Capital Expense Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in natureRead more

Capital Expense

Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in nature.

Revenue Expenses

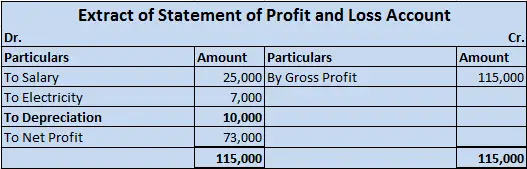

Revenue expenses are incurred to carry on operations of an entity during an accounting period. Such expenses help in maintaining the revenue earning capacity of the business and are recurring in nature.

These include ordinary repair and maintenance costs necessary to keep an asset working without any substantial improvement that leads to an increase in the useful life of the asset.

Suppose, company Takeaway ltd. purchases machinery for 50,000 and pays installation charges of 10,000. Salary of 15,000 is paid to the employees and existing machinery is painted costing 8,000. Here, the cost of machinery 50,000 and installation charges of 10,000 are treated as capital expenditure and the salary of 15,000 and painting cost of 8,000 is treated as revenue expenditure.

Identification

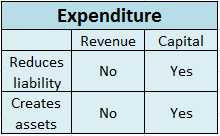

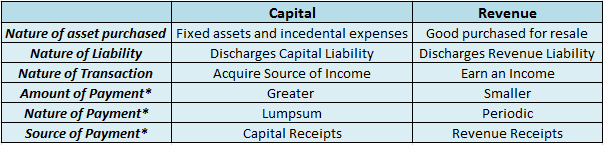

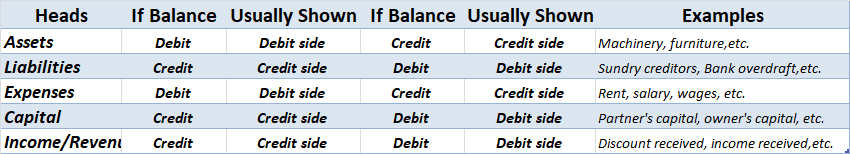

Points to categorize an expenditure as Capital or Revenue are as follows:

- An expenditure that neither creates assets nor reduces liability is categorized as revenue expenditure. If it creates an asset or reduces a liability, it is categorized as capital expenditure.

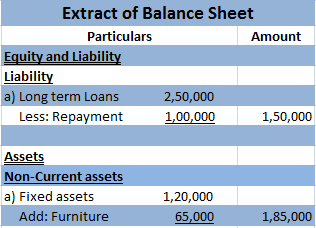

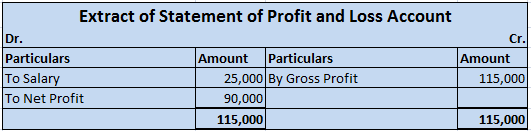

For example, a company Motors ltd. purchases furniture for 65,000, repays loans amounting to 1,00,000 and pays salary of 25,000.

Here the company creates an asset of 65,000 and reduces liability by 1,00,000 as shown below and therefore is considered as capital expenditure.

However, payment of salaries neither creates assets nor reduces liability. It only reduces profits and therefore is considered as revenue expenditure.

- Usually, the amount of capital expenditure is larger than that of revenue expenditure. But it is not necessary that if the amount is small it is revenue expenditure and if the amount is large, it is a capital expenditure.

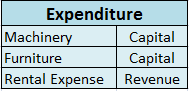

For example, a company Stars ltd purchases machinery for 1,20,000, furniture for 35,000 and has a rental expense of 80,000.

Here, the purchase of machinery is capital expenditure since it results in higher expense. However, the purchase of furniture cannot be regarded as a revenue expense and payment of rent cannot be regarded as a capital expense only because the rental expense is higher than the amount expended for the purchase of furniture.

- Usually, capital expenditure is not frequent and is made at a time, in lump sum. On the other hand, revenue expenditure is paid periodically. However, it is possible that capital expenditure is paid in installments.

For example, a company Caps ltd. purchases land for 1,00,00,000 on an equal monthly installment basis. Then such payments cannot be considered as revenue expense only because the payments are recurring. Since the installments are paid in lieu of the purchase of land which is a long term asset, the payments will be considered as capital expenditure.

- Mostly capital expenditures are met out of capital whereas revenue expenditures are met out of revenue receipts. However, payments can be made vice-versa.

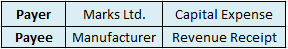

- If an expenditure is incurred by the payer as a capital expenditure, it will remain a capital expenditure even if the amount may be revenue receipt in the hands of the payee.

For example, a company Marks Ltd. purchases machinery directly from the manufacturer for 50,000. For the manufacturer, the proceeds from the sale of machine are revenue in nature but the amount expended by Marks Ltd. will be categorized as capital expenditure.

Following conclusion can be inferred from the above explanation:

*Such transactions may or may not hold true as explained above.

