Capital Expense Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in natureRead more

Capital Expense

Capital expenses are incurred for acquiring assets including incidental expenses. Such expenses increase the revenue earning capacity of the business. These are incurred to acquire, upgrade and maintain long term assets such as buildings, machines, etc and are non-recurring in nature.

Revenue Expenses

Revenue expenses are incurred to carry on operations of an entity during an accounting period. Such expenses help in maintaining the revenue earning capacity of the business and are recurring in nature.

These include ordinary repair and maintenance costs necessary to keep an asset working without any substantial improvement that leads to an increase in the useful life of the asset.

Suppose, company Takeaway ltd. purchases machinery for 50,000 and pays installation charges of 10,000. Salary of 15,000 is paid to the employees and existing machinery is painted costing 8,000. Here, the cost of machinery 50,000 and installation charges of 10,000 are treated as capital expenditure and the salary of 15,000 and painting cost of 8,000 is treated as revenue expenditure.

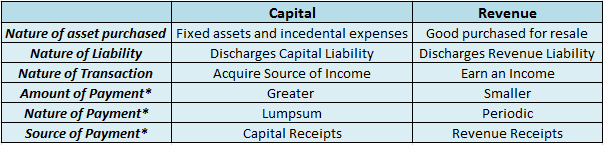

Identification

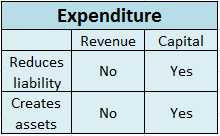

Points to categorize an expenditure as Capital or Revenue are as follows:

- An expenditure that neither creates assets nor reduces liability is categorized as revenue expenditure. If it creates an asset or reduces a liability, it is categorized as capital expenditure.

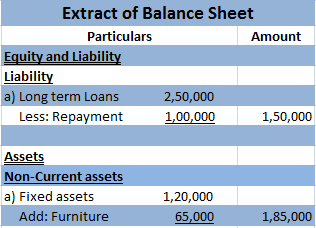

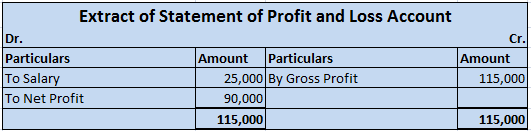

For example, a company Motors ltd. purchases furniture for 65,000, repays loans amounting to 1,00,000 and pays salary of 25,000.

Here the company creates an asset of 65,000 and reduces liability by 1,00,000 as shown below and therefore is considered as capital expenditure.

However, payment of salaries neither creates assets nor reduces liability. It only reduces profits and therefore is considered as revenue expenditure.

- Usually, the amount of capital expenditure is larger than that of revenue expenditure. But it is not necessary that if the amount is small it is revenue expenditure and if the amount is large, it is a capital expenditure.

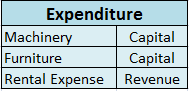

For example, a company Stars ltd purchases machinery for 1,20,000, furniture for 35,000 and has a rental expense of 80,000.

Here, the purchase of machinery is capital expenditure since it results in higher expense. However, the purchase of furniture cannot be regarded as a revenue expense and payment of rent cannot be regarded as a capital expense only because the rental expense is higher than the amount expended for the purchase of furniture.

- Usually, capital expenditure is not frequent and is made at a time, in lump sum. On the other hand, revenue expenditure is paid periodically. However, it is possible that capital expenditure is paid in installments.

For example, a company Caps ltd. purchases land for 1,00,00,000 on an equal monthly installment basis. Then such payments cannot be considered as revenue expense only because the payments are recurring. Since the installments are paid in lieu of the purchase of land which is a long term asset, the payments will be considered as capital expenditure.

- Mostly capital expenditures are met out of capital whereas revenue expenditures are met out of revenue receipts. However, payments can be made vice-versa.

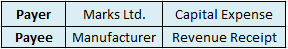

- If an expenditure is incurred by the payer as a capital expenditure, it will remain a capital expenditure even if the amount may be revenue receipt in the hands of the payee.

For example, a company Marks Ltd. purchases machinery directly from the manufacturer for 50,000. For the manufacturer, the proceeds from the sale of machine are revenue in nature but the amount expended by Marks Ltd. will be categorized as capital expenditure.

Following conclusion can be inferred from the above explanation:

*Such transactions may or may not hold true as explained above.

See less

A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period. When the total revenueRead more

A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period.

When the total revenue i.e. credit side of profit and loss a/c is more than the total of expenses i.e. the debit side of profit and loss a/c, it results in net profit whereas when the total revenue is less than the total of expenses, it results in a net loss.

The debit balance of the profit and loss account is the net loss incurred during the accounting period by an enterprise. It is transferred to a capital account thereby reducing the capital or can be shown as a debit balance on the asset side.

Accounting entry for loss transferred is as follows :

Capital A/c …Dr.

To Profit & Loss A/c

(being net loss transferred to capital account)

Example

A Business has a total income of $50,000 in an accounting year and has expenses amounting to $60,000 in that particular year. The profit and loss account will show a net loss of $10,000 ($60,000-50,000). Net loss will be transferred to capital A/c. Capital of the business will be reduced by $10,000. This loss can also be shown on the asset side of the balance sheet.

Extract of a Profit and loss a/c showing net loss is as under:

Profit and loss A/c for the year ended …..

The debit balance for a non-corporate entity is shown as a reduction from the capital account

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on…

Less: Profit & Loss A/c

While the Debit balance of profit and Loss A/c of a corporate entity is shown as a reduction in Reserves and surplus. If the business doesn’t have reserves then the debit balance is shown on the asset side.

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on..

Less: Profit & Loss A/c

Conclusion: Debit balance of profit and loss a/c represents that expenses are more than the income of a business in an accounting period. Debit balance of profit and loss a/c indicates that company need to increase its income or cut down on unnecessary expenses.

The business needs to find out the reason of excessive expenses because accumulated losses are not good for the health of the company.

See less