Drawings of goods The drawings of the goods, in a business, take place when the owner/partner of a business withdraws goods for their personal use. It's hence called drawings as it reduces the capital invested by the owner(s). It's also called the withdrawal account. The drawings are generally madeRead more

Drawings of goods

The drawings of the goods, in a business, take place when the owner/partner of a business withdraws goods for their personal use. It’s hence called drawings as it reduces the capital invested by the owner(s). It’s also called the withdrawal account.

The drawings are generally made for cash or stock by the owner/partner and the relevant account is thus reduced causing the adjustment done on the owner/partner’s capital at the cost price.

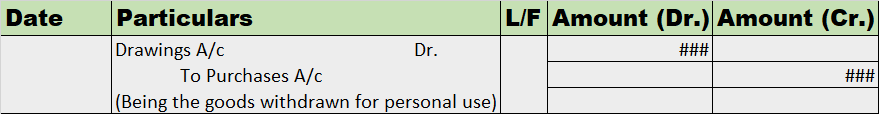

Journal entry

The journal entry for the goods withdrawn for personal use will be as follows:

Explanation via rules

The drawings account is debited because it decreases the balance of the capital account. Whereas, the purchases account is credited as it causes a reduction in the purchases account.

As per the modern rules of accounting, we credit the decrease in assets, thus, the purchases account is credited. Whereas, the withdrawal account when increased is debited. Therefore, the drawing account is debited here.

As per the golden rules of accounting, “debit what comes in and credit what goes out.” Hence, the purchase account is credited. And, “if any expense or loss is incurred for the business, the expense or loss account shall be debited“. Thus, the drawing account is debited.

See less

Business commencement with cash The term 'started the business with cash' is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business's capital in accounting. Commencement of business refers to theRead more

Business commencement with cash

The term ‘started the business with cash’ is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business’s capital in accounting.

Commencement of business refers to the starting or beginning of the business. In companies, it’s a declaration issued by the company’s directors with the registrar stating that the subscribers of the company have paid the amount agreed. In a sole proprietorship, the business can be commenced with the introduction of any asset such as cash, stock, furniture, etc.

Therefore, we may also call it the first journal entry of business because generally, people tend to start the business with cash rather than something else.

Journal entry

Explanation via rules

As per the golden rules of accounting, the cash a/c is debited as the rule says “debit what comes in, credit what goes out.” Whereas the capital a/c is credited because “debit all expenses and losses, credit all incomes and gains”

As per modern rules of accounting, cash is a current asset, and assets are debited when they increase. Whereas, on the increment on liabilities, they are credited, therefore, capital a/c is credited.

See less