Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not on a particular period. Importance As the tRead more

Definition

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not on a particular period.

Importance

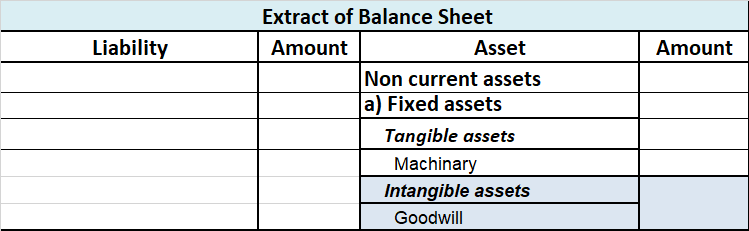

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheet or profit and loss

Purpose of trial balance which are as follows:

-

- To verify the arithmetical accuracy of the ledger accounts

- This means trial balance indicates that equal debits and credits have been recorded in the ledger accounts.

- It enables one to establish whether the posting and other accounting processes have been carried out without any arithmetical errors.

-

- To help in locating errors

- There can be some errors if the trial balance is untallied therefore to get error-free financial statements trial balance is prepared.

-

- To facilitates the preparation of financial statements

- A trial balance helps us to directly prepare the financial statements and then which gives us the right to not look or no need to refer to the ledger accounts.

Preparation of trial balance

-

- To verify the correctness of the posting of ledger accounts in the terms of debit credit amounts periodically, a periodic trial balance may be prepared ( say ) at the end of the month or quarter, or half year.

-

- There is no point in denying that a trial balance can be prepared at any time.

-

- But it should at least be prepared at the end of the accounting period to verify the arithmetical accuracy of the ledger accounts before the preparation of financial statements.

Methods of preparation

- Balance method

- Total amount methods

These are two methods that you can use to prepare trail balance, now let me explain to you in detail about these methods which are as follows:-

Balance method

- The balances of all the accounts ( including cash and bank account ) are incorporated in the trial balance.

- When ledger accounts are balanced only this method can be used.

- This method is generally used by accountants for preparation of the financial statements.

Total amount method

- Under this method, the total amount of debit and credit items in each ledger account is incorporated into the trial balance.

- This method can be used immediately after the completion of posting from the books of the original entry ledger.

Steps to prepare a trial balance

- First, we need to decide the method to opt for the preparation of the trial balance which is mentioned above.

- Then once opted, collect all the balances as per the method adopted and prepare accordingly by posting the debit and credit side of the trial balance.

- After this process arrange all the accounts in order of their nature (assets, liabilities, equity, income, and expenses ).

- Then you have to total debit and credit balances separately.

- After the above steps if there is any difference between the total debit and credit side balances then that is adjusted through the suspense account.

A suspense account is generated when the above case arises that is trial balance did not agree after transferring the balance of all ledger accounts including cash and bank balance.

And also errors are not located in timely, then the trial balance is tallied by transferring the difference between the debit and credit side to an account known as a suspense account.

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

- The balance of all

- Assets accounts

- Expenses accounts

- Losses

- Drawings

- Cash and bank balances

Are placed in the debit column of the trial balance.

- The balances of

- liabilities accounts

- income accounts

- profits

- capital

Are placed in the credit column of the trial balance.

See less

Debit Balance A debit accounting entry represents an increase in asset or expense account or a decrease in liabilities of an individual or enterprise. Debit balance is the amount in excess of debit entries over credit entries in the general ledger. The debit balance is shown as Dr. Credit Balance ARead more

Debit Balance

A debit accounting entry represents an increase in asset or expense account or a decrease in liabilities of an individual or enterprise.

Debit balance is the amount in excess of debit entries over credit entries in the general ledger. The debit balance is shown as Dr.

Credit Balance

A credit accounting entry represents a decrease in assets or an increase in liabilities or income accounts of an individual or enterprise.

Credit balance is the amount in excess of credit entries over debit entries in the general ledger. The credit balance is shown as Cr.

Debit Balance in the Passbook

A passbook is a record of a customer’s account transactions kept by the bank. The passbook is a copy of the bank account of the customer in the books of banks. Debit balance in the passbook is also called “Overdraft”.

All the transactions either debit or credit are recorded in the passbook. When the total amount of all debit entries in a passbook is more than the total of credit entries, it results in a debit balance. It means that an individual or enterprise owes to the bank.

The overdraft facility given by the bank has a limit i.e. only a certain amount can be withdrawn in excess of the amount deposited and if one avails overdraft facility, interest is also charged by the bank.

The amount withdrawn by a customer from the bank is shown as a debit entry and the amount deposited by the customer is shown as a credit entry. The passbook’s debit balance is a negative balance or unfavourable balance while the passbook’s credit balance is a positive or favourable balance.

For example: An individual deposited $50,000 in a bank account and withdrew a total sum of $60,000. So here, the passbook will show an overdraft of $10,000 i.e. the debit balance of the passbook. It signifies negative cash flow of the individual and that individual owes $10,000 to the bank.

Credit balance in Pass Book

On the other hand, when the total amount of all the debit entries in a passbook is less than the total amount of credit entries, it results in a credit balance. It means the amount deposited by a customer is more than the amount withdrawn indicating the positive cashflow in the account.

Reconciliation

It is the process of identifying and rectifying differences between the passbook and cashbook maintained by the bank and customer respectively. The aim is to ensure the accuracy of the transaction recorded in the cashbook and passbook.

Debit Balance Reconciliation

The debit balance in the cashbook and the credit balance in the passbook shows that some outstanding cheques are in the process of clearing and these cheques need to be adjusted for reconciliation of the balance of the passbook and cashbook.

Credit Balance Reconciliation

The credit balance in the cashbook and debit balance in the passbook shows that deposits already recorded in the cashbook are yet to be recorded in the passbook by the bank and these deposits need to be adjusted in the passbook for reconciliation of the balance of the passbook and cashbook.

Conclusion

The debit and credit balance of the passbook is the indicator of the financial position of an enterprise or individual. A debit balance signifies more withdrawals than receipts resulting in an overdraft.

See less