Let’s understand what a cashbook is: A petty cash book is a cash book maintained to record petty expenses. By petty expenses, we mean small or minute expenses for which the payment is made in coins or a few notes like tea or coffee expense, bus or taxi fare, stationery expense etc. Such expenses areRead more

Let’s understand what a cashbook is:

- A petty cash book is a cash book maintained to record petty expenses.

- By petty expenses, we mean small or minute expenses for which the payment is made in coins or a few notes like tea or coffee expense, bus or taxi fare, stationery expense etc.

- Such expenses are numerous in a day for a business and to account for such small expenses along with major bank and cash transactions may create an extra hassle for the chief cashier of a business.

- So, the cash is allocated for petty expenses and a petty cashier is appointed and the task of recording the petty expenses in the petty cashbook is delegated to him.

The manner in which entries are made

When cash is given to the petty cashier, entry is made on the debit side and in the petty cashbook and credit entry in the general cashbook.

Entries for all the expenses are made on the credit side.

Generally, the petty cashbook is prepared as per the Imprest system. As per the Imprest system, the petty expenses for a period (month or week) are estimated and a fixed amount is given to the petty cashier to spend for that period.

At the end of the period, the petty cashier sends the details to the chief cashier and he is reimbursed the amount spent. In this way, the debit balance of the petty cashbook always remains the same.

Format and items which appear in the petty cashbook

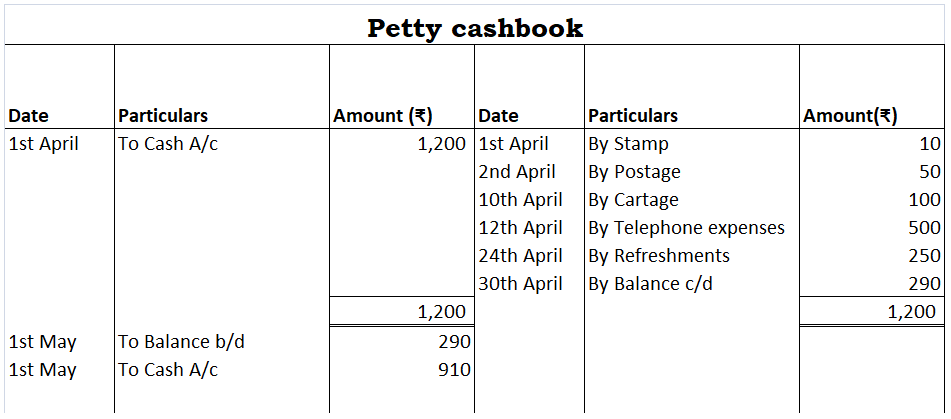

The format of the petty cashbook depends upon the type of petty cash book is prepared and the items appearing in it are nothing but petty expenses. Let’s see an example:-

A business incurred the following petty expenses for the month of April:-

- Stamp – Rs. 10

- Postage – Rs. 50

- Cartage- Rs. 100

- Telephone expense – Rs. 500

- Refreshments – Rs. 250

Now we will prepare two types of cashbooks:

- Ordinary Petty Cashbook:

Here, the Petty cash book is of the same format as the general cash book.

The cash allocated for petty expenses is recorded on the debit side of the petty cash book and on the credit side of the general cash book.

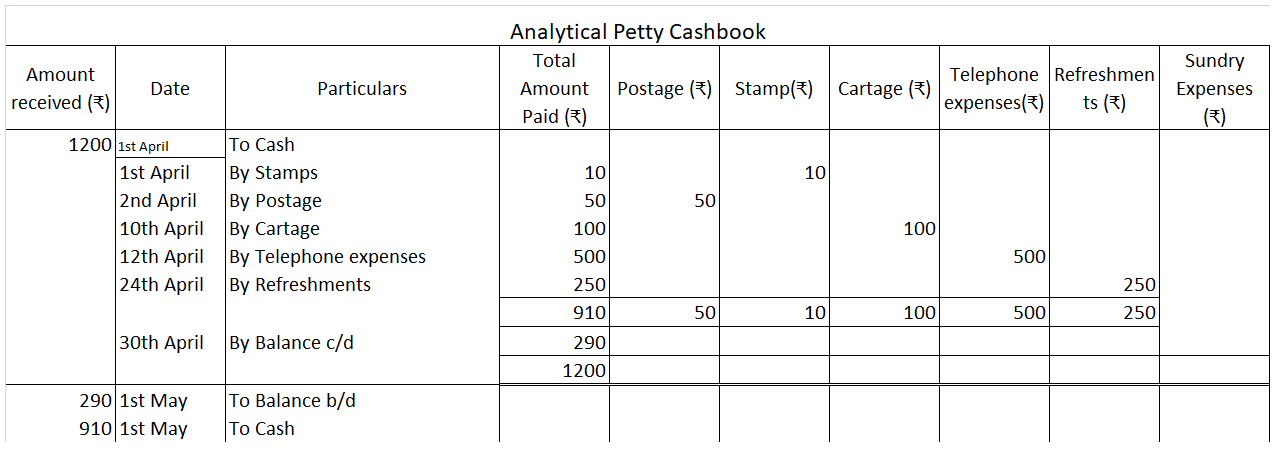

- Analytical Petty Cashbook

Here, there are separate amount columns for each type of expense. As the name suggests, this type of petty cashbook helps to analyse the petty cash spending on basis of the type of expense.

See less

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals. Recording all the journals entries in a single journal and these posRead more

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals.

Recording all the journals entries in a single journal and these posting them to different ledgers can be very difficult if the number of transactions is huge.

So, recording the same type of transactions in a special journal proves to be useful in efficient book-keeping and also information retrieval.

There are eight subsidiary books:

Also, there are a few more things to know:-

- Subsidiary books may look like ledger accounts but they are not ledgers. Ledgers are books of final entry and subsidiary books can be said to be the book of intermediate entry and are not but special journals.

- Once transactions are recorded in the subsidiary books, they are then posted to the ledgers.

See less