Deleting a company in Tally Prime Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9. To delete a company in TallRead more

Deleting a company in Tally Prime

Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9.

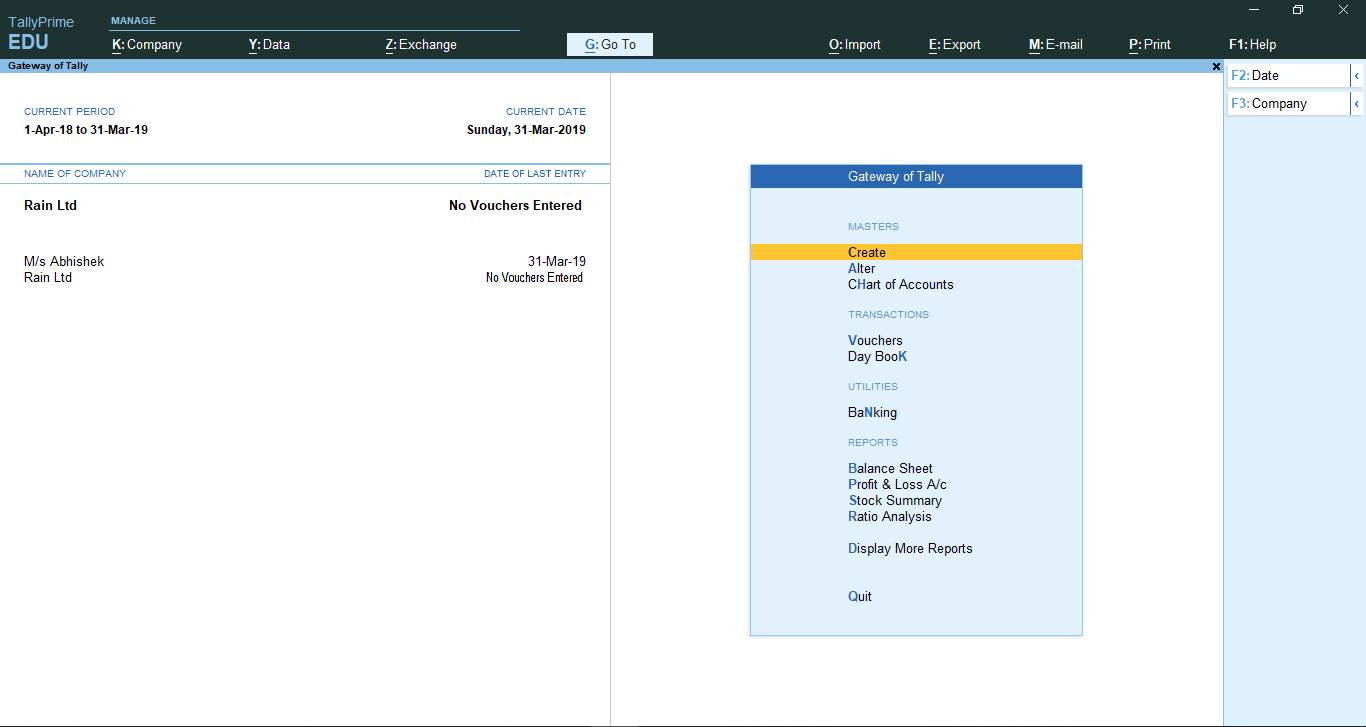

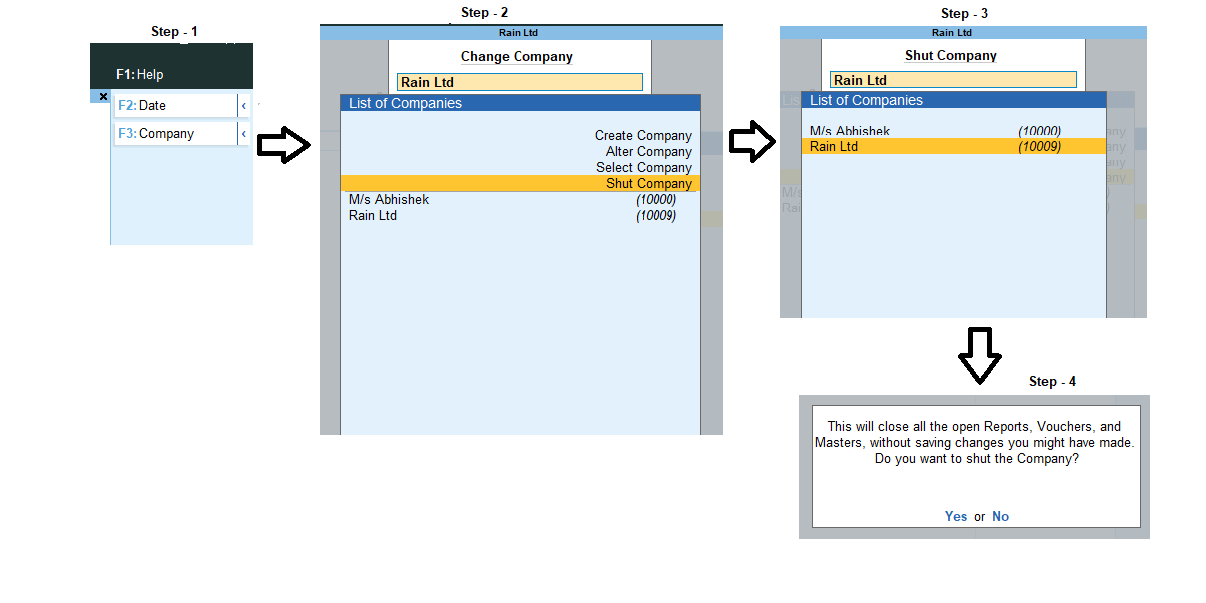

To delete a company in Tally Prime, you need to be in the Gateway of Tally window which looks the following:

On the right-hand side, there is a menu where is an option named ‘F3: Company’. You can either click on it or simply press F3.

