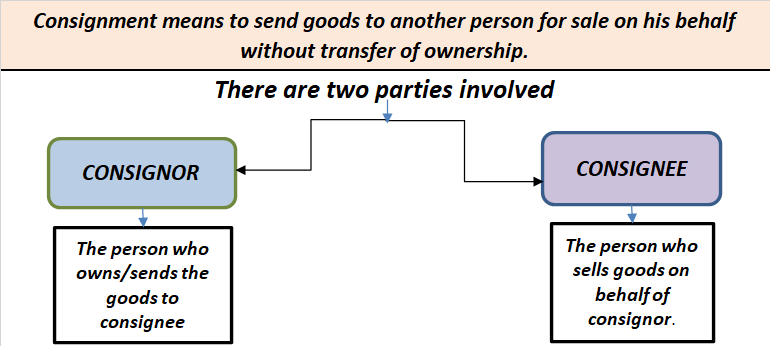

Consignment is "goods sent by its owners to his agent for the purpose of sale". In simple language, the word consignment means to send goods to another person for sale on his behalf without transfer of ownership. In accounting terms, consignment is the process where the owner (consignor) transfers tRead more

Consignment is “goods sent by its owners to his agent for the purpose of sale”. In simple language, the word consignment means to send goods to another person for sale on his behalf without transfer of ownership.

In accounting terms, consignment is the process where the owner (consignor) transfers the possession of the goods to the agent (consignee) to make a sale on his behalf while the ownership of goods remains with the owner until the sale is made by the agent. In return, the agent receives an agreed percentage of the sum in the form of commission.

Generally, there are two parties involved in consignment, those are as follows:

- CONSIGNOR: the person who is the owner and sender of goods.

- CONSIGNEE: the person who receives goods for sale/resale from the consignor in exchange for a percentage of the sale or on an agreed sum known as commission.

The relationship between consignor and consignee is that of principal and agent.

Let me give you a simple example of how consignment works.

Mr. John (consignor) sends goods to Mr. Jeh (consignee) worth Rs 20,000 to sell these goods at a cost plus 10%. Mr. Jeh agrees to sell these goods on his behalf for a commission of 1% on the sale. Therefore Mr. Jeh sold these goods at the agreed amount i.e Rs 22,000 [20,000+ 10% of 20,000] and charges Rs 220 [1% of Rs 22,000] as commission made on such sale and remit the remaining balance to the owner Mr. John.

There is a lot of confusion regarding “is consignment the same as the sale of goods?“. The answer is NO.

The reason what makes it different from the sale is

a) In sale the ownership gets transferred from seller to buyer but in case of consignment the ownership remains with the consignor until the sale is made by the agent.

b) In sale the risk gets transferred with the transfer of goods, whereas in consignment the risk remains with the owner till the sale is made.

c) Also goods once sold cannot be returned on damages /defaults, but in case of consignment goods that come to be faulty can be returned to the consignor.

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the nRead more

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the new partner. The partners can choose to forego their shares equally or in an agreed proportion.

Before admission of the new partner, the existing partners would be sharing their profits in the old ratio. Upon admission, the profit-sharing ratio would change to accommodate the new partner. This would give rise to the new ratio. Hence Sacrificing ratio can be calculated as:

Sacrificing Ratio = Old Ratio – New Ratio

For example, Tony and Steve are partners in a firm, sharing profits in the ratio of 3:2. They decide to admit Bruce into the partnership such that the new profit-sharing ratio is 2:1:2. Now, to calculate the sacrificing ratio of Tony and Steve, we subtract their new share from their old share.

Tony’s Sacrifice = 3/5 – 2/5 = 1/5

Steve’s Sacrifice = 2/5 – 1/5 = 1/5

Therefore, the Sacrificing ratio of Tony and Steve is 1:1. This shows that Tony gave up 1/5th of his share while Steve also sacrificed 1/5th of his share.

Calculation of sacrificing ratio is important in a partnership as it helps in measuring that portion of the share of existing partners that have to be sacrificed. This ensures a smooth reconstitution of the partnership. Since the old partners are foregoing a part of their share in profits, the new partner has to bring in some amount as goodwill to compensate for their loss.

See less