Sales Return is shown on the debit side of the Trial Balance. Sales Return is also called Return Inward. Sales Return refers to those goods which are returned by the customer to the seller of the goods. The goods can be returned due to various reasons. For example, due to defects, quality differenceRead more

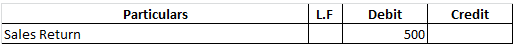

Sales Return is shown on the debit side of the Trial Balance.

Sales Return is also called Return Inward.

Sales Return refers to those goods which are returned by the customer to the seller of the goods. The goods can be returned due to various reasons. For example, due to defects, quality differences, damaged products, and so on.

In a business, sales is a form of income as it generates revenue. So, when the customer sends back those goods sold earlier, it reduces the income generated from sales and hence goes on the debit side of the trial balance as per the modern rule of accounting Debit the increases and Credit the decreases.

For Example, Mr. Sam sold goods to Mr. John for Rs 500. Mr. John found the goods damaged and returned those goods to Mr. Sam.

So, here Sam is the seller and John is the customer.

The journal entry for sales return in the books of Mr. Sam will be

| Particulars | Amt | Amt |

| Sales Return A/c | 500 | |

| To Mr John | 500 |

Treatment in Trial Balance

Yes, I agree with your statement that accounting information should be comparable. Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company's financial statements across time and across other companies. Comparability oRead more

Yes, I agree with your statement that accounting information should be comparable.

Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company’s financial statements across time and across other companies.

Comparability of financial statements is crucial due to the following reasons:

1. Intra-Firm Comparison:

Comparison of financial statements of two or more periods of the same firm is known as an intra-firm comparison.

Comparability of accounting information enables the users to analyze the financial statements of a business over a period of time. It helps them to monitor whether the firm’s financial performance has improved over time.

The intra-firm analysis is also known as Time Series Analysis or Trend Analysis.

To understand intra-firm analysis, I have provided an extract of the balance sheet of ABC Ltd. for two accounting periods.

2. Inter-Firm Comparison:

Comparison of financial statements of two or more firms is known as an inter-firm comparison.

Inter-firm comparison helps in analyzing the financial performance of two or more competing firms in an industry. It enables the firm to know its position in the market in comparison to its competitors.

Inter-firm comparison is also known as Cross-sectional Analysis.

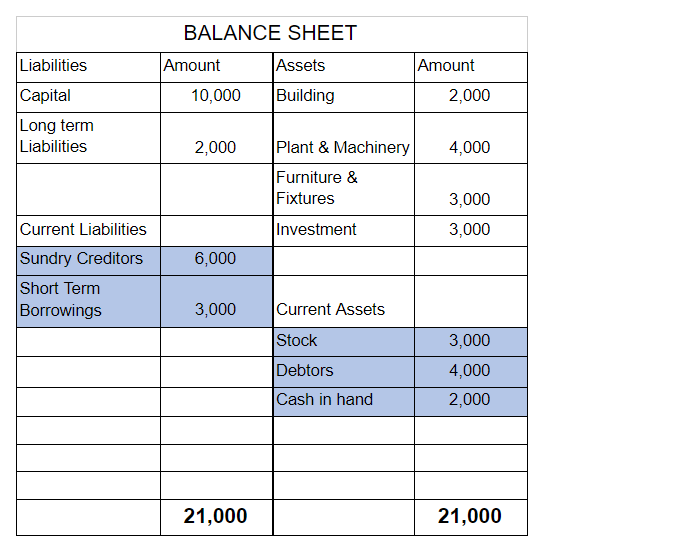

I’ve provided the balance sheets of Co. A and Co.B to make an inter-firm comparison.

Here is a piece of bonus information for you,

Sector Analysis – it refers to the assessment of economical and financial conditions of a given sector of a company/industry/economy. It involves the analysis of the size, demographic, pricing, competitive, and other economic dimensions of a sector of the company/industry/economy.

One more important thing to note here is that comparability can only be achieved when the firms are consistent in the accounting principles and standards they adopt. The accounting policies and standards must be consistent across different periods of the same firm and across different firms in an industry.

See less