Before starting with the main discussion, let me give you a brief explanation of what rent received is When a business or an organization rents out its unused property to earn some extra income and receive some amount from it, that amount of money is said to be rent received. Rent can be monthly, quRead more

Before starting with the main discussion, let me give you a brief explanation of what rent received is

When a business or an organization rents out its unused property to earn some extra income and receive some amount from it, that amount of money is said to be rent received.

Rent can be monthly, quarterly, half-yearly, or yearly rent depending upon the organization’s agreement.

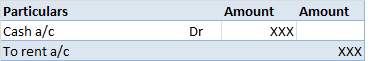

The journal entry for rent received will be

Here, Cash account is debited due to the increase in assets or because of a real account. Rent account is credited due to the increase in income or because of the nominal account.

However, Rent received in advance means the amount of rent that is not yet due but is received in advance. It is treated as a current liability because the benefit related is yet to be provided to the tenant.

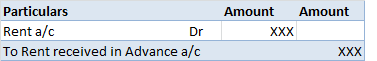

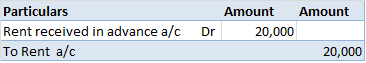

The Journal entry for Rent received in advance will be-

Here, rent is debited due to a decrease in income.

Rent received in Advance is credited due to an increase in liability.

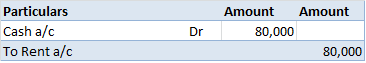

For Example, Johnson company rented out a part of its building that was not used to earn some extra income from it. The monthly rent was fixed as 20000. Johnson company follows calendar year as their accounting year. The tenant, therefore, paid 4 months advance rent to Johnson company i.e. the tenant in January gave his advance rent for February, March, April, and May.

While receiving the rent in the month of January. The journal entry would be

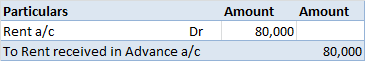

Now, the adjustment entry of rent received in advance would be

The rent received in advance will also be posted individually in each month of February, March, April, and May as

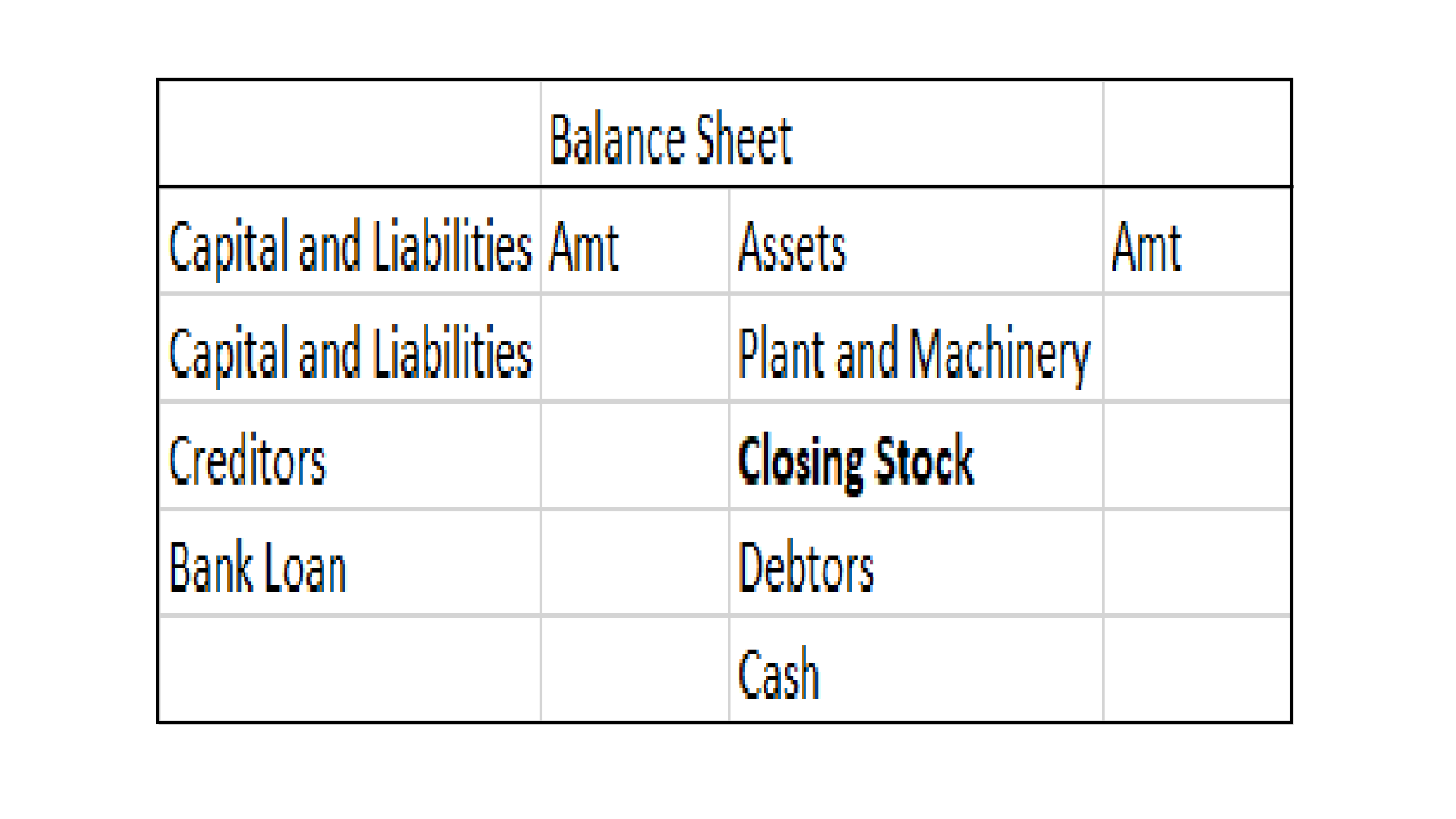

Furthermore, Rent received in advance is deducted from the amount of rent in the income and expenditure account and thereafter the amount received in advance is posted on the liability side of the Balance sheet.

See less

The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received. The journal entry is: An entity may receive cash in the following evRead more

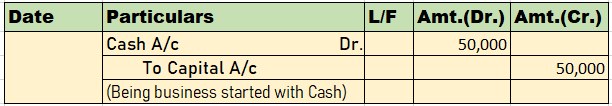

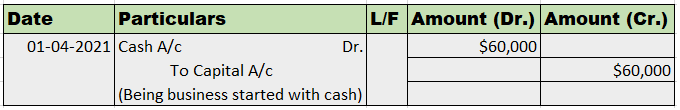

The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received.

The journal entry is:

An entity may receive cash in the following events:

This list is not exhaustive. There may be many such events. However, the cash account will be always debited.

Rules of accounting applicable on the cash account

As per the golden rules of accounting, the cash account is a real account as represents an asset. For real accounts, the rule, “Debit the receiver and credit the giver” applies.

Hence, when cash is received, cash is debited and the source (giver) is credited.

As per modern rules of accounting, the cash account is an asset account. Assets accounts are debited when increased and credited when decreased.

Hence, at receipt of cash, cash is debited as cash is increased.

See less