Effective Capital is an amount calculated for purpose of arriving at the maximum limit of managerial remuneration as per the Companies Act, 2013 where profit is inadequate or no profit. Other than that it has no use. Computation of effective capital is given in Explanation I to Schedule II of the CoRead more

Effective Capital is an amount calculated for purpose of arriving at the maximum limit of managerial remuneration as per the Companies Act, 2013 where profit is inadequate or no profit. Other than that it has no use.

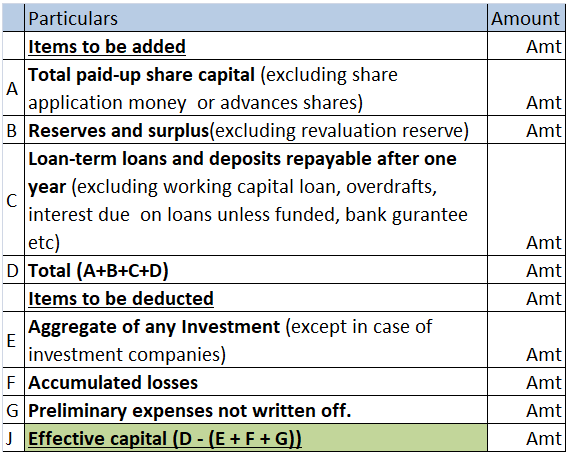

Computation of effective capital is given in Explanation I to Schedule II of the Companies Act. Schedule II deals with remuneration payable to managers in case of no profit or inadequate profit in the following manner:

Computation of effective capital is done in the following manner:

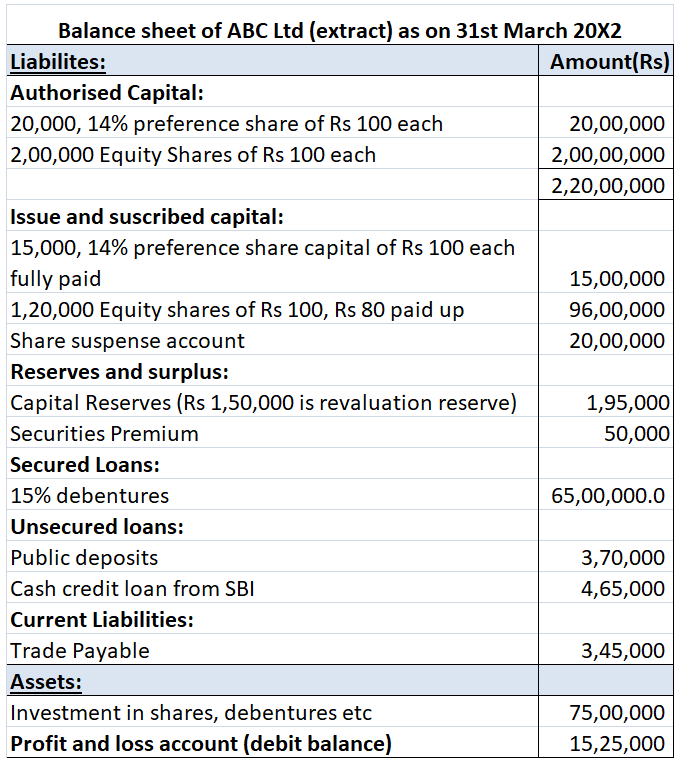

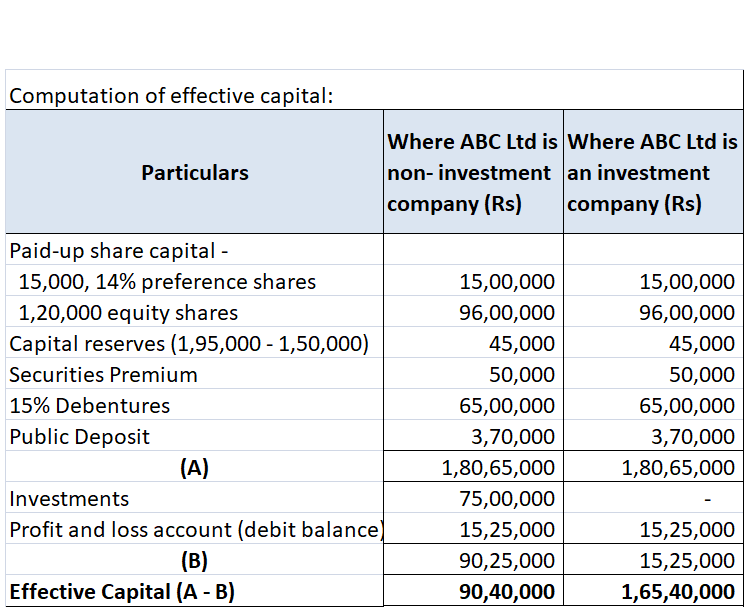

Numerical example:

ABC Ltd reports its balance sheet as given below:

We will compute its effective capital for both an investment company and a non-investment company.

