A Capital Account is an account that shows the owner's equity in the firm and a Partner's Capital Account is an account that shows the partner's equity in a partnership firm. Partner’s Capital Account includes transactions between the partners and the firm. Examples of such transactions are: CapitalRead more

A Capital Account is an account that shows the owner’s equity in the firm and a Partner’s Capital Account is an account that shows the partner’s equity in a partnership firm.

Partner’s Capital Account includes transactions between the partners and the firm. Examples of such transactions are:

- Capital introduced in the firm

- Capital withdrawn

- Interest on Capital

- Interest on Drawings

- Profit or loss in the financial year, etc.

When partners are given interest on their capital contribution in the firm, it is called on Interest on Capital.

In case the partnership firm does not have a Partnership Deed, the Partnership Act does not include a provision for Interest on Capital. However, if the partners want they can mutually decide the rate of Interest on Capital.

Interest on Capital is calculated on the opening capital of the partners and is only allowed when the firm makes a profit, that is, in case a firm incurs losses, it cannot allow Interest on Capital to its partners.

Example:

In a partnership firm, there are two partners A and B, and their capital contribution is Rs 10,000 and 20,000 respectively. Interest on capital is @ 10% p.a. The Interest on Capital for both the partners is:

Partner A- 10,000 * 10/100 = 1,000

Partner B- 20,000 * 10/100 = 2,000

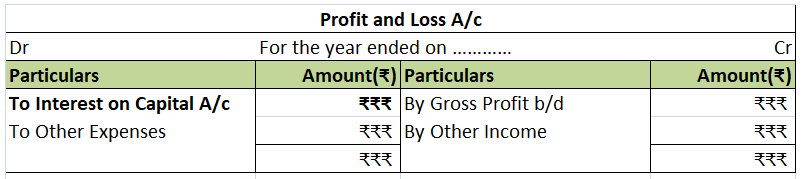

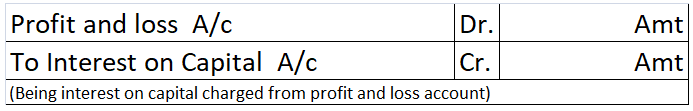

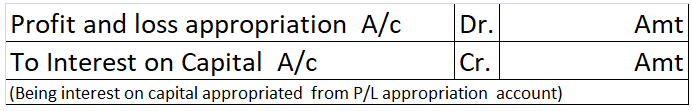

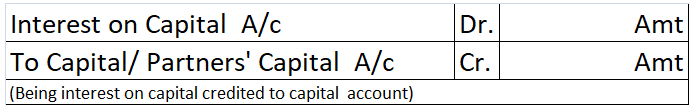

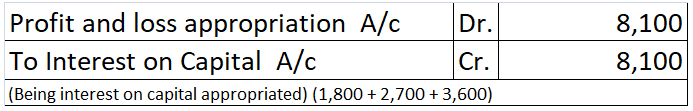

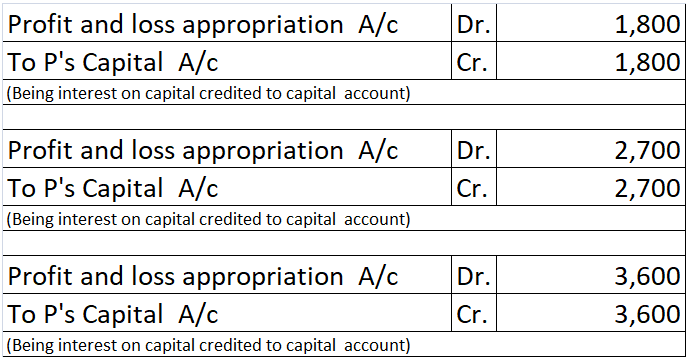

The journal entry for Interest on Capital is an adjusting entry and is shown as:

| Interest on Capital A/c Dr. | 3,000 | |

| To A’s Capital a/c | 1,000 | |

| To B’s Capital A/c | 2,000 |

- Partner’s Capital Account is credited because it is credit in nature and interest on capital is an addition to the account.

- Interest on Capital Account is debited because it is an expense account.

See less

Shareholder's Equity Meaning - Shareholder's Equity is the amount invested into the Company. It represents the Net worth of the Company. It is also where the owners have the claim on the Assets after the Debts are settled. It Calculation of Shareholder's Equity Method 1 Shareholder's Equity = TotalRead more

Shareholder’s Equity

Meaning – Shareholder’s Equity is the amount invested into the Company. It represents the Net worth of the Company. It is also where the owners have the claim on the Assets after the Debts are settled. It

Calculation of Shareholder’s Equity

Method 1

Shareholder’s Equity = Total Assets – Total Liabilities

Method 2

Shareholder’s Equity = Share Capital + Retained Earnings – Treasury Stock/Treasury Shares

Components of the Shareholder’s Equity

From the above Method 1, it can be understood that shareholder’s equity comprises of

Net Assets = Current Assets + Non-current Assets, reduced by

Net liabilities = Current liabilities + Long-term liabilities

where Long-term liabilities = Long-term debts + Deferred long-term liabilities + Other liabilities

Also from the method 2,

Share Capital = Outstanding shares + Additional Paid-up share capital

Retained Earnings are the sum of the company’s earnings after paying the dividends

Treasury stocks = Shares repurchased by the company

Example of Shareholder’s Equity

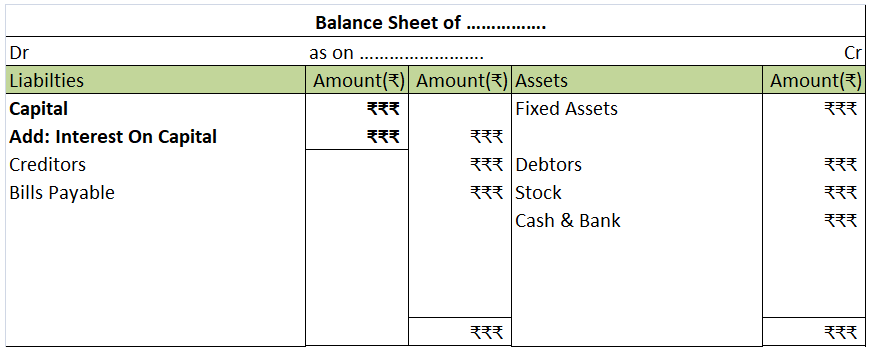

The shareholder’s Equity is represented in the Balance Sheet as below;

See less