To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 "A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even iRead more

To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 “A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even if no amount has been called up”.

To be more precise whenever excess money is received by the company than, what has been called up is known as calls-in-advance.

Accounting Treatment

Well, it is to be noted that calls-in-advance is never a part of share capital. A company when authorized by its article can accept those advance amounts and directly credit the amount received to the calls-in-advance account.

As these advance amounts are a liability for the company these are shown under the head current liability of the balance sheet until calls are made and are paid to the shareholders.

Since this is the liability of the company, it is liable to pay the interest amount on such call money from the date of receipt until the payment is done to the shareholders. The rate of interest is mentioned in the articles of association. If the article is silent regarding the rate on which interest is paid then it is assumed to be @6%.

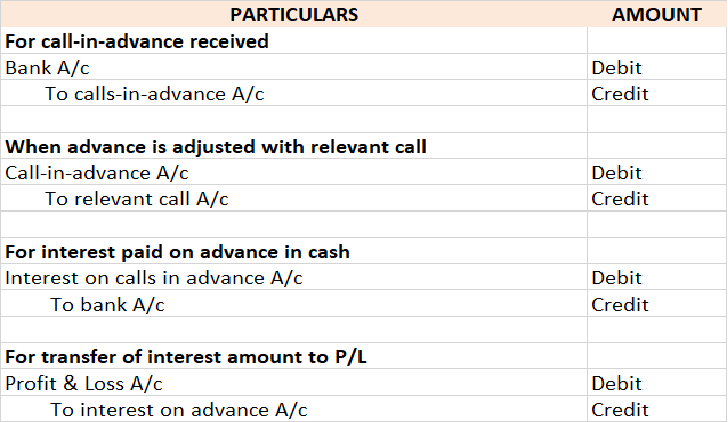

Accounting Entry

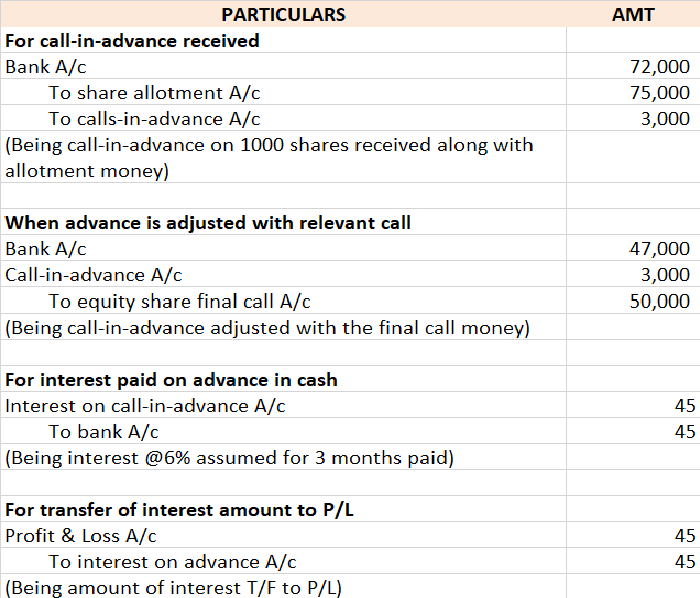

Bonnie let us understand the entries with help of an example

ADIDAS LTD issued 25,000 equity shares of Rs 10 each payable as follows:

ON APPLICATION Rs 5

ON ALLOTMENT Rs 3

ON FINAL CALL Rs 2

Application on 30,000 shares was received. excess money received on the application was refunded immediately. Mr. X who was allotted 1,000 shares paid the call money at the time of allotment and all amounts were duly received assume interest rate @6% for 3 months, so the relevant accounting entry goes as follows:

Important Points to be noted under calls-in-advance as per the companies act 2013

- The shareholder is not entitled to any voting rights on money paid until the said money is called for.

- No dividends are payable on advance money.

- Board may pay interest on advance not exceeding 12%.

- The shareholders are entitled to claim the interest amount as mentioned in the article, if there are no profits, then it must be paid out of capital because shareholders become the creditors of the company.

Accrual Accrual expense means the transaction that takes place in a particular period must be accounted for in that period only irrespective of the fact when such amount has been paid. An accrual of the expenditure which is not paid will be listed in the books of accounts. These accruals can be furtRead more

Accrual

Accrual expense means the transaction that takes place in a particular period must be accounted for in that period only irrespective of the fact when such amount has been paid.

An accrual of the expenditure which is not paid will be listed in the books of accounts. These accruals can be further divided into two parts

Accrual Expense-

Accrual Expense means any transaction that takes place in a particular period but the amount for it will be paid on a later period.

For example- If rent of 10,000 for the month of March was paid in April month then this rent will be accounted for in the books in March

For example- Interest of 1,000 for the month of March of the loan amount of 10,000 paid in April then will be accounted for in the books in March

These are the following accrued expense

Accrual Revenue-

Accrual Revenue means any transaction that takes place in a particular period but the amount for it will be received in the later period.

For example- If interest of 10,000 on bonds for the period of March is received in April months then this amount will be accounted for in March. These are the following accrued revenue

For example- Rent of 10,000 for the month of March received in April month then this rent will be accounted for in the books in March

- Accrual Income- Acrrual expense means the amount for any income received on a later period than the period when it pertains to be received

- Accrual Rent– Accrual rent means the amount for using the land of the entity by the other party is received at a later period than the period when it is put into use.

- Accrued Interest– Accrued interest means the amount of interest received on a later period than the period when it pertains to receive

See less