The correct option is (A) Original. Journal entry is the book of the original entry. It is because every event or transaction which is of monetary nature is first recorded in the journal. The transactions recorded in the journal are known as journal entries. Journal follows the double-entry system oRead more

The correct option is (A) Original. Journal entry is the book of the original entry. It is because every event or transaction which is of monetary nature is first recorded in the journal. The transactions recorded in the journal are known as journal entries.

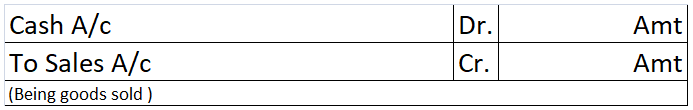

Journal follows the double-entry system of accounting. It means a journal entry affects at least two accounts. It is from the journal entries, the ledger accounts are prepared. For example, the transaction, ‘sale of goods for Rs 1000 for cash’ affects two accounts. The journal entry is:

There are many special journals that record some special set of transactions which are called subsidiary journals or daybooks. Such special journals are not considered the books of original entry.

Option (B) Duplicate is wrong. It is because the journal is the book where monetary events and transactions are recorded. It cannot be the book of duplicate entries. There is no such thing as ‘book of duplicate entry.’

Option (C) Personal is wrong. Personal is a type of account under the golden rules of accounting. A personal account is a type of account that represents a person. But, the journal is not an account, it is a book. Also, there is no such thing as book of personal entry.

Option (D) Nominal is wrong. Nominal is also a type of account under the golden rules of accounting. The nominal account is a type of account that represents an income, expense, gain or loss. Journal is a type of account but a book.

See less

Capitalize in Accounting The term 'capitalized' in accounting means to record an expenditure as an asset on the balance sheet. Capitalization takes place when a business buys an asset that has a useful life. The cost of the relevant asset is then allocated to expense over its useful life i.e charginRead more

Capitalize in Accounting

The term ‘capitalized’ in accounting means to record an expenditure as an asset on the balance sheet. Capitalization takes place when a business buys an asset that has a useful life. The cost of the relevant asset is then allocated to expense over its useful life i.e charging depreciation, etc. This means that the relevant expenditure will appear on the balance sheet instead of the income statement. The capitalizing of the expenses is a benefit for the company as the assets bought by them for the long-term are subjected to depreciation and capitalizing expenses can amortize or depreciate the costs. This process is called capitalization.

In order to capitalize any expense, we’ll have to make sure it meets the criteria stated below.

The assets exceeding the capitalization limit

The companies set a capitalization limit, below which the expenses are considered too immaterial to be capitalized. Therefore, the limit is supposed to be followed and considered as it controls the capitalization of the expenses. Generally, the capitalization limit is $1,000.

The assets have a useful life

The companies also seek to generate revenues for a long period of time. Thus, the asset should have a long and useful life at least a year or more. Thereby, the business can record it as an asset and depreciate it over its valuable life.

Most of the important principles of capitalization in accounting are from the matching principle.

Matching Principle

The matching principle states that the expenses in the accounting should be recorded when they are incurred and not when the payment is made. This helps the business identify the amounts spent to generate revenue.

For e.g, the company bought machinery for manufacturing goods with more efficiency. It is supposed to have a useful life for a period of over 10 years. Instead of expensing the entire cost of the machinery, the company will write off (depreciated) the cost of the asset over its useful life i.e 10 years. Therefore, the asset will be written off as it is used and these types of assets are automatically used as capitalized assets.

Benefits of Capitalization

Capitalization is of course recording expenses as an asset but this indeed has benefits.

See less