Let us begin with a short explanation of what opening balance is: The opening balance is the amount of funds that are bought forward from the end of one accounting period to the beginning of a new accounting period. In a firm’s account, the first entry done is of the opening balance. It can either hRead more

Let us begin with a short explanation of what opening balance is:

The opening balance is the amount of funds that are bought forward from the end of one accounting period to the beginning of a new accounting period.

In a firm’s account, the first entry done is of the opening balance. It can either have a debit balance or a credit balance depending upon whether the firm has a negative or positive balance.

Opening balance of a ledger

Opening balance is the first entry of the ledger account at the beginning of an accounting period.

In the case of a newly started business, there will be no closing balances and as such there will be no balances to be carried forward. In such a case, the investment and capital of the business will be entered as an opening balance for the current accounting period.

So the first and foremost part is to identify on which side of the ledger i.e. the debit side or the credit side the opening balance is to be entered.

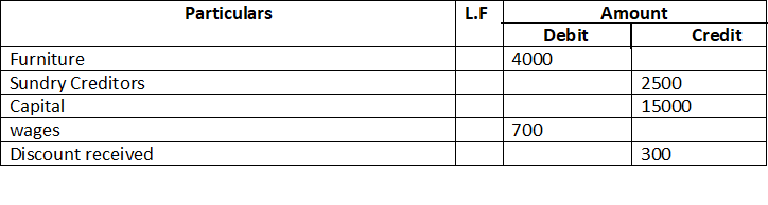

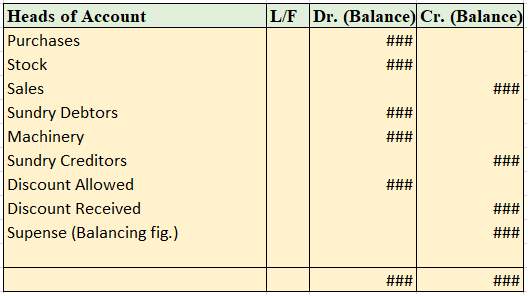

For Example, A trial balance is given which represents the debit and credit balances, accordingly, I will prepare different ledger accounts to make it simpler.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

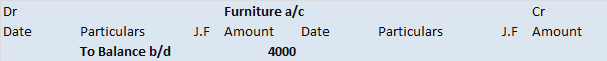

As the Furniture is an Asset account, the opening balance will be on the debit side of the ledger account.

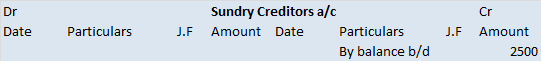

As Sundry creditor is a credit account, we put the opening balance on the credit side.

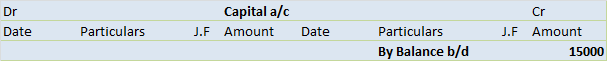

As the Capital is a credit account, we put the opening balance on the credit side.

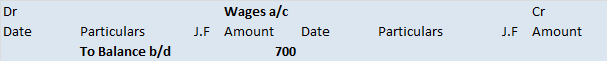

As Wages is a debit account, we put the opening balance on the debit side.

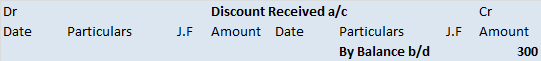

As the Discount received is a credit account, we put the opening balance on the credit side.

Exception

Drawing Account.

Drawing account is an exception to this topic. It is considered a contra account to the owner’s capital account because it reduces the value of the owner’s equity. Drawings, therefore, have no opening balance.

Contra Entry.

Contra entry involves transactions of cash and bank. Any entry which involves both the cash and bank is contra entry.

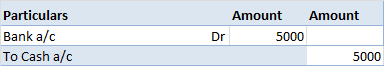

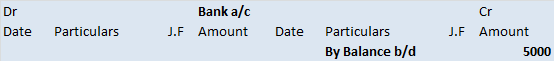

For example, we deposit cash 5000 into the bank.

