The journal entry for the dividend collected by the bank is as follows: Bank A/c Dr. Amt To Dividend Received A/c Amt Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below. The logRead more

The journal entry for the dividend collected by the bank is as follows:

| Bank A/c Dr. | Amt | |

| To Dividend Received A/c | Amt |

Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below.

The logic behind the journal entry

This can be explained through the following rules of accounting:

- Golden rules of accounting

- Modern rules of accounting

Golden rules of accounting

A bank account is a real account and the golden rule of accounting for the real account is, “Debit what comes in and credit what goes out”

Hence, the bank account is debited as the money is coming into the bank.

Dividend is an income hence dividend received is a nominal account. The golden rule of accounting for a nominal account is “Debit all expenses and losses and credit all income and gains”

Hence, the dividend received account is credited as income.

Modern rules of accounting

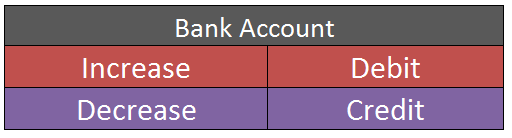

As per modern rules of accounting, a bank account is an asset account.

The asset account is debited when increased and credited when decreased.

Hence, the Bank account is debited here as it is increased.

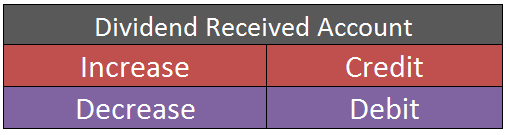

A dividend received account is an income account.

The income account is credited when increase and debited when decreased.

Hence, the dividend received account is credited here as it is increased.

Treatment in the financial statements

Since the dividend received is an income; it is shown on the credit side of the Statement of profit and loss.

The bank account is an asset so it will be shown on the balance sheet.

See less

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in: Contra accounts Contra entries The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corRead more

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in:

The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corresponds to.

Contra entries are entries of the debit and credit aspects related to the same parent account. Let’s discuss them in detail.

Contra accounts

Any account which is created with the purpose of reducing or offsetting the balance of another account is known as a contra account.

A contra account is just the opposite of the account to which it relates. The most common examples are the sales discount account and sales return account which is the contra account of the sales account. They are just the opposite of the sales accounts.

