an income statement, balance sheet, or trail balance it doesn’t measure the accuracy of accounts so it is not treated as a statement.

No journal entries are made in the books of accounts while spending or purchasing using a petty cash book so, it is not treated as a journal.

See less