Meaning of Working Capital Firstly, let’s understand the meaning of the working capital. Working capital is the factor which demonstrates the liquidity position of the business to carry out day to day operations. It majorly includes cash & bank balances and liquid assets. Managing working capitaRead more

Meaning of Working Capital

Firstly, let’s understand the meaning of the working capital. Working capital is the factor which demonstrates the liquidity position of the business to carry out day to day operations. It majorly includes cash & bank balances and liquid assets.

Managing working capital is a crucial process to maintain short term liquidity and so ultimately resulting into achieving long term objectives efficiently. Working capital can be calculated by deducting business’s current liabilities from current assets.

To achieve the ideal working capital requirement for any business, it is important to understand various types of working capital and various ways to manage it.

Coming to Permanent Working Capital, also called as Fixed Working Capital, it is the minimum working capital required or maintained by businesses. Such type of working capital is maintained to take care of regular financial obligations like creditors, inventory, salaries etc.

Irrespective of scale of operations carried out in business, Permanent Capital is maintained by businesses which can be in form of Net Working Capital.

There is no specific formula for calculating Fixed Working Capital, it completely depends upon the business’s assets and liabilities. So accordingly, it can be estimated through the balance sheet of the business.

For calculating Permanent Working Capital, you can follow below steps:

- Calculate Net Working Capital for each day for a whole month

- Find the smallest value among them

- That will be Permanent Working Capital for the month

- Follow the above steps for every month

- There you have the annual figure for Permanent Working Capital

The requirement of Permanent Working Capital changes as the business expands. It is crucial to make sure that the working capital level does not fall below the Permanent Working Capital requirement.

Types of Permanent Working Capital:

Permanent working capital is further divided into two types:

- Regular working capital – This refers to capital required to maintain healthy cashflow for purchases of raw materials, payment of wages etc.

- Reserve working capital – This refers to amount which is more than regular working capital to take care of unexpected business expenses due to contingent events.

Introduction Working capital refers to the capital which is required by an enterprise to smoothly run its daily operations. It is the measure of the short-term liquidity of a business. Working capital is the total of the current assets of a business, net of its current liabilities. Working capitalRead more

Introduction

Working capital refers to the capital which is required by an enterprise to smoothly run its daily operations.

It is the measure of the short-term liquidity of a business.

Working capital is the total of the current assets of a business, net of its current liabilities.

Working capital = Current Assets – Current Liabilities

The working capital consists of cash, accounts receivable and inventory of raw materials and finished goods fewer accounts payable and other short-term liabilities.

Without a proper level of working capital, a business cannot maintain regular production and pay its creditors and expenses.

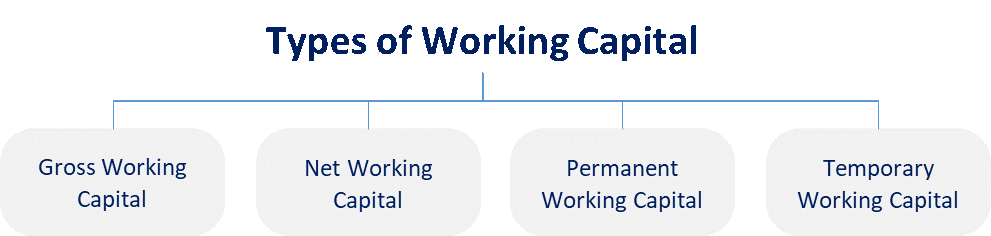

Hence, for proper management of working capital, it is divided into types:

I have discussed them below:

Permanent Working Capital

It is the fixed level or minimum level of working capital that an enterprise needs to maintain to ensure production at the normal capacity and pay for its daily expenses. It is independent of the level of production.

It is also known as fixed working capital.

By ‘permanent’, it does not mean that it will forever remain at the same level or amount but it may change if the overall production capacity changes. But such changes in permanent working capital are not often.

Temporary Working Capital

It is the level of working capital that depends upon the level of production of a business. It is the excess working capital over the permanent capital that is required to meet seasonal high demand.

It is also known as fluctuating working capital because it tends to change often depending on the level of production.

Temporary working capital is required when high production is required to meet seasonal demands.

For example, a bakery will need more working capital to meet the increased demand for cakes and pastry during Christmas season

Graph showing permanent and temporary working capital

Here, the temporary working capital is fluctuating whereas the permanent working capital is gradually increasing with time.

See less