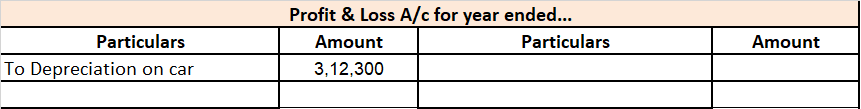

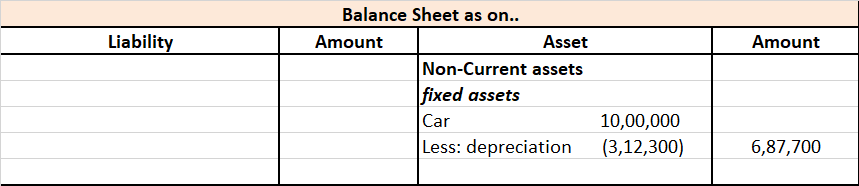

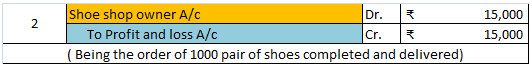

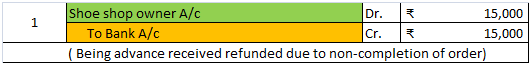

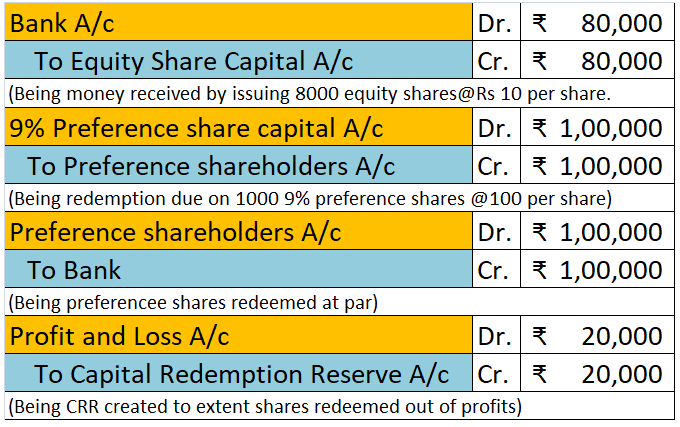

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and otherRead more

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and other such things.

See less

Subsidiary Books Introduction & Definition In large business organizations, it is practically impossible to keep a record of every single business affair, while neglecting them and not recording them wouldn't be an ideal choice, this is where subsidiary books come into the role. As we were introRead more

Subsidiary Books

Introduction & Definition

In large business organizations, it is practically impossible to keep a record of every single business affair, while neglecting them and not recording them wouldn’t be an ideal choice, this is where subsidiary books come into the role. As we were introduced to the basics of accounting in the 11th standard, we learned about different elements like journals, ledgers, trial balances, etc. It is practically impossible for a business to keep track of every single affair just through only those elements. Thus, the Subsidiary book is the next step here.

Subsidiary books are the books of original entry. They are a dedicated form of books that maintains an analysis of a specific account. It records financial transactions of a similar nature. They are sub-division of a journal.

In big business organizations, it’s very hard for a bookkeeper or accountant to record all the transactions in one journal and post them into various accounts. This is where special purpose books or subsidiary books may be required for more efficient bookkeeping. They are a subdivision of journals and for every type of transaction, there is a separate book.

Types of Subsidiary Books

There are eight types of subsidiary books that are required for recording transactions. The list of various subsidiary books is as follows:

Types of Subsidiary Books

Now, we’ll be taking a closer look at each and every subsidiary book.

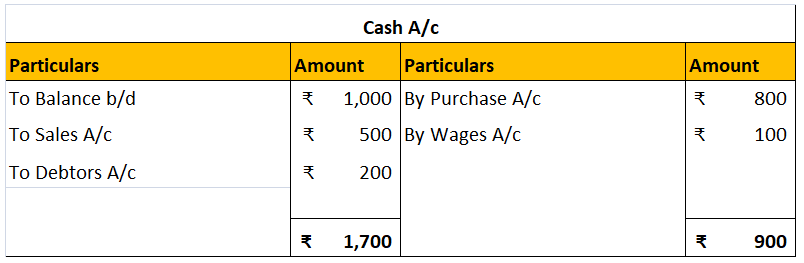

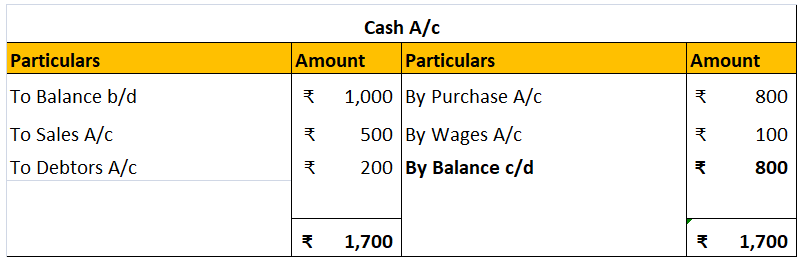

Cash Book

The cash book is the most important subsidiary book, it’s a book of a prime entry recording all the cash spent or received by the business, either in cash form or from the bank. In simple words, recording all the transactions made by the business.