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the nRead more

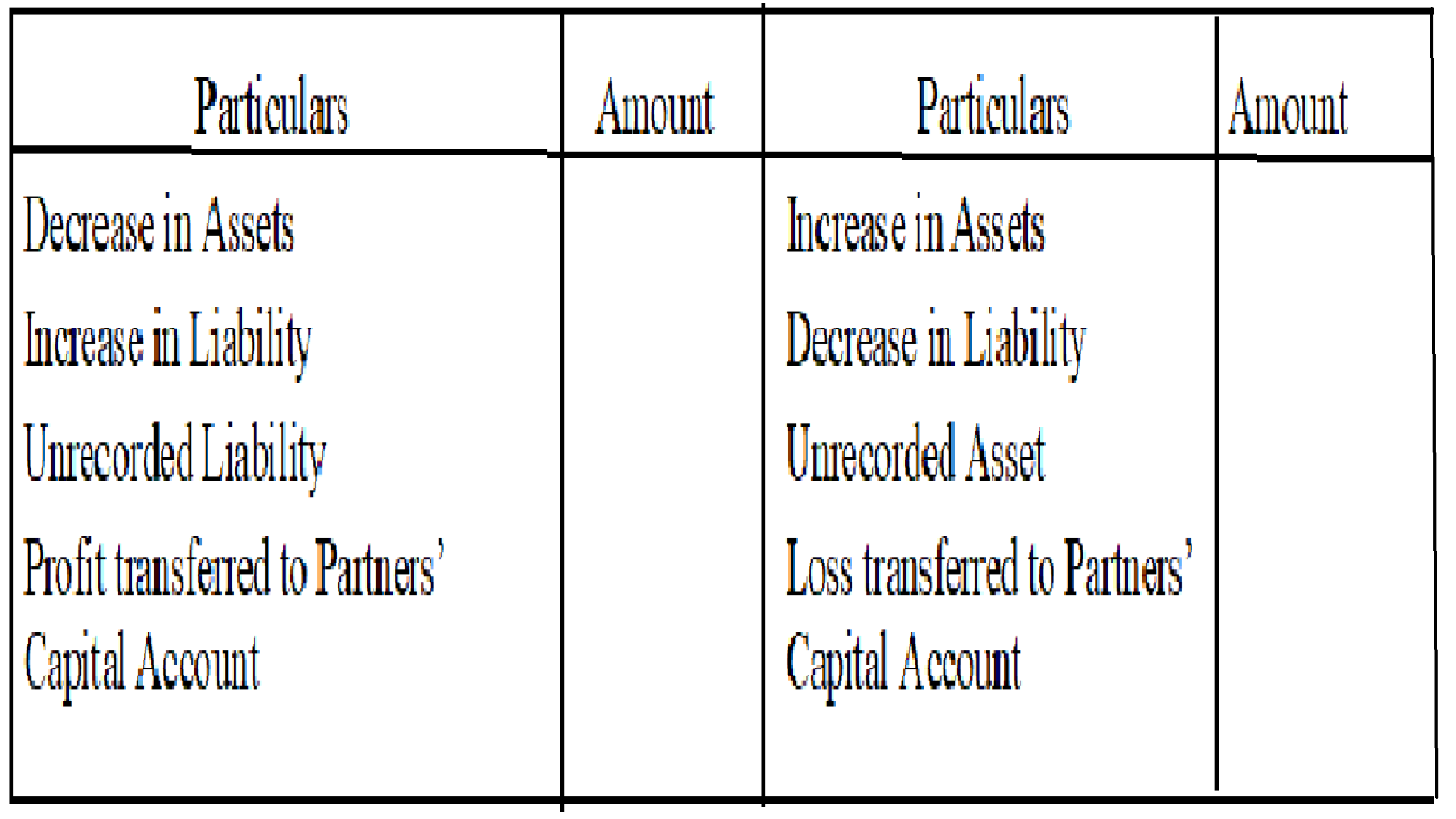

When a partnership firm consisting of some partners, decide to admit a new partner into their firm, they have to forego a part of their share for the new partner. Therefore, sacrificing Ratio is the proportion in which the existing partners of a company give up a part of their share to give to the new partner. The partners can choose to forego their shares equally or in an agreed proportion.

Before admission of the new partner, the existing partners would be sharing their profits in the old ratio. Upon admission, the profit-sharing ratio would change to accommodate the new partner. This would give rise to the new ratio. Hence Sacrificing ratio can be calculated as:

Sacrificing Ratio = Old Ratio – New Ratio

For example, Tony and Steve are partners in a firm, sharing profits in the ratio of 3:2. They decide to admit Bruce into the partnership such that the new profit-sharing ratio is 2:1:2. Now, to calculate the sacrificing ratio of Tony and Steve, we subtract their new share from their old share.

Tony’s Sacrifice = 3/5 – 2/5 = 1/5

Steve’s Sacrifice = 2/5 – 1/5 = 1/5

Therefore, the Sacrificing ratio of Tony and Steve is 1:1. This shows that Tony gave up 1/5th of his share while Steve also sacrificed 1/5th of his share.

Calculation of sacrificing ratio is important in a partnership as it helps in measuring that portion of the share of existing partners that have to be sacrificed. This ensures a smooth reconstitution of the partnership. Since the old partners are foregoing a part of their share in profits, the new partner has to bring in some amount as goodwill to compensate for their loss.

See less