When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium. UtilizatiRead more

When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium.

Utilization

Securities premium reserve can be used for the following reasons:

- Issue of fully paid Bonus share capital.

- To cover preliminary expenses of a company.

- For funding the buy-back of securities.

Since it is not a free reserve, it can only be used for a few specific purposes. The amount received as securities premium cannot be used to transfer dividends to shareholders

Treatment

When a company issues shares at a premium, the securities premium reserve account is credited along with share capital as an increase in capital is credited according to the modern rule of accounting.

For example,

Sonly Ltd. issues 1,000 shares of $10 face value at $15. Here, the amount of premium would be $5 (15 – 10) per share. Therefore, the journal entry would show:

Bank a/c (15 x 1,000) Dr 15,000

To Share Capital (10 x 10,000) 10,000

To Securities Premium Reserve a/c (5 x 10,000) 5,000

From the above example, we can see that the company receives $15,000, but transfers $10,000 to share capital and the excess $5,000 to securities premium reserve.

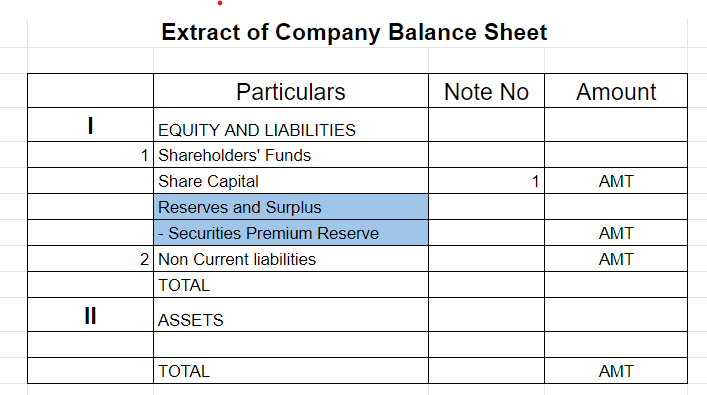

In the balance sheet, this securities premium reserve is shown under the title “Equity and Liabilities” under the head ‘‘Reserves and Surplus”.

The reserves created for specific purposes in business are called specific reserves. According to the Companies Act, 2013, these reserves cannot be used for any other purposes. However, if the Article of Association of a company allows, these reserves can be used for other purposes as well. Amount tRead more

The reserves created for specific purposes in business are called specific reserves. According to the Companies Act, 2013, these reserves cannot be used for any other purposes. However, if the Article of Association of a company allows, these reserves can be used for other purposes as well.

Amount to any specific reserve is generally transferred from the Profit and Loss Appropriation Account.

Various specific reserves are:

Debentures are debt instruments of a company and they have to be redeemed, that is, paid back after the expiry of the specified period. According to Accounting Standards, companies are required to set aside a specific amount in Debenture Redemption Reserve, when they are due for redemption.

When shares or debentures are issued at a price higher than its book value/face value, the difference between the market value and book value is called Securities Premium. The amount of Securities Premium is transferred to Securities Premium Account. This amount is utilized to issue fully paid bonus shares, write off preliminary expenses, write off commission discounts, etc., to provide a premium on redemption of debentures.

The investments made by a company are subject to fluctuations in its market value. Company Law and Accounting Standards require companies to provide for such fluctuations by creating a reserve called Investment Fluctuation Reserve.

Companies are required to pay a dividend to their shareholders. It is often difficult for a company to maintain a consistent rate of dividend as the dividend paid is equivalent to the profit made by a company during the financial year which is not consistent. So, Dividend Equalisation Reserve is created to maintain a consistent rate of dividend on shares over time, in the event of both high and low profits.

See less