Activity-based costing (ABC) is a system used to find production costs. It breaks down overhead costs between production-related activities and other activities. The ABC system assigns costs to each activity that goes into production, such as workers testing a product. ABC is based on the principleRead more

Activity-based costing (ABC) is a system used to find production costs.

It breaks down overhead costs between production-related activities and other activities.

The ABC system assigns costs to each activity that goes into production, such as workers testing a product. ABC is based on the principle that ‘products consume activities.’

Traditional cost systems allocate costs based on direct labor, material costs, revenue, or other simplistic methods. As a result, traditional systems tend to over-cost high volume products, services, and customers; and under-cost low volume.

Hence, Activity Based Costing was developed for determining the cost. The basic feature of ABC is its focus on activities. It uses activities as the basis for determining the costs of products or services.

Activity-Based Costing is mostly used in manufacturing industries, however, its application is not only limited to that. Various industries like, construction, health care, medical organizations also use this method of assigning costs. Industries where customized products are made also tend to use such methods as it is easier to charge appropriate overhead costs from the customer.

Objectives of Activity-Based Costing:

Companies adopt ABC to assign cost elements to the products, activities, or services so that it helps the management to decide:

- which cost can be eliminated or cut back

- which products are unprofitable

- if a product is over-priced or under-priced

- if any activity is ineffective

- various processing of the same product to yield better results

Advantages of Activity Based Costing are:

- it takes into consideration both direct and overhead costs of creating a product.

- it recognizes the fact that different products require different indirect expenses.

- it sets prices more accurately.

- it helps to see what overhead cost the company might be able to cut back on.

- it helps to segregate fixed costs, variable cost, and overhead cost which helps to identify “cost drivers”.

- it focuses on cost allocation in operational management.

Before implementing ABC, a company should consider the following:

- manually driven Activity Based Accounting cost derivers is an inefficient use of resources.

- it is an expensive method and it is difficult to implement

- for small gains, there are alternative costing methods available for a company to use.

Formula= Total Cost Pool / Cost Driver

For example:

For a company, the salary for workers is Rs 1,00,000 for a financial year, the number of labor hours worked is 50,00 hrs. The cost driver rate is calculated by dividing the workers’ salary by the labor hours worked, that is,

Salary of the workers / Number of labor hours

Rs 1,00,000 / 50,000 hrs = Rs 2 per labor hour.

In the above example, the salary of the workers is the total cost pool or the overhead cost for which we want to find the cost driver rate and labor hours is the cost driver, that is, on the basis of what we want to find the rate.

See less

Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. It's a fixed return that a business owner is eligible to receive. When the business firm faces a loss, the interest on capital will not be providRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. It’s a fixed return that a business owner is eligible to receive.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business, it is also taken into account for providing interest on capital.

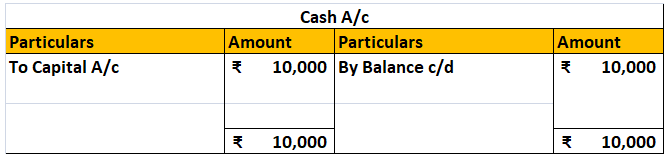

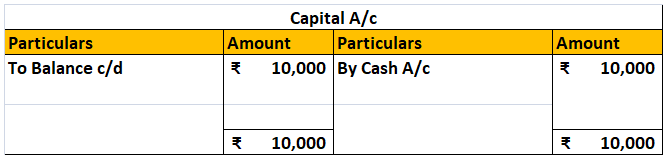

Sample journal entry

Interest on capital is an expense for business, thus, debited as per the golden rules of accounting, debit the increase in expense, and the owner/partner’s capital a/c is credited as per the rule, credit all incomes and gain.

As per the modern rules of accounting, we debit the increase in expenditure and credit the increase in capital.

As we know, as per the business entity concept, business and owner are two different entities and a business is a separate living entity. Therefore, the capital introduced by the owner/partners is the amount on which they’re eligible to receive a return.

Example:

Tom is the business owner of the firm XYZ Ltd. He has contributed ₹ 10,00,000 to the business with 10% interest provided to Tom at the end of the year.

Solution:

Here interest on capital will be calculated as,

Interest on capital = Amount invested × Rate of interest × Number of Months/12

= 10,00,000 × 10% × 12/12

= ₹ 1,00,000

See less