Generally, Assets are classified into two types. Non-Current Assets Current Assets Non-Current Asset Noncurrent assets are also known as Fixed assets. These assets are an organization's long-term investments that are not easily converted to cash or are not expected to become cash within an acRead more

Generally, Assets are classified into two types.

- Non-Current Assets

- Current Assets

Non-Current Asset

Noncurrent assets are also known as Fixed assets. These assets are an organization’s long-term investments that are not easily converted to cash or are not expected to become cash within an accounting year.

In general terms, In accounting, fixed assets are assets that cannot be converted into cash immediately. They are primarily tangible assets used in production having a useful life of more than one accounting period. Unlike current assets or liquid assets, fixed assets are for the purpose of deriving long-term benefits.

Unlike other assets, fixed assets are written off differently as they provide long-term income. They are also called “long-lived assets” or “Property Plant & Equipment”.

Examples of Fixed Assets

- Land

- Land improvement (e.g. irrigation)

- Building

- Building (work in progress)

- Machinery

- Vehicles

- Furniture

- Computer hardware

- Computer software

- Office equipment

- Leasehold improvements (e.g. air conditioning)

- Intangible assets like trademarks, patents, goodwill, etc. (non-current assets)

Valuation of Fixed asset

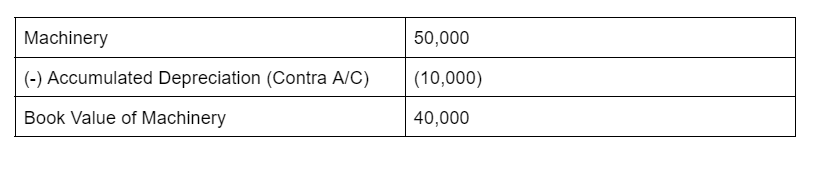

fixed assets are recorded at their net book value, which is the difference between the “historical cost of the asset” and “accumulated depreciation”.

“Net book value = Historical cost of the asset – Accumulated depreciation”

Example:

Hasley Co. purchases Furniture for their company at a price of 1,00,000. The Furniture has a constant depreciation of 10,000 per year. So, after 5 years, the net book value of the computer will be recorded as

1,00,000 – (5 x 10,000) = 50,000.

Therefore, the furniture value should be shown as 50,000 on the balance sheet.

