The term "principal book of accounts'' refers to the set of ledgers that an entity prepares to group the similar transactions recorded as journal entries under an account. So to put it simply, the principal book of accounts mean ledgers. Ledgers are prepared by posting the debits and credits of a joRead more

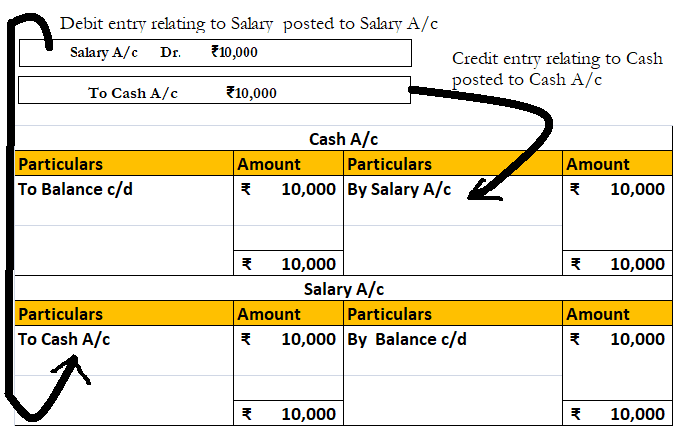

The term “principal book of accounts” refers to the set of ledgers that an entity prepares to group the similar transactions recorded as journal entries under an account.

So to put it simply, the principal book of accounts mean ledgers.

Ledgers are prepared by posting the debits and credits of a journal entry to the respective accounts.

A ledger groups the transactions concerning the same account. For example, Mr B is a debtor of X Ltd. Hence all the transactions entered into with Mr. will be grouped into the ledger Mr B A/c in the books of X Ltd.

Ledgers are of utmost importance because all the information to any account can be known by its ledger.

Preparation of ledger is very important because all the information to any account can be known by its ledger. Ledgers also display the balance of each and every account which may be debit or credit. This helps in the preparation of the trial balance and subsequently the financial statements of an entity.

Hence, it is the most important book of accounts and calling it the ‘books of final entry’ is also justified.

See less

The value of inventory at the end of the financial year or balance sheet date is called closing stock. Closing stock includes: Raw Material Work-in-Progress Finished Goods Example: If the value of raw material is Rs 10,000, value of WIP is Rs 5,000 and value of Finished Goods is Rs 15,000 then valueRead more

The value of inventory at the end of the financial year or balance sheet date is called closing stock. Closing stock includes:

Example:

If the value of raw material is Rs 10,000, value of WIP is Rs 5,000 and value of Finished Goods is Rs 15,000 then value of Closing Stock will be Rs (10,000 + 5,000 + 15,000) = Rs 30,000

Adjustment entries are done on the accrual basis of accounting, that is, income is recorded when earned and not received and expenses are recorded when incurred and not paid. Adjustment entries are usually made before or after the preparation of the trial balance at the end of the accounting period.

If the entries are made after the preparation of the trial balance, then two adjustment entries are recorded while preparing Trading and Profit & Loss A/c.

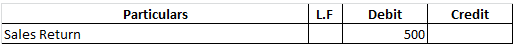

Since closing stock is an item outside the trial balance, the double-entry would be:

The journal entry

The second adjustment would be to show closing stock on the balance sheet and since the closing stock is an asset it is shown under the head Current Assets.

In case where adjustment for Closing Stock is to be done before preparation of Trial Balance, then it will be shown on the credit side of the Trial Balance, since it is an asset for the company and will have a credit brought down balance as shown in the image.

Later, while preparing Balance Sheet, Closing Stock will be shown on the Asset side of the Balance Sheet.

See less