A. Trading Account B. Trial Balance C. Profit and Loss Statements D. Balance Sheet

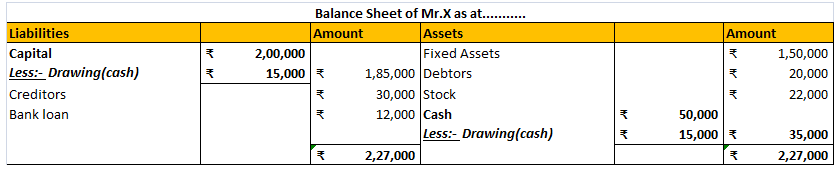

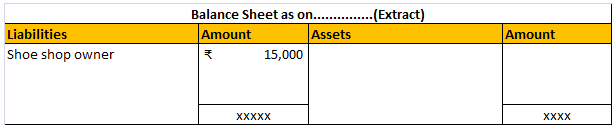

Order of Liquidity Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so onRead more

Order of Liquidity

Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so on and further. In the end, we will write goodwill.

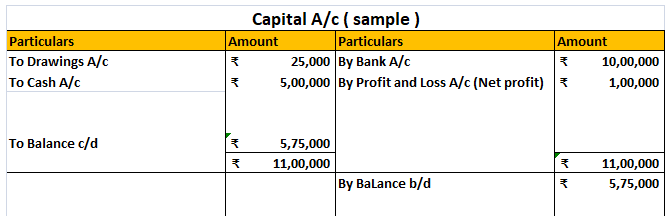

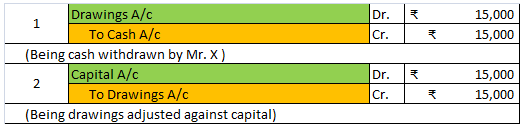

Liabilities are presented based on the order of urgency of payment. On the liabilities side, we start from short-term liabilities for example outstanding expenses, creditors and bill payable, and so on. In the end, we write capital adjusted with net profit and drawings if any.

This approach is generally used by sole traders and partnerships firms. The following is the format of Balance sheet in order of liquidity:

Order of Permanence

Under this method, while preparing a balance sheet by a company assets are listed according to their permanency. Permanent assets are shown at first and then less permanent assets are shown afterward. On the assets side of the balance sheet starts with more fixed and permanent assets i.e. it begins with goodwill, building, machinery, furniture, then investments and ends with cash in hand as the last item.

The fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. On the liabilities side, we start from capital, Reserve and surplus, Long term loans and end with outstanding expenses.

The following is the format of the Balance sheet in order of permanence:

Such order or arrangement of balance sheet items are refer as ‘Marshalling of Balance Sheet’.

See less

The correct answer is Option C. The Profit and loss statement is also referred to as the statement of revenues and expenses. It is because the Profit and Loss statement reports all types of revenue that have been earned and all types of expenses that have been incurred during a particular period ofRead more

The correct answer is Option C.

The Profit and loss statement is also referred to as the statement of revenues and expenses. It is because the Profit and Loss statement reports all types of revenue that have been earned and all types of expenses that have been incurred during a particular period of time.

Option A Trading Account reports only the operating revenues and operating expenses.

Option B Trial Balance shows the balances of all the ledgers of a business and is prepared to check the arithmetical accuracy of the books of accounts.

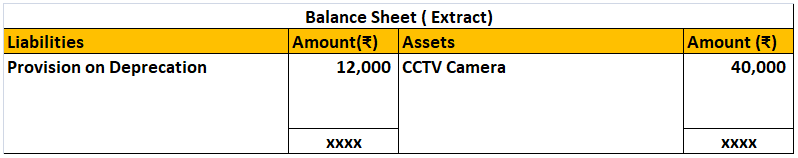

Option D Balance sheet reports the balances of assets and liabilities of a business as at a particular date.

People often confuse the trading and the profit and loss statement to be the same. But they are different.

Trading Account is prepared with aim of arriving at operating profit or gross profit whereas the profit and loss statement is prepared to arrive at the net profit of a business and reports every revenue and expense whether operating or non operating in nature.

Operating revenue and operating expense are earned or incurred respectively are related to the chief business activities of a business.

Features of profit and loss statement:

- It is prepared to measure the net profit of a business hence its profitability.

- It is usually prepared for a period of one year but many companies do prepare quarterly statements to better judge their performance.

- It helps the management in decision making and the other stakeholders like shareholders, creditors to make informed decisions.

See less