Yes, the account receivable is a sub ledger account. It is an account that is used to record the payment history of each and every customer to whom the business has sold goods or provided services on credit. Accounts receivable represent the amount that the customers owe to the business with respectRead more

Yes, the account receivable is a sub ledger account. It is an account that is used to record the payment history of each and every customer to whom the business has sold goods or provided services on credit.

Accounts receivable represent the amount that the customers owe to the business with respect to the goods sold or services provided to them on credit. They are also known as trade receivable or debtors.

The accounts receivable subledger shows various details of every transaction like the invoice number, amount due, date of payment, discount allowed etc. The subledger accounts are also known as the subsidiary accounts.

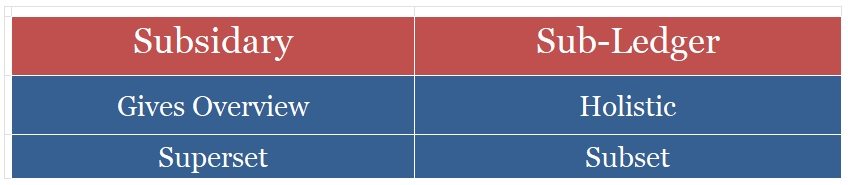

Difference between general ledger and subledger accounts

Here is a list of the major differences between sub-ledgers and the general ledger:

- The subsidiary accounts or the sub ledger are a subset of the general ledger. In other words we can say that subsidiary accounts are a part of the general ledger.

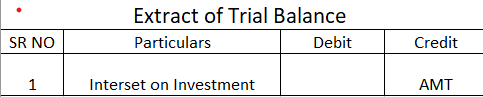

- The trial balance is prepared with the help of the general ledger and not with the help of subsidiary accounts.

- The trial balance is prepared with the help of the general ledger and not with the help of subsidiary accounts.

- The subledger accounts help us to store large volumes of data. They provide us with detailed and comprehensive analysis of each item of financial statements. On the other hand, a general ledger provides us with superficial information about every item in one place.

Importance/ use of Subsidiary Account

The usefulness of an accounts receivable sub ledger account lies in the fact that it provides detailed information about the money different customers owe to the business.

For example, the general ledger account may show that the total balance of trade receivable is 1 lakh without indicating the individual amount that each customer owes to the business. The subsidiary account can help us by showing that customer A owes 50000 rupees, customer B owes 30000 rupees while customer C owes 20000 rupees.

In short, the subsidiary accounts provide detailed information about each and every transaction. They help us to find useful information quickly and easily. They help us analyze the business policies and take corrective actions.

Thus, we can conclude that accounts receivable is a subledger account that provides us detailed information about the various credit transactions and the amount that each customer owes to the business. It helps us analyze our credit policies and take corrective actions. It helps us identify and classify bad debts as such on

See less

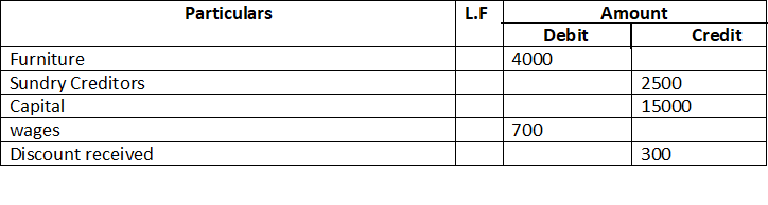

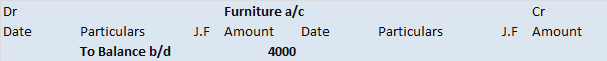

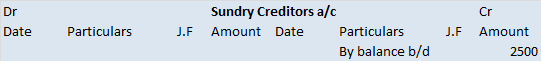

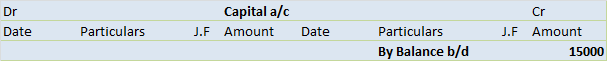

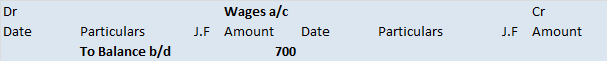

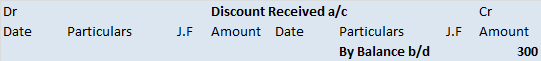

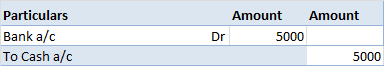

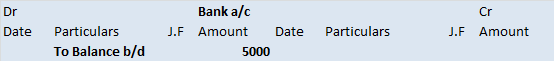

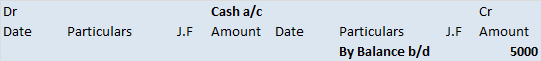

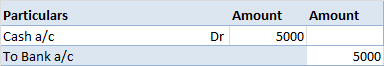

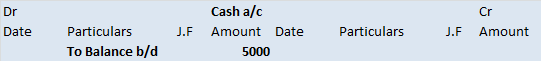

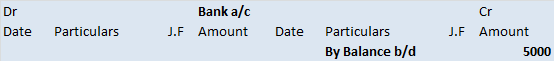

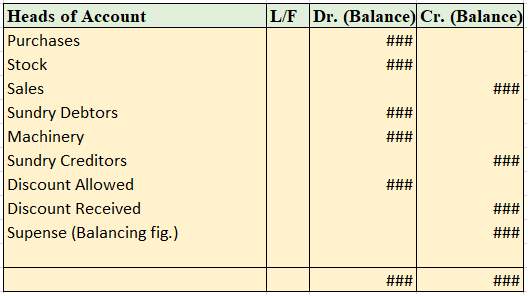

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not on a particular period. Importance As the tRead more

Definition

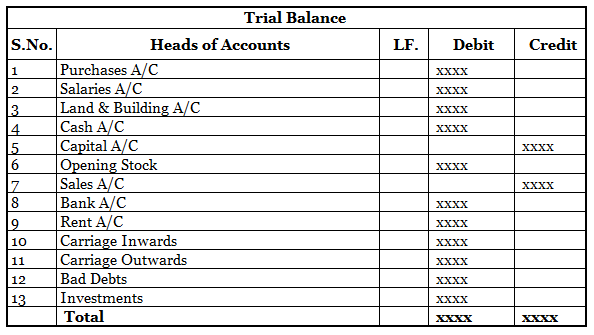

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not on a particular period.

Importance

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheet or profit and loss

Purpose of trial balance which are as follows:

Preparation of trial balance

Methods of preparation

These are two methods that you can use to prepare trail balance, now let me explain to you in detail about these methods which are as follows:-

Balance method

Total amount method

Steps to prepare a trial balance

A suspense account is generated when the above case arises that is trial balance did not agree after transferring the balance of all ledger accounts including cash and bank balance.

And also errors are not located in timely, then the trial balance is tallied by transferring the difference between the debit and credit side to an account known as a suspense account.

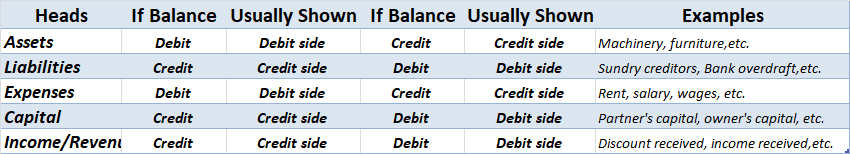

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

Are placed in the debit column of the trial balance.

Are placed in the credit column of the trial balance.

See less