1) Liability 2) Asset 3) Expenses 4) Income

The correct answer is 2. Credit balance in the bank column of the cash book. The credit balance in the bank column of Cash Book represents the overdraft facility utilized by the business. Overdraft is a credit extension facility offered by banks to both savings and current account holders. It allowsRead more

The correct answer is 2. Credit balance in the bank column of the cash book.

The credit balance in the bank column of Cash Book represents the overdraft facility utilized by the business. Overdraft is a credit extension facility offered by banks to both savings and current account holders. It allows the account holder to borrow a specified sum of money over and above the balance in their accounts.

It is a form of short-term borrowing offered by banks and is extremely useful for businesses to resolve short-term cash flow issues.

The account holder can withdraw money even when his/her account does not have enough balance to cover the withdrawal. Since the business is withdrawing money that is not in its account, an overdraft is represented by a negative bank balance. That is why they are shown as a credit balance in the bank column of the Cash Book.

Overdraft is a liability for the business. Hence, it is shown on the Equity and Liability part of the Balance Sheet under the head Current Liabilities and sub-head Short Term Borrowings.

Banks do not offer this facility to all customers. Only those who have a good reputation and credit score are eligible for this facility. Like any other borrowing, interest is charged on the amount utilized by the account holder as an overdraft.

See less

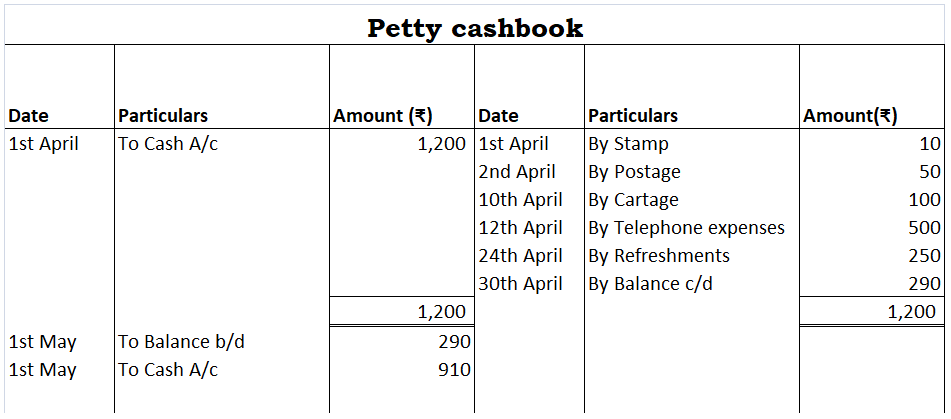

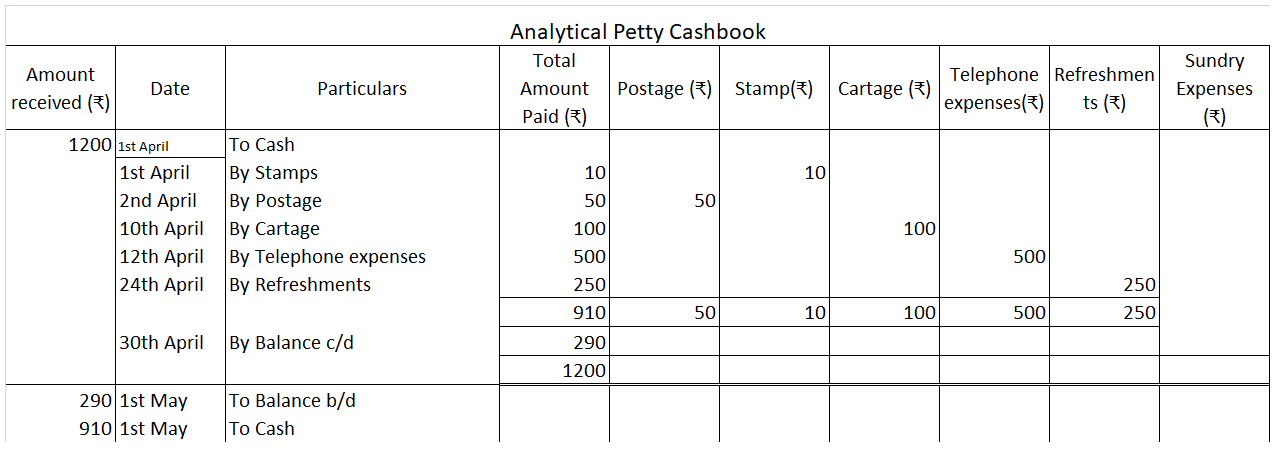

Therefore, 2) Asset is the correct option. Explanation The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction oRead more

Therefore, 2) Asset is the correct option.

Explanation

The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction of the total expenditure and total cash receipt is the closing balance of the petty cash book.

Petty cash refers to the in-hand physical cash that a business holds to pay for small and unplanned expenses.

Asset: The closing balance of the petty cash book is considered an asset because the petty cash book is a type of cash book. The petty cash book also deals in outflow and inflow of the cash, it also maintains and records income and expenditure that are similar to the cash book.

The petty cash book since being a part of the cash book, which records all the inflow and outflow of cash in a business, which is an asset, thus petty cash book’s closing balance is considered an asset. Also, the balance of the petty cash book is never closed. Their closing balance is carried forward to the next year.

Liability: The closing balance of the petty cash book is not considered a liability because that closing balance of the petty cash book doesn’t create a liability for the business. In fact, the closing of the petty cash book is placed under the head current asset in the balance sheet as mentioned above, it’s a part of the cash book which records the transactions of cash a/c which is an asset itself.

Expenses or Income: It is not an expense because the closing balance of the petty cash book is calculated by deducting the total expenditure from the total cash receipt.

That is an asset and it is considered to be a current asset, neither an income nor an expense. It is used for paying out petty expenses.

Therefore, the closing balance of the petty cash book is considered an asset.

See less