It is of three types i.e single-column cash book, double-column cash book, and triple-column cash book. As the name indicates, the column of cash, bank, and discount increases/decreases as per the column of the cash book stated.

Format

Note: this is a triple-column cash book format, for the double-column cash book format, we remove the discount column from both sides, and for the single column, we may remove the bank column as well.

Purchase Book

A purchase book is a subsidiary book that records all the transactions related to the credit purchase in a business. Thereby, the normal purchasing of assets is never recorded in the purchase book.

The credit purchases are directly recorded in the purchase book from the journals or the source documents. The source document indicates bills payable, invoices, etc.

Format

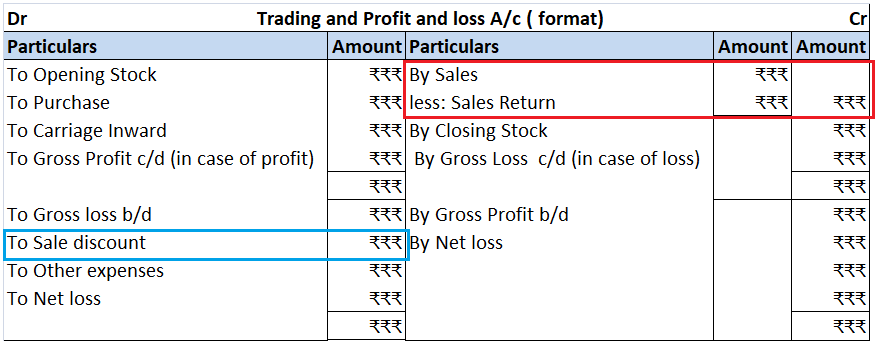

Sales Book

A sales book, similar to a purchase book, is a special book where all the credit sales are recorded. The sales book doesn’t record the transactions related to the normal sale of assets and hence, is a special type of book, just like the purchase book.

Format

Purchase Return Book

The purchase return book, also known as the return outwards book, is that book that records the goods that were returned by us to the supplier. Thereby, called purchase return book.

When the goods are returned, a debit note is issued against every return and hence, recorded in the purchase return book.

Format

Sales Return Book

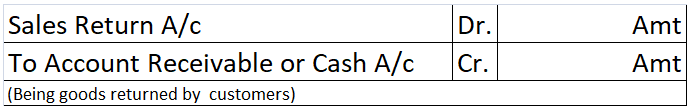

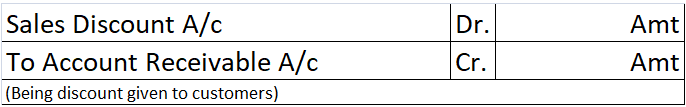

The sales return book, also known as the return inwards book, refers to that subsidiary book that records the goods which were returned to us by the customer.

For every good returned to us, a credit note is issued to the customer. And thus, it is recorded in the sales return book.

Format

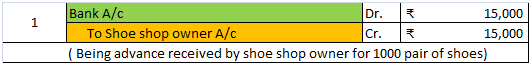

Journal Proper

Just like we recently learned in class 11th about what a journal entry is and how it is made, it’s a little different from the journal proper. Journal proper is a subsidiary book that records all the transactions which are not recorded in other subsidiary books.

A journal is an original book of entries that records all the business transactions, while a journal proper is a subsidiary book in which all types of miscellaneous credit business transactions are recorded that do not fit anywhere in the other subsidiary books. Its format is the same as the journal entries’ format. Therefore, it’s also known as a miscellaneous journal.

Format

Bills Receivable Book

The bills receivable book is the book that draws the bills favorable to the business i.e when the goods or services are provided to any customer on credit, they become a debtor, and bills receivable is a written note received from the customer indicating that they formally agree to pay the sum of money owed.

Therefore, it helps in recording these types of transactions. The sum total of the bills receivable book is posted to the bills receivable account.

Format

Bills Payable Book

The bills payable book is the subsidiary book that records all the bills that are drawn on the company. The bills payable is drawn on the company when we buy a good/service on credit and agrees to pay the amount to the supplier by signing a written note with the date we agree to pay.

It’s a liability of the business and the total of the bills payable book is posted on the credit side of the bills payable account.

Format

See less