A cash flow statement presents the changes in the cash and cash equivalents of a business. It classifies the cash flow items into either operating, investing, or financing activities. The cash flow statement provides information about the flow of cash over a period of time. General reserve is a reseRead more

A cash flow statement presents the changes in the cash and cash equivalents of a business. It classifies the cash flow items into either operating, investing, or financing activities. The cash flow statement provides information about the flow of cash over a period of time.

General reserve is a reserve created by taking a portion of the profits for future requirements.

TREATMENT OF GENERAL RESERVE

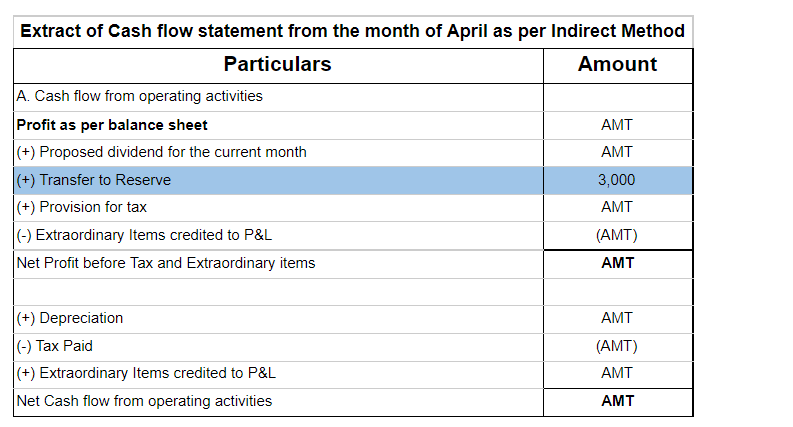

As per the indirect method, Since there is no actual flow of cash, any addition to reserves is added back to net profit for calculation of net profit before tax and extraordinary items. This net profit before tax will appear under cash flow from operating activities. If there is a reduction in reserve, then they are subtracted from net profit.

As per the Direct method, an increase or decrease in general reserve will not affect the cash flow statement since non-cash items are not recorded. Only cash receipts and payments that come under operating activities are recorded. So, net profit is not shown in the direct method and hence neither is general reserve.

General reserve does not fall under the head investing activities as investing activities involve the acquisition or disposal of long-term assets or investments. They do not fit in financing activities either as financing activities relate to change in capital or borrowings of the company.

EXAMPLE

If the balance in general reserve for the period of March was Rs 4,000 and in April the balance was Rs 7,000, then its treatment in cash flow would be:

See less

When a manager provides services to a company, he is expected to receive some kind of compensation. This is given in the form of managerial remuneration. Section 197 of the Companies Act allows a maximum remuneration of 11% of the net profit of the company to the directors, managing directors and whRead more

When a manager provides services to a company, he is expected to receive some kind of compensation. This is given in the form of managerial remuneration. Section 197 of the Companies Act allows a maximum remuneration of 11% of the net profit of the company to the directors, managing directors and whole-time directors etc. This section is applicable for public companies and not private companies

Yes, a company can pay managerial remuneration in case of inadequacy of profits or losses, provided they follow the condition in Schedule V of the Companies Act 2013.

Conditions

In order to pay remuneration while the company is at a loss, it has to comply with the following:

The limit mentioned above refers to the maximum limit of Rs 60 lakhs when the effective capital is negative or less than Rs 5 Crore. Such remuneration can also only be paid if such a manager does not have any interest in the company and also possesses special knowledge and expertise along with a graduate-level qualification.

Effective capital is the aggregate of paid-up share capital, share premium, reserves and surplus, long term loans and deposits and after subtracting Investments, accumulated losses and preliminary expenses not written off.

Percentage of Remuneration

When the Company earns adequate profits, they are allowed to provide remuneration up to a certain per cent. The percentage of remuneration depends on whether the directors are working whole-time or part-time according to the Companies Act.

See less