When in a single transaction two or more accounts are involved, such kinds of transactions are termed as Compound entries. Example 1, Johnson Co. purchased goods worth 5,000, and half of the amount was paid in cash and the other half by cheque. So here three accounts are involved: Purchase account-Read more

When in a single transaction two or more accounts are involved, such kinds of transactions are termed as Compound entries.

Example 1, Johnson Co. purchased goods worth 5,000, and half of the amount was paid in cash and the other half by cheque.

So here three accounts are involved:

Purchase account- That is to be debited.

Cash account- That is to be credited.

Bank account- That is to be credited.

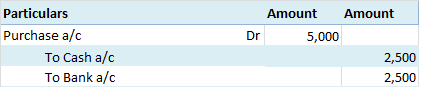

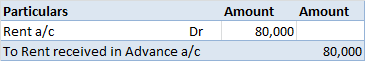

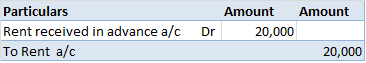

Journal entry:

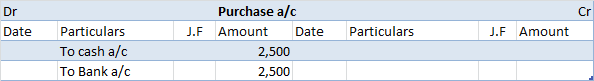

Now posting the above journal entry in a ledger account.

In the Journal, the Purchase account has been debited. So in the ledger, the purchase account will also be debited. Since the purchase account is debited in the ledger, the corresponding two credit accounts of this entry i.e. the cash and the bank will be written on the debit side in the particulars column. So while posting, the amount to be considered would be the amount individually paid in cash and bank as shown in the journal entry.

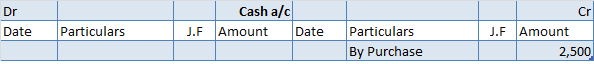

Cash a/c is credited with the purchase account. In the ledger, purchase a/c will be posted on the credit side. So while posting, the amount to be considered would be the amount individually paid in cash.

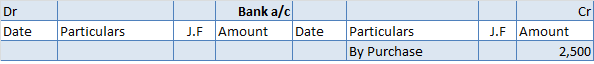

Bank a/c is credited with the purchase account. In the ledger, purchase a/c will be posted on the credit side. So while posting, the amount to be considered would be the amount individually paid in Bank a/c.

Example 2, Johnson Co purchased goods and made payment in cash 2,000. Along with it, it also paid commission and interest of 1,000 and 500 respectively.

So here four accounts are involved:

Purchase account- That is to be debited.

The commission allowed account- That is to be debited.

Interest allowed account- That is to be debited.

Cash account- That is to be credited.

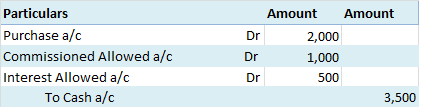

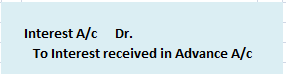

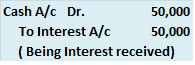

Journal Entry:

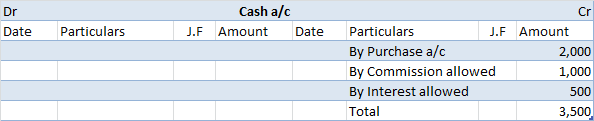

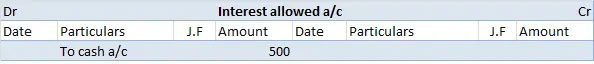

Now posting the above journal entry in a ledger account.

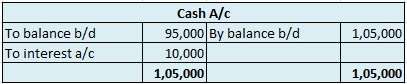

In the journal entry, the cash account has been credited. So in the ledger, the cash account will also be credited. Since the cash account is credited in the ledger, the corresponding three accounts will also be credited in the particulars column. As in the journal entry the three debit accounts viz. Purchase, the commission allowed, and interest allowed, the amounts written against them shall be entered in the respective accounts in the amount column on the credit side of the cash account.

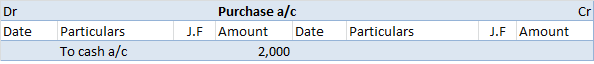

Purchase a/c is debited with a cash account. In the ledger, Cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in the Purchase account.

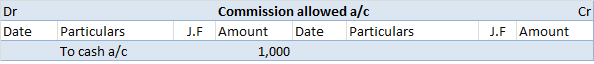

The commission allowed a/c is debited with a cash account. In the ledger, cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in Commission allowed a/c.

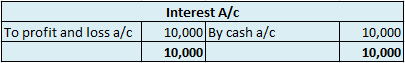

Interest allowed a/c is debited with a cash account. In the ledger, cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in Interest allowed a/c.

See less

Let us first understand the concepts of Amortization and Impairment. Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets ovRead more

Let us first understand the concepts of Amortization and Impairment.

Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets over its life span.

Amortization is similar to Depreciation, however, while depreciation is over tangible assets amortization is over Intangible assets of the company.

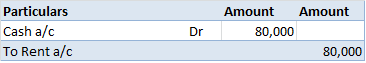

For example, Cipla Ltd. acquired a patent over a new drug for a period of 10 years. The cost of creating the new drug was 80,000 and the company must record its patent at 80,000. However, the company must amortize this cost by dividing the cost over the patent’s life, i.e., the amortization cost would be 8,000 (80,000/10) p.a. for the next 10 years.

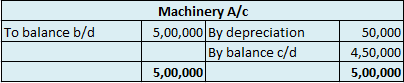

Impairment means a decline in the value of fixed assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value” and such increase is recorded as an impairment loss.

Now suppose, Cipla Ltd. had existing machinery which suffered physical damage and is recorded at 50,000 in the books but the realizable value of the asset would only be 20,000. Hence, the asset would be written down to 20,000 and an impairment loss of 30,000 will be recorded.

Impairment Vs Amortization

Differences between the two can be shown as follows:

Suppose Unilever Ltd. has a patent over one of its products for a period of 5 years. The cost of the patent was 1,00,000. Then after 2 years one of its rivals, say ITC Ltd., launches a new product which is more preferred by the consumers over the one produced by Unilever Ltd. and the fair market value of the patent of Unilever Ltd. changes to 10,000.

Now in this scenario, Unilever Ltd. would have amortized the patent (costing 1,00,000) at 20,000 (1,00,000/5) p.a. for 2 years and the book value at the end of the 2nd year is 60,000 (1,00,000 – 40,000). Now due to the new launch by ITC Ltd. the drastic change in the value of the asset from the book value of 60,000 to the realizable value of 10,000 will be recorded as an Impairment loss. Hence Impairment loss would be recorded at 50,000 (60,000 – 10,000).

See less