To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 "A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even iRead more

To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 “A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even if no amount has been called up”.

To be more precise whenever excess money is received by the company than, what has been called up is known as calls-in-advance.

Accounting Treatment

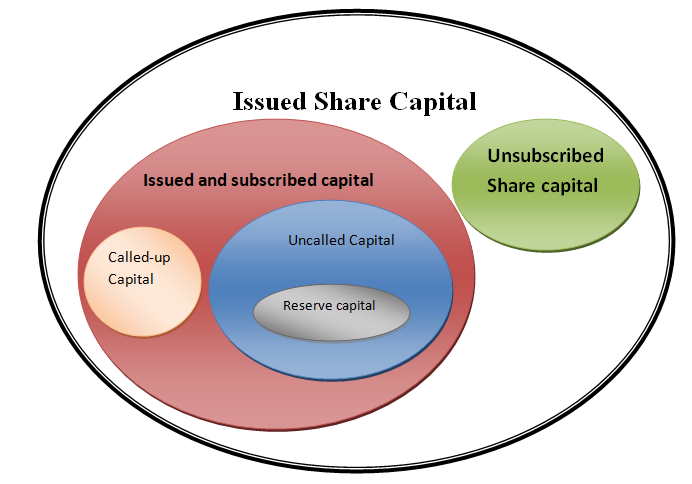

Well, it is to be noted that calls-in-advance is never a part of share capital. A company when authorized by its article can accept those advance amounts and directly credit the amount received to the calls-in-advance account.

As these advance amounts are a liability for the company these are shown under the head current liability of the balance sheet until calls are made and are paid to the shareholders.

Since this is the liability of the company, it is liable to pay the interest amount on such call money from the date of receipt until the payment is done to the shareholders. The rate of interest is mentioned in the articles of association. If the article is silent regarding the rate on which interest is paid then it is assumed to be @6%.

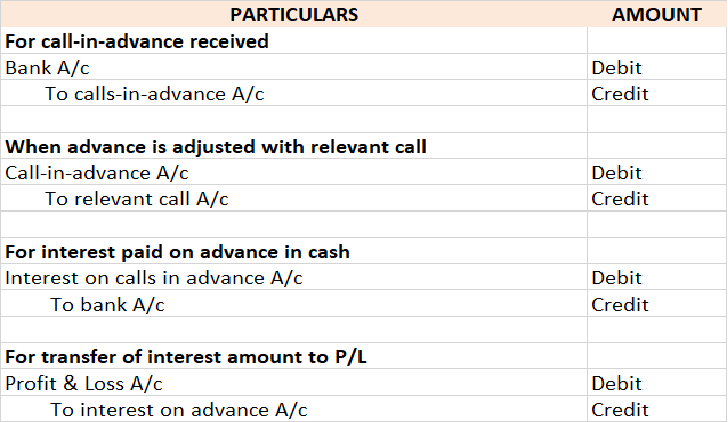

Accounting Entry

Bonnie let us understand the entries with help of an example

ADIDAS LTD issued 25,000 equity shares of Rs 10 each payable as follows:

ON APPLICATION Rs 5

ON ALLOTMENT Rs 3

ON FINAL CALL Rs 2

Application on 30,000 shares was received. excess money received on the application was refunded immediately. Mr. X who was allotted 1,000 shares paid the call money at the time of allotment and all amounts were duly received assume interest rate @6% for 3 months, so the relevant accounting entry goes as follows:

Important Points to be noted under calls-in-advance as per the companies act 2013

- The shareholder is not entitled to any voting rights on money paid until the said money is called for.

- No dividends are payable on advance money.

- Board may pay interest on advance not exceeding 12%.

- The shareholders are entitled to claim the interest amount as mentioned in the article, if there are no profits, then it must be paid out of capital because shareholders become the creditors of the company.

Let us begin with a short explanation of what Calls-in-Advance is: Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An imporRead more

Let us begin with a short explanation of what Calls-in-Advance is:

Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An important thing to note here is that a company can accept calls-in-advance from its shareholders only when authorized by its Articles of Association.

Calls-in-advance is treated as the company’s liability because it has received the money in advance, which has not yet become due. Till the amount becomes due, it will be treated as a current liability of the company.

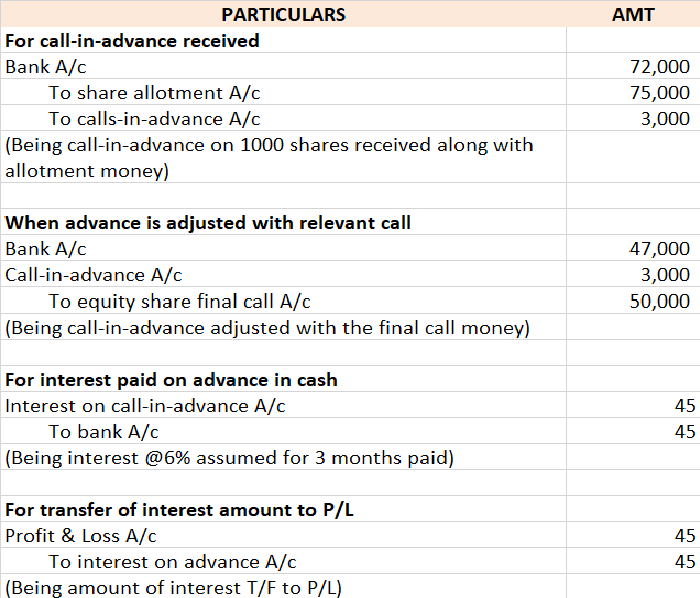

The journal entry for recording calls-in-advance is as follows:

The money received from the shareholder is an asset for the company and therefore Bank A/c is debited with the amount received as calls-in-advance. The calls-in-advance A/c is credited because it is a liability for the company.

Since Calls-in-Advance is a liability, it is shown in the Equities and Liabilities part of the Balance Sheet under the head Current Liabilities and sub-head Other Current Liabilities.

For better understanding, we will take an example,

ABC Ltd. made the first call of 3 per share on its 10,00,000 equity shares on 1st May. Max, a shareholder, holding 5,000 shares paid the final call amount 2 along with the first call money. Now let me show the journal entry to record calls-in-advance.

In the Balance Sheet, I will show calls-in-advance in the following manner,

The calls-in-advance of 10,000 is shown under the Equities and Liabilities side of the balance sheet under the head current liabilities and sub-head other current liabilities. It will be shown as a liability till the final call money becomes due. The amount received by the company from Max is shown on the Assets side of the balance sheet under head current assets and under the sub-head cash and cash equivalents.

See less