Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided. The rate of depreciation to be charged on mobile phones is 15Read more

Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided.

The rate of depreciation to be charged on mobile phones is 15% WDV* as per the Income Tax Act. The rates as per the companies act, 2013 are 4.75% SLM** and 13.91% WDV*.

*Written Down Value **Straight Line Method

A company has to charge depreciation on mobiles in their books as per the rates of Companies Act, 2013.

Any business or entity other than a company can choose the rate as per the Income Tax Act, 1961 which is 15% WDV. It is a general practice for non-corporates to charge depreciation in their books as per the rates of the Income Tax Act.

An important thing to know is that as per the Income Tax Act, 1961, mobile phones are treated as plants and machinery and the general rate of 15% is applied to it.

One may consider mobile phones as computers and charge depreciation at the rate of 40%. However, such a practice is not correct. Mobile phones are not considered equivalent to computers and there is case judgment given by Madras High Court which backs this consideration. The case is of Federal Bank Ltd. vs. ACIT (supra).

Therefore we are bound to this case judgment and should treat mobile phones as part of plant and machinery and charge depreciation on it accordingly for the time being.

See less

Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

2. Decrease in value of an asset upon revaluation:

3. Increase in value of liabilities upon revaluation:

4. Decrease in value of liabilities upon revaluation:

5. Transfer or distribution of the balance of revaluation account

or

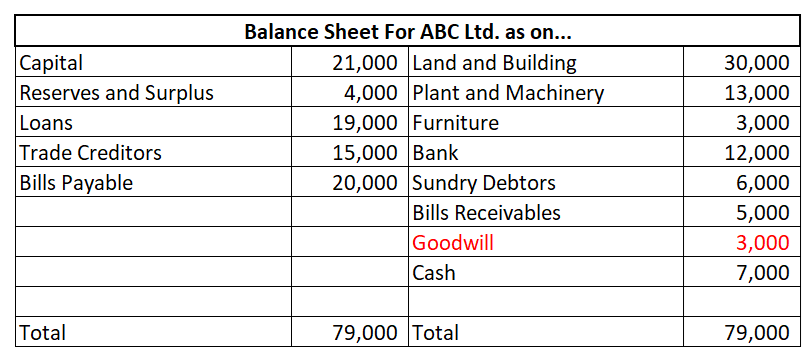

Numerical example

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

Let’s prepare the revaluation account.

See less