Introduction Working capital refers to the capital which is required by an enterprise to smoothly run its daily operations. It is the measure of the short-term liquidity of a business. Working capital is the total of the current assets of a business, net of its current liabilities. Working capitalRead more

Introduction

Working capital refers to the capital which is required by an enterprise to smoothly run its daily operations.

It is the measure of the short-term liquidity of a business.

Working capital is the total of the current assets of a business, net of its current liabilities.

Working capital = Current Assets – Current Liabilities

The working capital consists of cash, accounts receivable and inventory of raw materials and finished goods fewer accounts payable and other short-term liabilities.

Without a proper level of working capital, a business cannot maintain regular production and pay its creditors and expenses.

Hence, for proper management of working capital, it is divided into types:

- Permanent working capital

- Temporary working capital

I have discussed them below:

Permanent Working Capital

It is the fixed level or minimum level of working capital that an enterprise needs to maintain to ensure production at the normal capacity and pay for its daily expenses. It is independent of the level of production.

It is also known as fixed working capital.

By ‘permanent’, it does not mean that it will forever remain at the same level or amount but it may change if the overall production capacity changes. But such changes in permanent working capital are not often.

Temporary Working Capital

It is the level of working capital that depends upon the level of production of a business. It is the excess working capital over the permanent capital that is required to meet seasonal high demand.

It is also known as fluctuating working capital because it tends to change often depending on the level of production.

Temporary working capital is required when high production is required to meet seasonal demands.

For example, a bakery will need more working capital to meet the increased demand for cakes and pastry during Christmas season

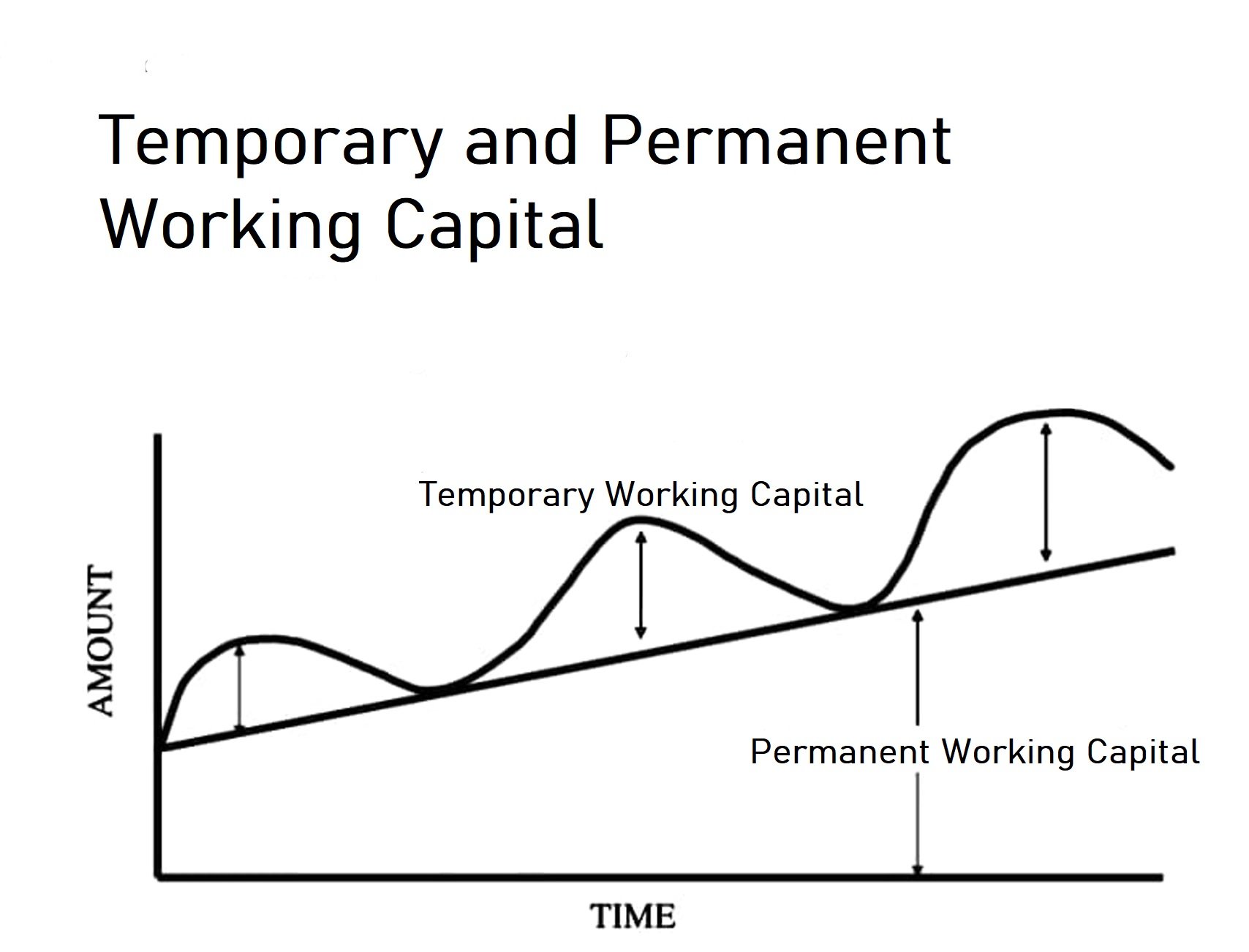

Graph showing permanent and temporary working capital

Here, the temporary working capital is fluctuating whereas the permanent working capital is gradually increasing with time.

See less

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income. In accrual accounting, income is recognised only when it is accrued or earned. DeferredRead more

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income.

In accrual accounting, income is recognised only when it is accrued or earned. Deferred revenue is the income received before the performance of the economic activity to earn it.

Example: A shoe shop owner gives an order to a shoe manufacturer of 1000 pair of shoes which is to be delivered after 4 months. He also gives him a cheque of ₹15,000 in advance, the rest ₹5000 is to be given at the time of delivery.

So, in this case, the ₹15,000 is actually is unearned revenue i.e. deferred revenue. It will be recognised as revenue when the shoe manufacture completes the order and deliver it.

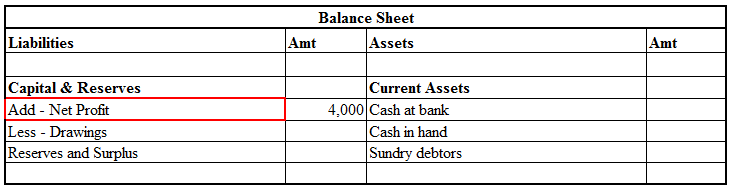

Till then, the deferred revenue is reported as a liability in the balance sheet. Like this:

After recognition as revenue, it will be reported in the statement of profit or loss:

Hence, to summarise, deferred revenue is:

Some examples of deferred revenue are as follows:

Now the question arises why deferred revenue is recognised as a liability. It is due to the fact that the business may not be able to perform the economic activity successfully to earn that revenue.

Taking the above example, suppose the shoe manufacturer is not able to honour its commitment and the shoe shop owner can wait no more, then the advanced money of ₹ 15,000 is to be refunded. That’s why deferred revenue is recognised as a liability because it is a liability if we consider the principle of conservatism (GAAP).

See less