Contra Entries

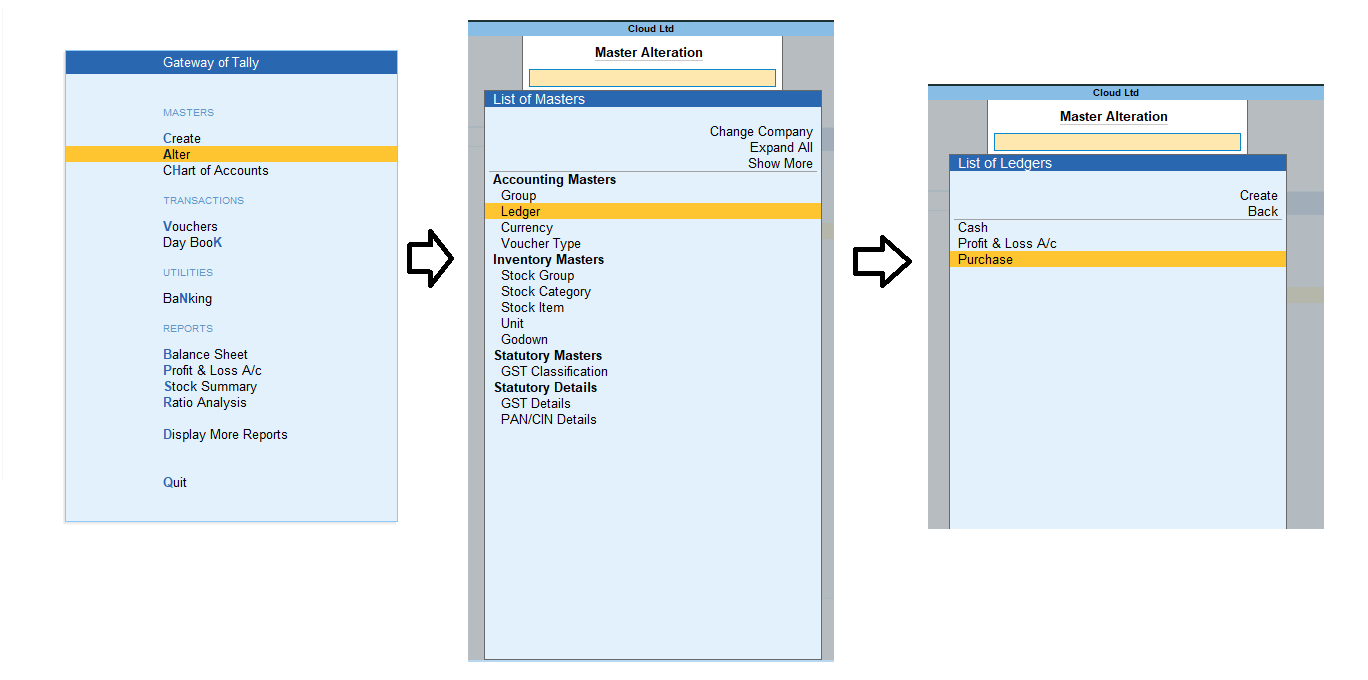

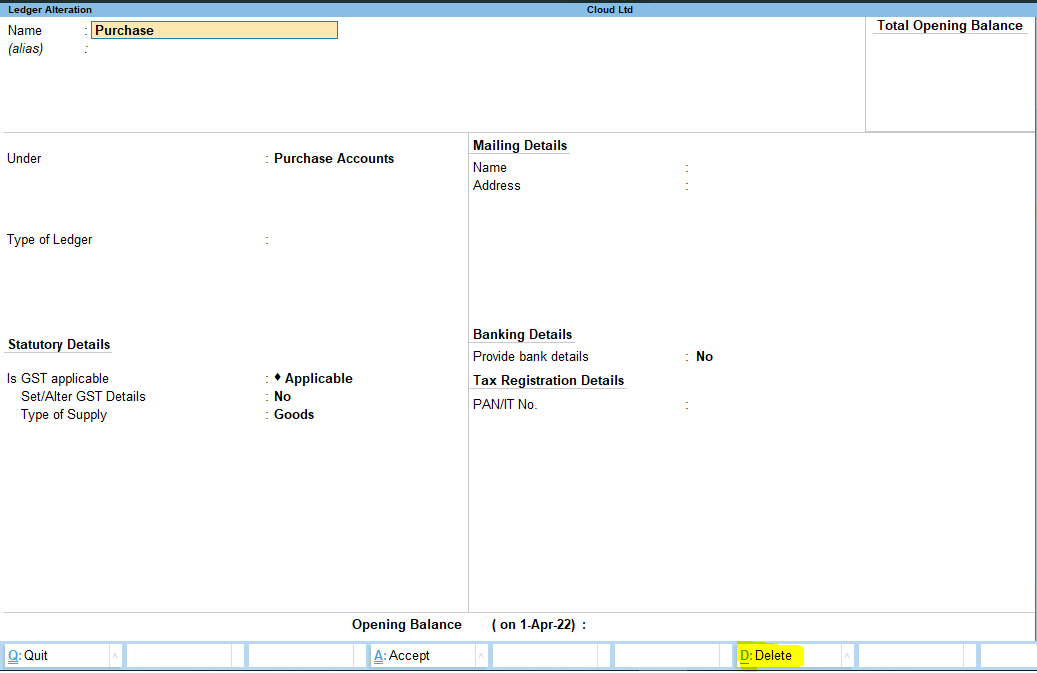

Contra entries refer to the entries which show the movement of the amount within the same parent account. Here, the debit and credit entry is posted on the debit and credit side respectively of a single parent account. Mainly, contra entries are the entries involving cash and bank accounts.

The following transactions are recorded as contra entries:

Contra entries are marked by the letter ‘C’ beside the postings in the ledger. Deposit of cash in to bank will be posted in cashbook as below:

See less