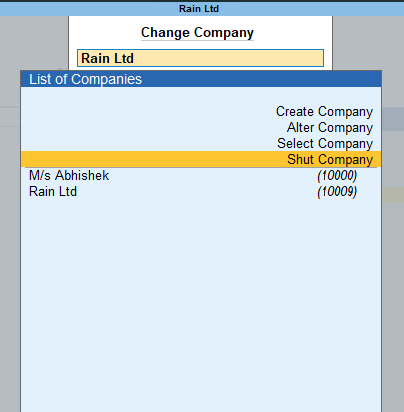

After clicking on the option, the Company menu where a list of names of the companies created in the Tally is there, along with some options above the company name list.

You have to select the option named, ‘Shut Company’. After clicking the option, the screen will display a ‘Shut Company’ menu.

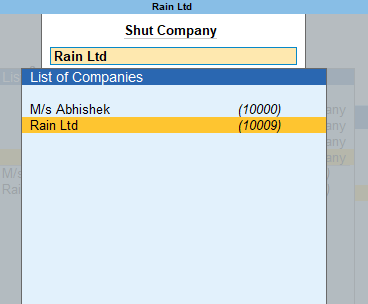

From there, you have to select the company you want to delete. Like in the example given, I have selected the company named Rain Ltd.

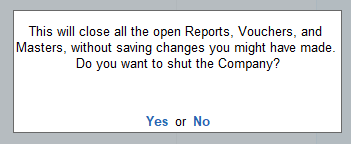

After selecting the name of the company you want to delete, a confirmation dialog box will appear.

You have to click OK and the company will be shut down or deleted.

In short, the steps to delete a company in Tally Prime are as follows:

Gateway of Tally –> Press F3 –> Select ‘Shut Company’ option –> Select the name of the company –> Confirm and press OK

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period. GOODWILL Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person. YouRead more

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period.

GOODWILL

Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person.

You may have seen some famous shop in your locality which usually charges a higher price as compared to the other local shops selling the same product.

You may have also noticed that bigger brands like Bata, Titan, Zara, etc. charge higher prices for their products as compared to the same products available in the local market and people are even willing to pay for them. Ever wondered why?

This is because of the goodwill created by them over the years by providing quality products and services, good employee relationships, a strong customer base, social service, a brand name and so on. Customers trust them and for this trust, they are even willing to pay higher prices.

Goodwill is the quantitative value (i.e. in monetary terms) of the reputation of the firm in the market.

FIXED ASSETS

An asset is any possession or property of the business that enables the firm to get cash or any benefit in the future.

Fixed Assets are assets which are purchased for long-term use. They are for continued use in the business for producing goods or services and are not meant for resale. For example- Plant, machinery, building, goodwill, patents etc.

Fixed assets can be tangible or intangible.

Tangible assets are those assets which can be seen and touched and have physical existence like Plant and machinery, building, stock, furniture etc.

Intangible assets are those assets which cannot be seen or touched i.e. they don’t have any physical existence like goodwill, patent, trademark, prepaid expenses etc. Even though they can’t be seen or touched by they have value and are not fictitious assets.

Goodwill as a Fixed Asset

Goodwill is an intangible asset as it cannot be seen or touched but has value and adds value to the business over a long period. Thus, goodwill is a fixed asset.

It is shown in the balance sheet as a Fixed asset under the head Intangible asset.

Goodwill can be

Self-generated goodwill is created over a period due to the good reputation of the business. It is the difference between the value of the firm and the fair value of the net tangible assets of the firm.

Goodwill = Value of the firm – Fair value of net tangible assets

Here, F.V of net tangible assets = Fair value of tangible assets- Fair value of tangible liabilities

Purchased goodwill arises when one business purchases another business. It is the difference between the price paid for the purchased firm and the sum of the fair market value of the assets received and liabilities to be paid by them on behalf of the purchased firm.

Goodwill = Purchase price – (F.V of assets received + F.V of liabilities to be paid)

Only purchased goodwill is recorded in the books of accounts because it is difficult to correctly calculate the value of self-generated goodwill as the future is uncertain, also its valuation depends on the judgement of the person calculating it, which defers from person to person. Since there is no fixed standard to calculate self-generated goodwill only purchased goodwill is recorded as the price paid for it at the time of acquiring another business.

Suppose Firm A acquired Firm B.

Purchase price= $100,000

Assets received=$60,000

Liabilities (to be paid by Firm A on behalf of Firm B) = $10,000

Goodwill = $100,000 – ($60,000 + $10,000) = $30,000

This, goodwill of $30,000 will be recorded under the head Fixed Asset, subhead Intangible Assets in the balance sheet of Firm A (that is in the balance sheet of the acquiring firm)

See less