Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business. Creating new products or designing changes and testing existinRead more

Every business requires research and development to create innovative products for consumers. More innovative and creative products and services are more popular among customers, leading to increased revenue and profits for the business.

Creating new products or designing changes and testing existing products also forms a part of research and development.

Examples of Research and Development costs are –

- Salaries of employees

- Cost of making prototypes

- Cost of raw material

- Overhead expenses

Let us now understand how research and development costs are treated in Financial Statements.

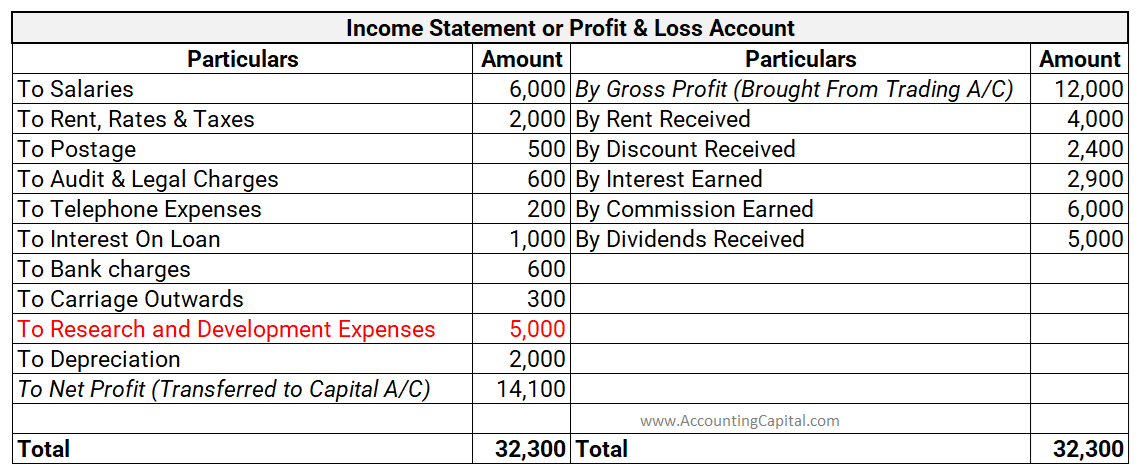

Research and Development Costs are generally shown as an expense in the Income Statement.

IAS-38

IAS-38 majorly governs the accounting of research and development costs. There are two phases in R&D:

- Research: During this phase, costs are incurred for understanding or designing the product. These costs are expensed as incurred costs as there is an uncertainty of a future benefit.

- Development: Economic value can be ascertained during this phase and hence, the costs incurred can be capitalized as Intangible assets. To be recognised as intangible assets, the following conditions shall be satisfied:

1. it is developed with the intention of putting it to use in the future

2. the asset shall hold an economic value

3. the costs can be measured reliably

Treatment of R&D costs in the Financial statements:

-

- Income statement: Research costs are shown as expenses in the income statement. However, development costs if capitalized as intangible assets can be amortised over time.

- Balance Sheet: Capitalised development costs are shown as intangible assets under the Assets head of the Balance Sheet.

Conclusion

The above discussion can be summarised as follows:

- Research and development is essential for creating innovative and creative products and services.

- Accounting standard IAS-38 governs the accounting for Research and Development.

- Research costs are usually shown as an expense in the Income statement of the business.

- Development costs when capitalised can be shown as Intangible assets in the Balance Sheet.

Yes, accounting is necessary even for not-for-profit organizations. NPOs or not-for-profit organizations are those that are created for the welfare of the society. They intend to advance some social cause. For example charities, orphanages etc Accounting for NPOs becomes necessary as the trustees ofRead more

Yes, accounting is necessary even for not-for-profit organizations.

NPOs or not-for-profit organizations are those that are created for the welfare of the society. They intend to advance some social cause. For example charities, orphanages etc

Accounting for NPOs becomes necessary as the trustees of these institutions are liable to their members, the donors and the government. They discharge this function with documenting activities of the institution.

What is a not-for-profit organization?

A not-for-profit organization is an entity that undertakes charitable activities. These institutions do not have earning profit as their primary motive. Their focus is on extending social welfare.

Every not-for-profit organization usually has a group of trustees that are responsible for handling all its operations. These trustees are accountable to the members of the NPO.

A not-for-profit organization usually relies on donations and grants as its primary source of revenue. They do not charge the stakeholders to whom they extend their services or goods.

What does accounting for Not-for-profit organizations entail

The professionals undertaking accounting of not-for-profit organizations must have a significant knowledge of statutory provisions and accounting principles. Here is a brief overview of what accounting for a not-for-profit organizations entails

We can conclude that accounting is an indispensable requirements for not-for-profit organizations to be able to continue their operations and claim the statutory benefits that the government has extended to them.

See less