Meaning of lease A lease is an agreement or a contract in which the right to use an asset like land, building, or machinery is given by one party to the other party for a fixed period of time against the consideration of a single payment or a series of payments. There are two parties in a lease agreRead more

Meaning of lease

A lease is an agreement or a contract in which the right to use an asset like land, building, or machinery is given by one party to the other party for a fixed period of time against the consideration of a single payment or a series of payments.

There are two parties in a lease agreement:

- Lessor: The party who gives the right to use its asset in return for a series of payments or a single payment.

- Lessee: The party who receives the right to use the asset from the Lessor.

This is similar to a rent agreement or contract. The only difference between lease and rent is duration. A rent agreement is generally for less than 12 months while a lease agreement is for more than 12 months like 5 years or 10 years, sometimes even for like 99years.

Type of lease

There are two types of lease:

- Operating lease

- Finance Lease

Operating lease

- An operating lease is a type of lease in which the possession of the leased asset is transferred back from the lessee to the lessor at the end of the lease period.

- Here, all the risk and rewards incident to ownership remains with the lessor, not the lessee.

- The depreciation on the leased asset in case of operating lease is not charged by the lessee to its profit and loss account as the leased asset is not shown in the balance sheet. A leased asset is an off-balance sheet item in the case of an operating lease.

Finance lease

- Unlike an operating lease, the ownership of the leased asset is transferred to the lessee at the end of the leased period.

- Thus, at the inception of the lease agreement, all the risk and rewards incident to ownership is transferred from the lessor to the lessee.

- The depreciation on the leased asset is charged by the lessee to its profit and loss account as the leased asset is shown in the balance sheet. A leased asset is a balance sheet item in the case of an operating lease.

- Along with the leased asset, the obligation to pay the future lease payment is also shown in the balance sheet as a non-current liability or current liability as the case may be.

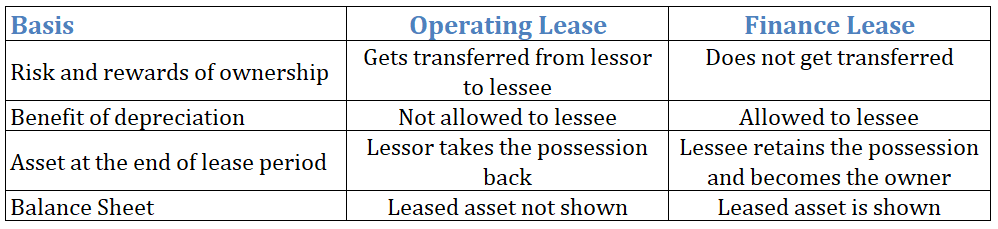

Difference between operating lease and finance lease in tabular format

See less

Introduction Ind AS 110 stands for Indian Accounting Standard 110. It deals with principles of preparation and presentation of consolidated financial statements when an entity controls one or more other entities. It is often seen that an entity owns and controls one or more entities. Like a parent cRead more

Introduction

Ind AS 110 stands for Indian Accounting Standard 110. It deals with principles of preparation and presentation of consolidated financial statements when an entity controls one or more other entities.

It is often seen that an entity owns and controls one or more entities. Like a parent company have many subsidiaries. For example, Alphabet is the parent company of Google. The parent and its subsidiaries prepare their financial statements separately to present to the true and fair view of their business.

Consolidated financial statements are the financial statements of the whole group i.e. taking the parent and its subsidiaries together. It reports the assets, liabilities, equity, income and expenses of the whole group as a single economic entity.

It helps the stakeholders to know the overall performance and positions of assets and liabilities of the whole group.

When to prepare Consolidated Financial Statements(CFS)

The requirement for the preparation of CFS depends on the control model provided by Ind AS 110. As per this model, an investor controls an investee when:

If both the conditions are fulfilled, then it can be said that the investor controls the investee and the investor has to prepare the consolidated financial statements with its investee. Every type of investor-investee relationship is judged as per Ind AS 110.

Exposure or right to variable returns

Variable returns mean no fixed returns and can vary as per the performance of the investee. Such returns can be both positive and negative. These returns include not only return on investment but also the benefits or expenses to which the investor is entitled to or has to bear respectively. Such returns are:

It is not required by Ind AS 110 for an investor to be exposed or have the right to all such variable returns, but there should be significant exposure or right.

Power to affect the variable returns from investee

An investor has power over an investee if it has existing rights that give it direct ability to affect the relevant activities of the investee

An investor generally has many rights over the investee. These rights are of two types:

However, the investor may other substantive rights like power to appoint or remove the board of directors etc.

These rights should not only exist with investors but the investor should also have the ability to exercise such rights.

Scope of Ind AS 110

The investee can be any type of entity, the structure of the investee does not matter whether it is a partnership firm, LLP, company or any Special Purpose Entity (SPE).

If any investor control one or more other entities it will be called parent entity and it will present the consolidated financial statements.

Exemptions

If any parent entity fulfils any of these conditions, then the presentation of consolidated financial statements is not necessary:

- It is an investment entity.

- Its debt or equity securities are not listed on any recognized stock exchange or any other public market.

- It is a wholly-owned or partially owned subsidiary of another entity and all of its owners have been informed about and do not have any objections to the parent not preparing the consolidated financial statements.

- Its ultimate or any intermediate parent entity has prepared consolidated financial statements for the whole group.

- It did not file or is in process of filing its financial statement with the concerned securities commission or any other regulatory body for issuing its securities in the public market.

See less