See less

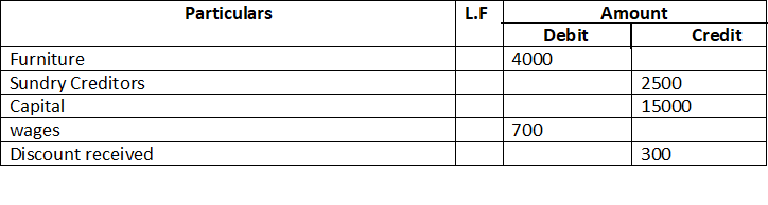

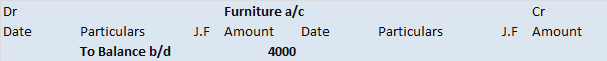

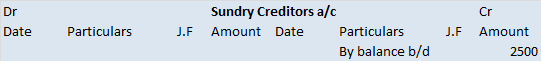

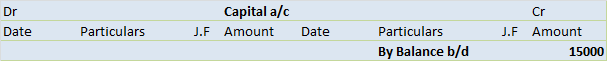

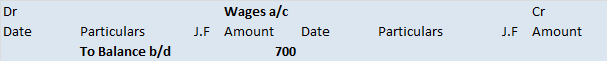

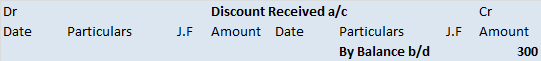

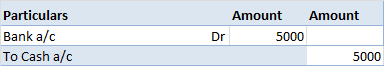

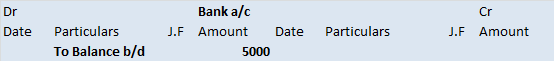

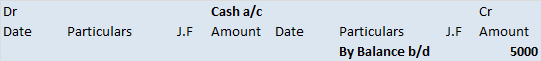

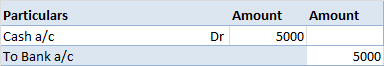

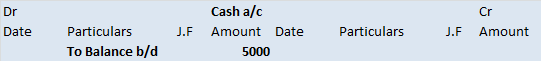

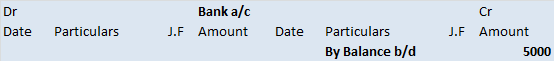

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

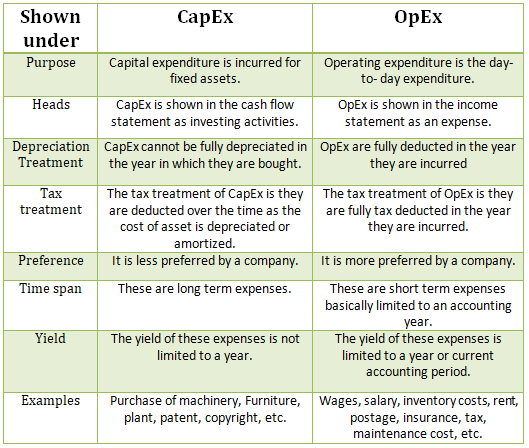

Let us first understand the concepts of Amortization and Impairment. Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets ovRead more

Let us first understand the concepts of Amortization and Impairment.

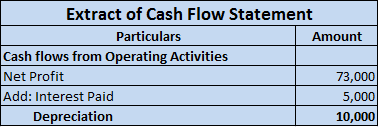

Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets over its life span.

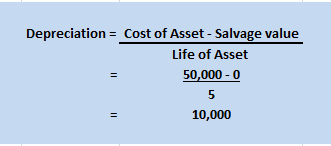

Amortization is similar to Depreciation, however, while depreciation is over tangible assets amortization is over Intangible assets of the company.

For example, Cipla Ltd. acquired a patent over a new drug for a period of 10 years. The cost of creating the new drug was 80,000 and the company must record its patent at 80,000. However, the company must amortize this cost by dividing the cost over the patent’s life, i.e., the amortization cost would be 8,000 (80,000/10) p.a. for the next 10 years.

Impairment means a decline in the value of fixed assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value” and such increase is recorded as an impairment loss.

Now suppose, Cipla Ltd. had existing machinery which suffered physical damage and is recorded at 50,000 in the books but the realizable value of the asset would only be 20,000. Hence, the asset would be written down to 20,000 and an impairment loss of 30,000 will be recorded.

Impairment Vs Amortization

Differences between the two can be shown as follows:

Suppose Unilever Ltd. has a patent over one of its products for a period of 5 years. The cost of the patent was 1,00,000. Then after 2 years one of its rivals, say ITC Ltd., launches a new product which is more preferred by the consumers over the one produced by Unilever Ltd. and the fair market value of the patent of Unilever Ltd. changes to 10,000.

Now in this scenario, Unilever Ltd. would have amortized the patent (costing 1,00,000) at 20,000 (1,00,000/5) p.a. for 2 years and the book value at the end of the 2nd year is 60,000 (1,00,000 – 40,000). Now due to the new launch by ITC Ltd. the drastic change in the value of the asset from the book value of 60,000 to the realizable value of 10,000 will be recorded as an Impairment loss. Hence Impairment loss would be recorded at 50,000 (60,000 – 10,000).

See less