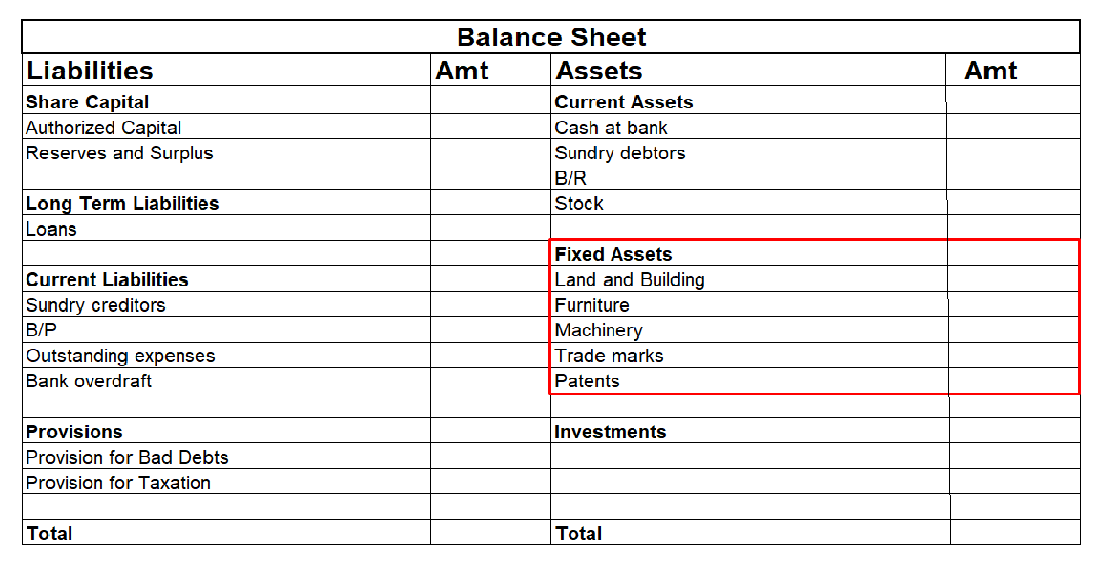

Presentation in the Balance Sheet

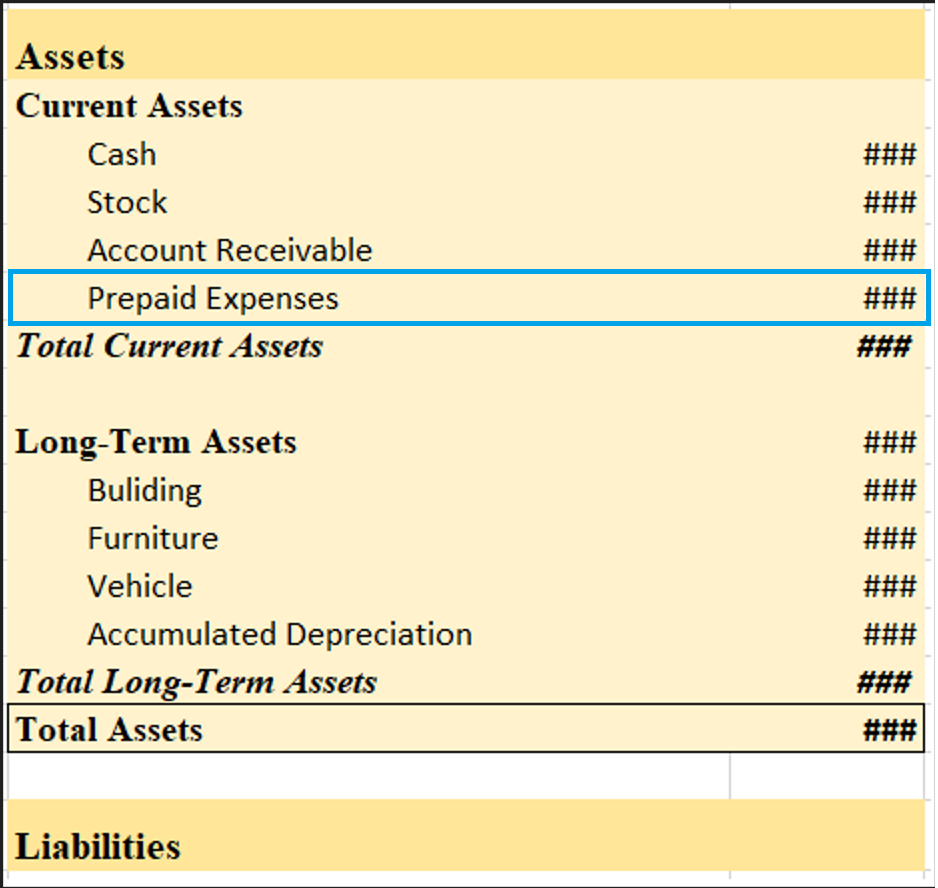

Both current assets and non-current assets are shown on the asset side(Right side) of the balance sheet.

Difference between Current Asset and Non-Current Asset

Current assets are the resources held for a short period of time and are mainly used for trading purposes whereas Fixed assets are assets that last for a long time and are acquired for continuous use by an entity.

The purpose to spend on fixed assets is to generate income over the long term and the purpose of the current assets is to spend on fixed assets to generate income over the long term.

At the time of the sale of fixed assets, there is a capital gain or capital loss but at the time of the sale of current assets, there is an operating gain or operating loss.

The main difference between the fixed asset and current asset is, although both are shown in the balance sheet fixed assets are depreciated every year and it is valued by (the cost of the asset – depreciation) and current asset is valued as per their current market value or cost value, whichever is lower.

See less

Meaning A valuation account is a balance sheet account that is paired with another balance sheet account to report the carrying amount of the paired account at a reduced value. The purpose of a valuation account is to reduce the balance of the concerned asset or liability without affecting the mainRead more

Meaning

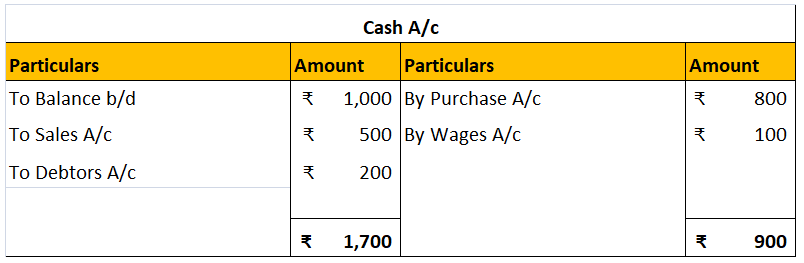

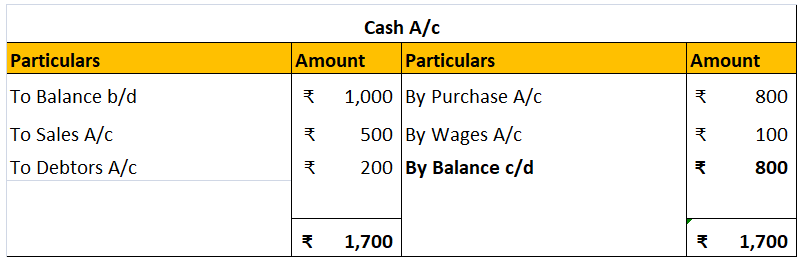

A valuation account is a balance sheet account that is paired with another balance sheet account to report the carrying amount of the paired account at a reduced value.

The purpose of a valuation account is to reduce the balance of the concerned asset or liability without affecting the main ledger account. This is a conservative approach to use valuation accounts to present the value of the concerned asset or liability at a reduced value.

The most common example of a valuation account is the ‘Provision for doubtful debts account’. It appears in the balance sheet as a reduction from the debtors’ accounts. Also when the amount is transferred to this provision, it appears in the statement of profit and loss account. But it doesn’t appear in the debtors’ account ledger.

Treatment

A valuation account appears only in the balance sheet. Sometimes, it also appears in the profit and loss account when any amount is transferred to it.

Valuation accounts are only used in accrual accounting. They cannot be used in cash-based accounting as there is no flow of cash related to valuation accounts.

They have a balance opposite of their paired accounts i.e. if their paired account is an asset then they will have a credit balance and if it is a liability then they will have a debit balance.

Other Examples of valuation accounts are as follows:

- Provision for doubtful debts (offsets the account receivables or debtors’ account)

- Accumulated depreciation (report the assets net of depreciation)

- Discount on bonds payable (reduces the reporting balance of bond payable account)

See less