Depreciation of fixed capital assets refers to C. Normal wear & tear & foreseen obsolescence. Normal wear & tear refers to the damage caused to an asset due to its continuous usage. Even when the asset is properly maintained, wear and tear occurs. Hence, it is considered to be inevitableRead more

Depreciation of fixed capital assets refers to C. Normal wear & tear & foreseen obsolescence.

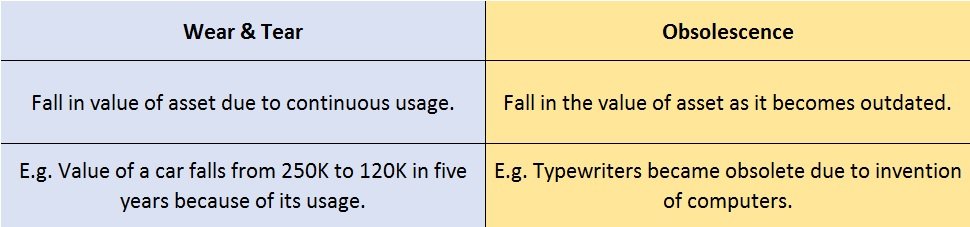

Normal wear & tear refers to the damage caused to an asset due to its continuous usage. Even when the asset is properly maintained, wear and tear occurs. Hence, it is considered to be inevitable and natural.

For example, Kumar has purchased a car for 25,00,000. After five years he wishes to sell his car. Now the market price of his used car is 12,00,000. This reduction in the value of the car from 25,00,000 to 12,00,000 is because of its usage. This fall in the value of the asset due to usage is known as normal wear & tear.

In generic terms, obsolescence means something that has become outdated or is no longer being used. Foreseen obsolescence is nothing but obsolescence that is expected.

In the context of business, whenever the value of an asset falls because it has become outdated or is replaced by a superior version, we call it obsolescence. The fall in the value of the asset due to obsolescence expected by the purchaser of the asset is known as foreseen obsolescence.

When an asset becomes obsolete it doesn’t mean it is not in working condition. Even when an asset is in good working condition it can become obsolete due to the following reasons:

- Technology advancement.

- Change in demand (change in fashion, change in taste and preferences of the consumers, etc.)

For example, before the invention of computers, people used typewriters for getting their paperwork done. With the invention of computers, laptops, etc. it is easier to type as well as save our documents, spreadsheets, etc. Thus typewriters became obsolete with the invention of computers. It has become a technology of the past.

Here is a summarised version of wear & tear and obsolescence:

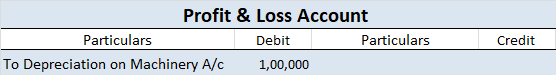

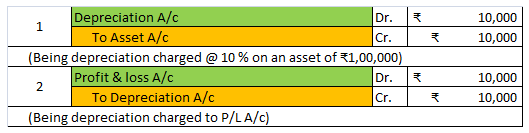

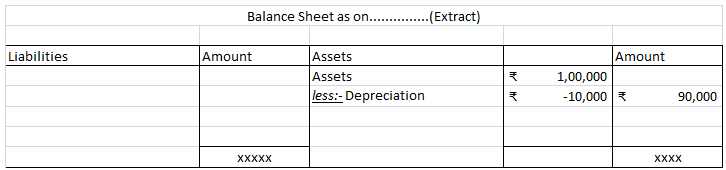

When the Accumulated depreciation account is not maintained, the journal entry for vehicle depreciation shall be Particulars Debit Credit Depreciation a/c Dr. (xxx) To Vehicle a/c (xxx) (Being DepreciationRead more

When the Accumulated depreciation account is not maintained, the journal entry for vehicle depreciation shall be

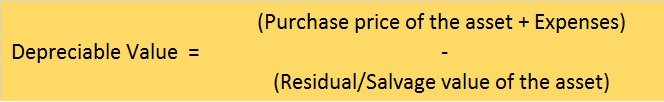

For example, let us assume that a vehicle (Bike) was purchased on 1st April 2019 with INR. 2,50,000, the rate of depreciation is 15% and also the Company follows the straight-line method of calculating depreciation.

Then the journal entries shall be,

The depreciation charge for the 1st Year

The depreciation charge for the 2nd Year

The depreciation charge for the 3rd Year

The respective ledger accounts for all three years are given below:

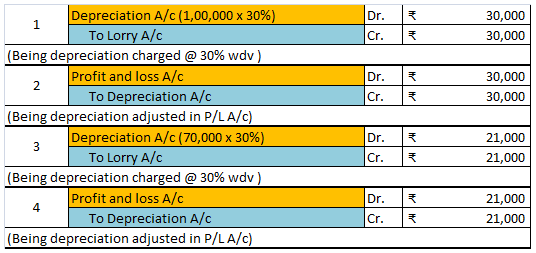

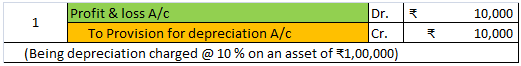

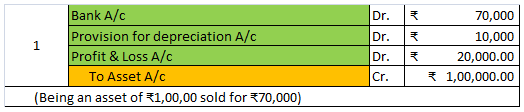

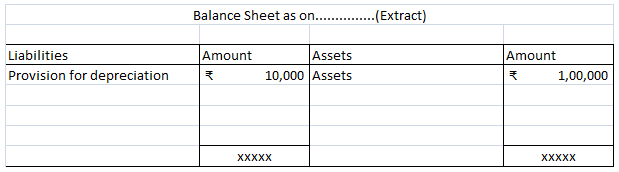

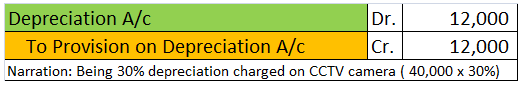

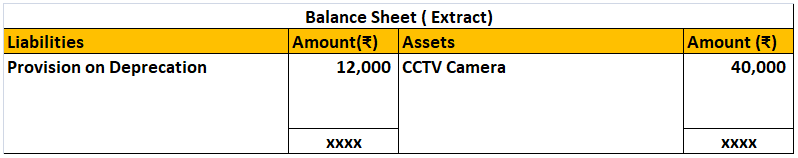

When the Accumulated depreciation account is maintained, the journal entry for vehicle depreciation shall be

Taking the above said example,

The depreciation charge for the 1st Year

The depreciation charge for the 2nd Year

The depreciation charge for the 3rd Year

The respective ledger accounts for all three years are given below:

See less