To start with let me give you a brief explanation of what a subscription is After joining a not-for-profit organization, a member is required to pay a certain amount of money every year at periodical intervals in order to keep his membership activated, such an amount of money is the subscription. FoRead more

To start with let me give you a brief explanation of what a subscription is

After joining a not-for-profit organization, a member is required to pay a certain amount of money every year at periodical intervals in order to keep his membership activated, such an amount of money is the subscription.

For accounting purposes, subscription is always taken on an accrual basis which means the amount which is received during the current year is only taken into consideration.

Now, Subscription received in advance means the amount of money that has been received during the current year but which relates to the year that is yet to come. In other words, we can say it is the unearned income by the organization.

It is recurring in nature and liability for the organization as it does not relate to the current year.

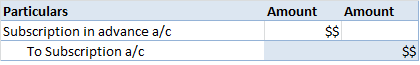

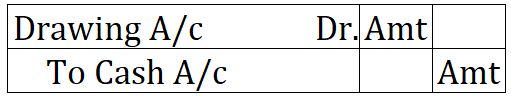

Journal Entry for Subscription received in advance

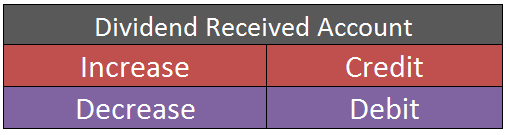

Here, the Subscription received in advance is credited to the Subscription account for the current year.

This is the adjustment entry made during the current year.

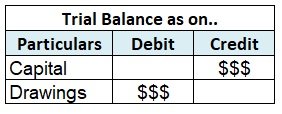

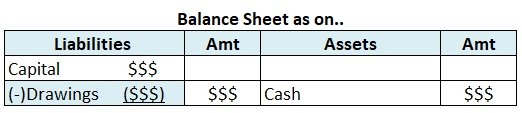

Treatment of Subscription in Financial Statements

- Receipts and payment account.

- Income and expenditure account.

- Balance sheet.

Receipts and Payment account: In the receipts and payment account, the entire amount of subscription is written on the receipts side. That is to say, subscription amount relating to the previous year, current year, and the year to come (outstanding subscription, current year subscription, advance subscription).

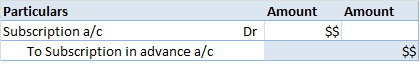

Income and Expenditure account: In the Income and Expenditure Account, the subscription comes on the Income side. It is shown as

Here, a subscription received in advance in the current year is deducted to find the actual amount because although the money is received in advance the benefits related to it are yet to be provided by the organization.

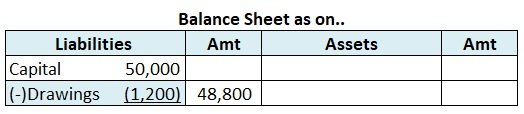

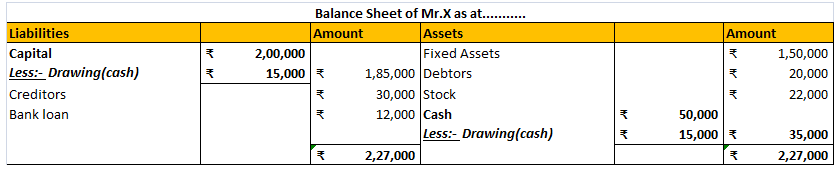

Balance sheet: In the balance sheet, a subscription received in advance comes in the liability side under current liabilities as the benefits related to it are yet to be derived.

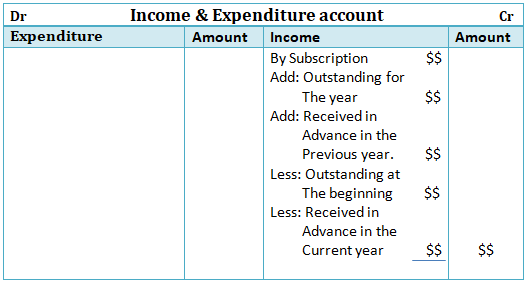

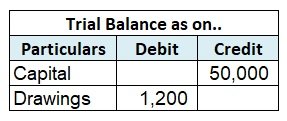

For Example, Lionel club received subscription from its members for the year 2020 as follows-

- Subscription of 2020 was received in 2019 – 2,000

- Subscription of 2021 was received in 2020 – 3,000

The total subscription was received during the year – 10,000

Here,

Subscription of 2020 was received in 2019- It is an Outstanding Subscription.

Subscription of 2021 was received in 2020- It is an advance Subscription.

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

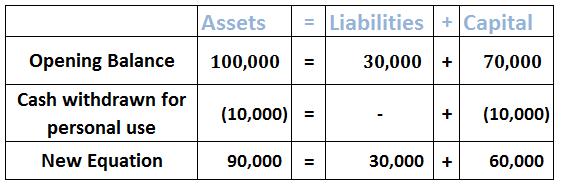

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

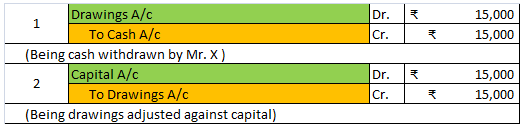

The following journal entry is posted to record the car loan taken for office use:

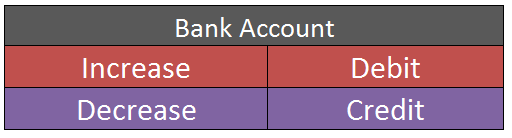

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

See less