Definition Not-for-profit organizations are also known as non-profit organizations set up to further cultural, educational, religious, professional, or public service objectives. Its aim is not to earn profit Accounting done by non-profit organizations is fund based. Type of accounting Non-pRead more

Definition

Not-for-profit organizations are also known as non-profit organizations set up to further cultural, educational, religious, professional, or public service objectives. Its aim is not to earn profit

Accounting done by non-profit organizations is fund based.

Type of accounting

Non-profit organizations do Fund Based Accounting.

Donations received or funds set aside for specific purposes are credited to a separate fund account and are shown on the liabilities side of the balance sheet.

The income from or donations for these funds are credited to the respective fund account. On the other hand, expenses or payments out of these funds are debited.

Accounting when done on this basis is known as Fund Based Accounting.

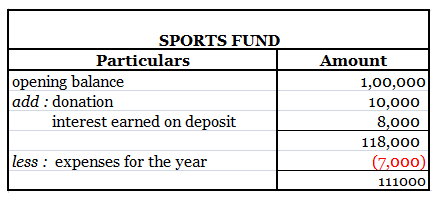

Let me explain to you with an example :

The sports fund has a balance of Rs 100000 which is invested as a fixed deposit in a bank earning 8% interest. A further donation of Rs 10000 is received towards it. Expenses incurred towards prizes are Rs 7000; Rs 3000 towards trophies and Rs 4000 distribution of cash prizes. The accounts are shown as follows :

Categories of funds

In the case of non-profit organizations, funds may be classified under the following heads :

Unrestricted fund :

The unrestricted fund does not carry any restriction with respect to its use. In other words, management can use the amounts in the funds as it deems appropriate, but to carry out the purpose for which the organization exists.

This is known as the general fund or the capital fund to which the surplus for the year is added and in case of deficit, deducted.

Restricted fund :

A restricted fund is a fund, the use of which is restricted either by the management or by the donor for a specific purpose.

Examples of such funds are endowment funds, annuity funds, loan funds, prize funds, sports funds, etc.

- Government grant: grant received from the government for a specific purpose is restricted to be used for the purpose it is granted. It is accounted for in the books following fund-based accounting.

- For example, a grant received from the government for ‘the polio eradication program is credited to the polio eradication fund, and income earned relating to the fund is credited to the fund while expenses are debited.

- Endowment fund: it’s a fund usually a non-profit organization, arising from a bequest or gift, the income of which is devoted to a specific purpose.

- Annuity fund: an annuity fund is established when a non-profit organization receives assets from a donor with a condition to pay

- Loan fund: loan fund is set up to grant loans for specific purposes say loans to pursue higher studies.

- A fixed assets fund is a fund earmarked for investment in fixed assets or already invested in fixed assets.

- Prize funds: it is a fund set up to use for distribution as prizes say for achievements or contributions to the welfare of society.

To start with let me first explain the difference between receipts and income & payment and expenditure. Although Receipts and Income may look similar terms, there are some differences. Receipts have their relation with both cash and cheques received on account of various items of the organizatiRead more

To start with let me first explain the difference between receipts and income & payment and expenditure.

Although Receipts and Income may look similar terms, there are some differences.

Receipts have their relation with both cash and cheques received on account of various items of the organization. Whereas, income is considered as a revenue item for finding surplus or deficit of the organization. All the receipts collected during the year may not be considered as income.

For Example, if an organization sale of its assets that is of a capital nature, it would not be considered as an item of income and hence would be treated in the balance sheet.

Similarly, Payment and Expenditure are two different terms. Payments are those that have their relation with cash and cheques given for various activities of the organization. Whereas, Expenditure is considered as revenue expenditure for ascertainment of surplus or deficit in the case of a not-for-profit organization. All payments made during the year may not be considered as expenditures.

Differences

See less