Based on duration, expenses can be categorized as capital expenditure and revenue expenditure. A) Capital expenditure or CAPEX are those funds that are used to acquire or maintain or enhance long-term assets. Such expenses do not occur frequently and are incurred to enhance the company’s utility inRead more

Based on duration, expenses can be categorized as capital expenditure and revenue expenditure.

A) Capital expenditure or CAPEX are those funds that are used to acquire or maintain or enhance long-term assets. Such expenses do not occur frequently and are incurred to enhance the company’s utility in the long-term i.e. more than one year.

The formula of CAPEX can be given as –

Capital expenditure = Net increase in PP & E + Depreciation Expense

. It is showed in companies’ cash flow statement and in its Balance Sheet under the head of fixed assets. These capital expenditures are capitalized.

List of some capital expenses –

- Buildings (Including costs of purchase and other cost that extend the useful life of a building)

- Computer equipment (Cost of purchase and installation cost)

- Office equipment (Purchase cost)

- Furniture and fixtures (Cost of purchase and installation cost)

- Intangible assets (i.e. patent, trademark)

- Land (Including the cost of purchasing and upgrading the land)

- Machinery (Purchase cost and costs that bring the equipment to its location and for its intended use)

- Software (Installation cost)

- Vehicles

Example- If an asset costs Rs10,000 when bought and installation cost is Rs2000. The total capital expenditure will be Rs12000 and is expected to be in use for five years, Rs2,500 may be charged to depreciation in each year over the next five years.

B) Revenue expenditure or OPEX are those expenses that are incurred during its course of the operation. It can also be termed as total expenses that are incurred by firms through their production activities. Such costs do not result in asset creation, and the benefits resulting from it are limited to one accounting year. These are for managing operational activities and revenue within a given accounting period.

The accounting treatment for revenue expenditure for an accounting period is shown in a companies Income Statement, but it is not recorded in the firm’s Balance Sheet. OPEX is not capitalized and depreciation is not levied on such expenses.

Examples for revenue expenditures are as follows –

- Direct expenses

These types of expenses are mostly incurred directly through the production process. Common direct expenses include – direct wages, freight charge, rent, material cost, legal expenses, and electricity cost.

- Indirect expenses

These expenses are indirectly related to production like during sale, distribution, and management of finished goods or services. They include expenses like selling salaries, repairs, interest, commission, depreciation, rent, and taxes, among others.

See less

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method. It is a general practice for non-corporates to charge depreciation at rates slRead more

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method.

It is a general practice for non-corporates to charge depreciation at rates slightly lower than the rate provided by the Income Tax Act, 1961. But one cannot charge depreciation more than it.

In the case of corporate, the rates for charging depreciation are provided by the Companies Act 2013, which is

Let’s take an example:

Mr X is a jewellery shop owner and has installed CCTV cameras on 1st April 2021, costing ₹ 40,000 at various points in his shop to ensure safety and security. Keeping in mind the Income-tax rates, his accountant decided to charge depreciation @ 30% p.a. on the CCTV cameras.

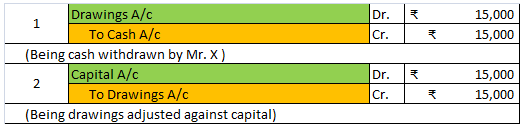

Following is the journal entry:

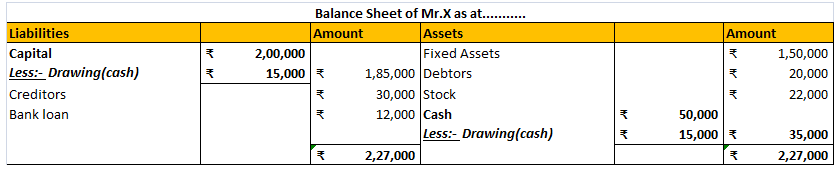

The balance sheet will look like this:

See less