No, the building is not a current asset. Explanation Current assets are those in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting through normal day-to-day business operations. Examples: Cash and cash equivalent, stock, liquid assets, etRead more

No, the building is not a current asset.

Explanation

Current assets are those in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting through normal day-to-day business operations.

Examples: Cash and cash equivalent, stock, liquid assets, etc.

The building is expected to have a valuable life for more than a year and is bought for a longer term by a company. The building is a fixed asset/non-current asset, those assets which are bought by the company for a long term and aren’t supposed to be consumed within just one accounting year.

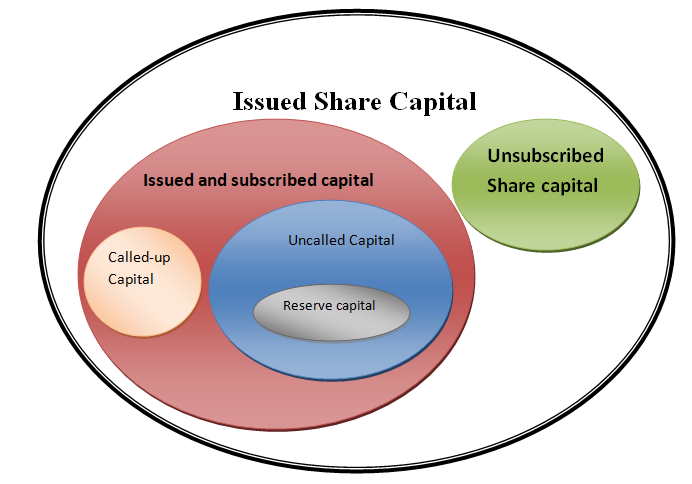

In order to understand it more clearly, let’s see the two types of assets in the classification of the assets on the basis of convertibility:

In the classification of the assets on the basis of their convertibility, they are classified either as current assets or fixed assets. Also referred to as current assets/ non-current assets or short-term/ long-term assets.

- Current Assets – As explained above, those assets in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting.

- Fixed Assets – Those assets which are not likely to be converted into cash quickly and are bought by the business for a long term.

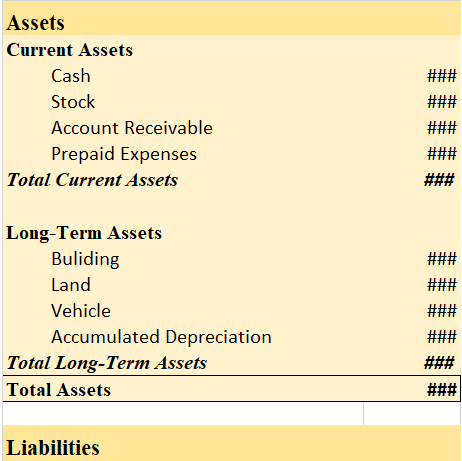

Building in the balance sheet

Let us take a look at the balance sheet’s asset side and see where building and current assets are shown

Balance Sheet (for the year ending…)

As we can see, the building is shown on the long-term assets side and not in the current assets.

Therefore, the building is not a current asset.

See less

Sundry Debtors in Trial Balance The debtor is a company's asset, and assets are always debited in the trial balance. The trial balance is a statement maintained at the end of an accounting period, listing the ending balances in each general ledger account. There are two sides to this account, debit,Read more

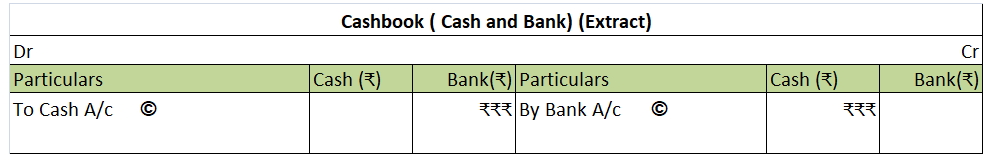

Sundry Debtors in Trial Balance

The debtor is a company’s asset, and assets are always debited in the trial balance.

As we know, assets, expenses, and drawings are always debited. That applies not only in journals but here as well, hence, all of your assets are to be debited.

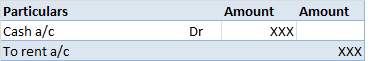

Trial Balance Statement

As we can see here, the sundry debtors (on the 4th) are debited like all the other assets, expenses, and losses. In the end, if the basic accounting equation i.e. assets=capital+liability is violated, a mismatch arises which in the balancing figure is shown under the name of suspense account. Such errors must not be found and corrected to avoid any mismatch in the balance sheet of the company.

Total Assets = Capital + Other Liabilities.

Therefore, this is how the sundry debtors are treated in the Trial Balance.

See less