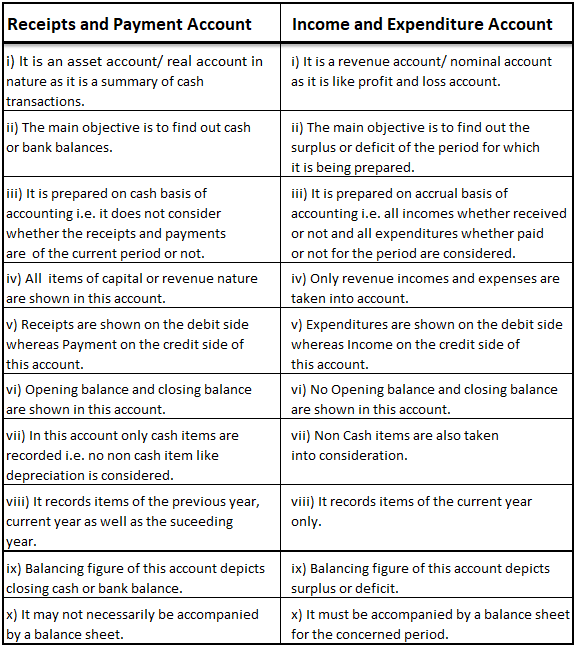

To start with let me first explain the difference between receipts and income & payment and expenditure. Although Receipts and Income may look similar terms, there are some differences. Receipts have their relation with both cash and cheques received on account of various items of the organizatiRead more

To start with let me first explain the difference between receipts and income & payment and expenditure.

Although Receipts and Income may look similar terms, there are some differences.

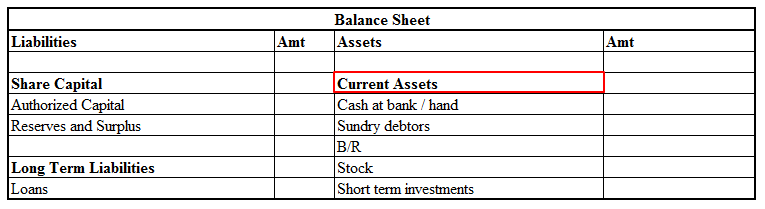

Receipts have their relation with both cash and cheques received on account of various items of the organization. Whereas, income is considered as a revenue item for finding surplus or deficit of the organization. All the receipts collected during the year may not be considered as income.

For Example, if an organization sale of its assets that is of a capital nature, it would not be considered as an item of income and hence would be treated in the balance sheet.

Similarly, Payment and Expenditure are two different terms. Payments are those that have their relation with cash and cheques given for various activities of the organization. Whereas, Expenditure is considered as revenue expenditure for ascertainment of surplus or deficit in the case of a not-for-profit organization. All payments made during the year may not be considered as expenditures.