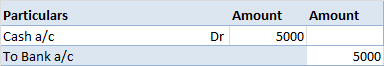

Accounting entry for this transaction would be

In this case, the ledger entry would be

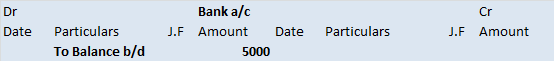

As the bank account has a debit balance, the opening balance would come on the debit side.

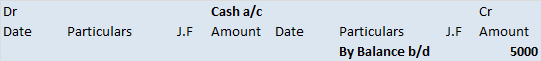

As the cash account has a credit balance, the opening balance would come on the credit side.

Alternatively, If we withdraw cash 5000 from the bank.

Accounting entry would be

In this case, the ledger entry would be

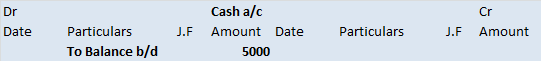

As the Cash account has a debit balance, the opening balance would come on the debit side.

As the Bank account has a credit balance, the opening balance would come on the credit side.

See less

Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not in a specific period. Types of error in theRead more

Definition

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not in a specific period.

Types of error in the trial balance

Now let me explain to you that what are the errors of trail balance which are as follows :

• Error of principle

• Compensating error

• Transactions completely omitted

• Error of recording

• Error of posting

A trial balance is not conclusive proof of the accuracy of the books of accounts since certain types of errors remain even when it tallies. They are explained below :

Error of principle

This error arises due to the incorrect application of the principle of accounting is not disclosed by the trial balance.

Compensating error

It means the group of errors committed in such a way that one mistake is compensated by another and the trial balance still agrees.

Transaction completely omitted

When the transaction is entirely omitted from recording in the books of account cannot be detected.

Error of recording

When both aspects of recording a transaction twice in the books of account take place.

Error of posting

Posting the correct amount on the correct side but in the wrong account is not reflected in the trial balance.

Steps to locate errors

Differences in the trial balance, howsoever minor they may be, must be located and rectified. The following steps are useful in locating errors are :

• Two columns of the trial balance should be totaled again.

• The list of sundry debtors and creditors should be checked to find out whether all balances of debtors and creditors have been correctly written in the trial balance or not.

• It should be checked that the balances of every account including cash and bank balances ( from the cash book ) have been written in the correct column of the trial balance.

• If the errors remain undetected, try to locate the errors by trial and error techniques such as finding an account showing a balance difference from the trial balance.

• Ledger balances should be balanced again.

• Check the totals of subsidiary books.

• Check the posting of nominal accounts.

• And at last if not possible to locate the difference in the trial balance is temporarily transferred to a suspense account.

Importance

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheets or profit and loss.

Purpose of trial balance

• To verify the arithmetical accuracy of the ledger accounts

This means trial balance indicates that equal debits and credits have been recorded in the ledger accounts.

It enables one to establish whether the posting and other accounting processes have been carried out without any arithmetical errors.

• To help in locating errors

There can be some errors if the trial balance is untallied therefore to get error-free financial statements trial balance is prepared.

• To facilitate the preparation of financial statements

A trial balance helps us to directly prepare the financial statements and then which gives us the right to not look or no need to refer to the ledger accounts.

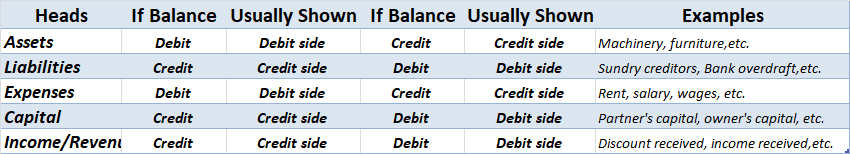

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

• The balance of all

• Assets accounts

• Expenses accounts

• Losses

• Drawings

• Cash and bank balances

Are placed in the debit column of the trial balance.

• The balances of

• liabilities accounts

• income accounts

• profits

• capital

Are placed in the credit column of the trial balance.

See less