As you know all transactions occurring in a business are recorded in the journal (book of original entry) in chronological order. After recording them in the journal, they are posted to their respective ledger accounts. Here I've explained the steps involved in posting a journal entry to the ledger.Read more

As you know all transactions occurring in a business are recorded in the journal (book of original entry) in chronological order. After recording them in the journal, they are posted to their respective ledger accounts.

Here I’ve explained the steps involved in posting a journal entry to the ledger.

Posting of an account debited in the journal entry:

Step 1: Identify the account which has to be debited in the ledger.

Step 2: Write the date of the transaction under the ‘Date Column’ of the debit side of the ledger account.

Step 3: Write the name of the account which has been credited in the journal entry in the ‘Particulars Column’ on the debit side of the account as “To (name of the account)”.

Step 4: Write the page number of the journal where the entry exists in the ‘Journal Folio (JF) Column’.

Step 5: Enter the amount in the ‘Amount Column’ on the debit side of the ledger account.

Posting of an account credited in the journal entry:

Step 1: Identify the account which has to be credited in the ledger.

Step 2: Write the date of the transaction under the ‘Date Column’ of the credit side of the ledger account.

Step 3: Write the name of the account which has been debited in the journal entry in the ‘Particulars Column’ on the credit side of the account as “By (name of the account)”.

Step 4: Write the page number of the journal where the entry exists in the ‘Journal Folio (JF) Column’.

Step 5: Enter the amount in the ‘Amount Column’ on the credit side of the ledger account.

I’ll explain the process of preparing a ledger A/c with a simple transaction.

On 1st May ABC Ltd. purchased machinery for 5,00,000. In the Journal the following entry will be made.

| Machinery A/c | 5,00,000 |

| To Bank A/c | 5,00,000 |

| (Being machinery purchased for 5,00,000) |

Let’s assume that this entry appears on page no. 32 of the journal. Now we will open Machinery A/c and Bank A/c in the Ledger.

On the debit side of the Machinery A/c “To Bank A/c” will be written. In the Bank A/c “By Machinery A/c” will be written on the credit side.

An extract of both the accounts are as follows:

Machinery A/c

| Date | Particulars | J.F. | Amt. | Date | Particulars | J.F. | Amt. |

| May-01 | To Bank A/c | 32 | 5,00,000 |

Bank A/c

| Date | Particulars | J.F. | Amt. | Date | Particulars | J.F. | Amt. |

| May-01 | By Machinery A/c | 32 | 5,00,000 |

General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves. General reserve forms a part of the Profit & Loss ApprRead more

General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves.

General reserve forms a part of the Profit & Loss Appropriation account and is created to strengthen the financial position of the entity and serves as a sources of internal financing. It is upon the discretion of the management as to how much of a reserve is to be created. No reserve is created when the entity incurs losses.

General reserve is shown in the Reserves & Surplus head on the liability side of the balance sheet of the entity and carries a credit balance.

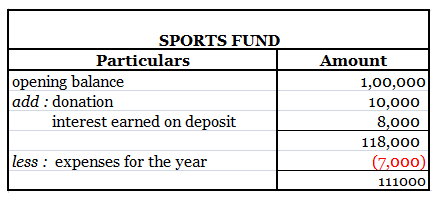

Suppose, an entity, ABC Ltd engaged in the business of electronics earns a profit of 85000 in the current financial year and has an existing general reserve amounting to 100000. The management decides to keep aside 20% of its profits as general reserve.

Then the amount to be transferred to general reserve will be = 85000*20% = 17000.

In the financial statements it will be shown as follows-

Now, in the next financial year, the entity incurs losses amounting to 45000. In this case, no amount shall be transferred to the general reserve of the entity and will be shown in the financial statement as follows-

The creation of general reserve can sometimes be deceiving since it does not show the clear picture of the entity and absorbs losses incurred.

See less