Differences

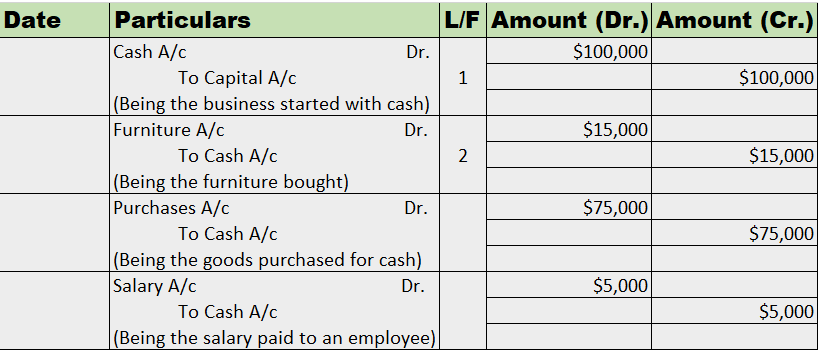

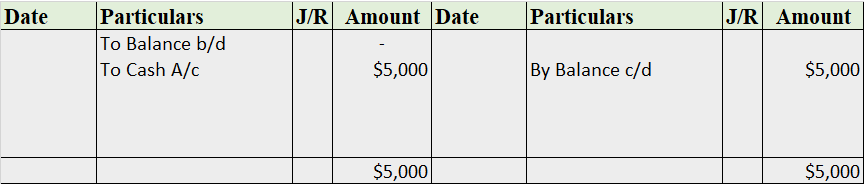

Specimen of Ledger account This is the specimen of a ledger account. J.F. here represents the journal folio. A Ledger account is an account that consists of all the business transactions that take place during the current financial year. For Example, cash, bank, machinery, A/c receivable account, etRead more

Specimen of Ledger account

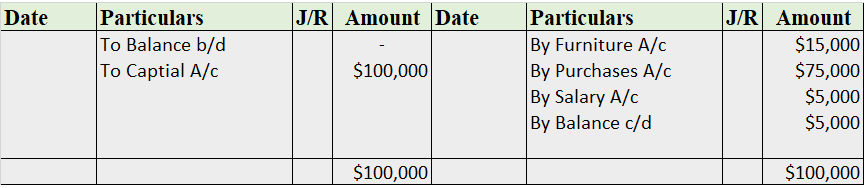

This is the specimen of a ledger account. J.F. here represents the journal folio.

A Ledger account is an account that consists of all the business transactions that take place during the current financial year.

For Example, cash, bank, machinery, A/c receivable account, etc.

After the financial data is recorded in the Journal. It is then classified according to the nature of accounts viz. Asset, liability, expenses, revenue, and capital to be posted in the ledger account.

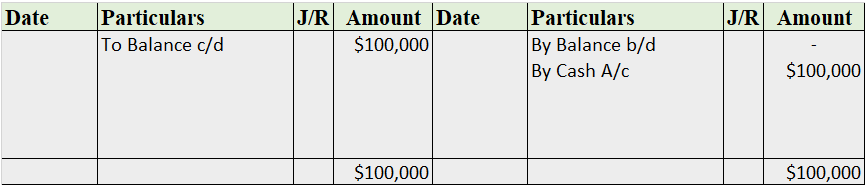

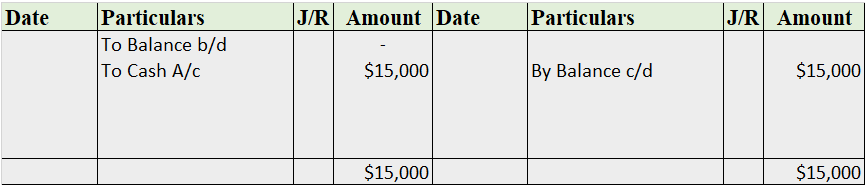

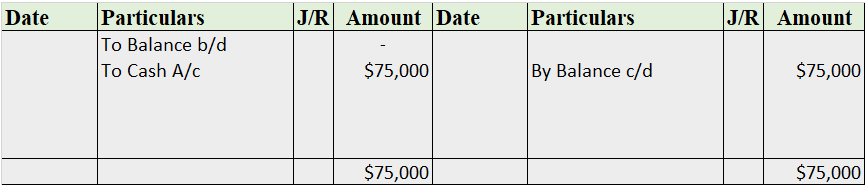

With this head, the identification as to whether the opening balance will come under the debit side or the credit side is done.

The table below would help to understand the concept of opening balance in the ledger.

For further clarification of the concept let me give you a practical example.

Suppose, a manufacturing firm Amul purchased machinery for, say, Rs 2,50,000. The installation charges were Rs 25,000 and the opening balance of machinery during the year was Rs 5,00,000.

So as the machinery account comes under the category assets, its opening balance would come under the debit side of the ledger account.

And as purchase and installation charges mean expenses for the firm, they would also come under the debit side of the account.

And in case of any sale of a part of the machinery, it would be posted on the credit side of the account as the sales would generate revenue for the firm.

See less