Order of Liquidity Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so onRead more

Order of Liquidity

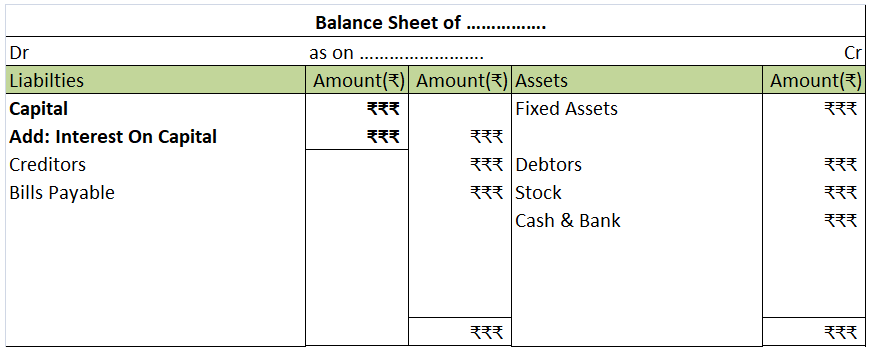

Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so on and further. In the end, we will write goodwill.

Liabilities are presented based on the order of urgency of payment. On the liabilities side, we start from short-term liabilities for example outstanding expenses, creditors and bill payable, and so on. In the end, we write capital adjusted with net profit and drawings if any.

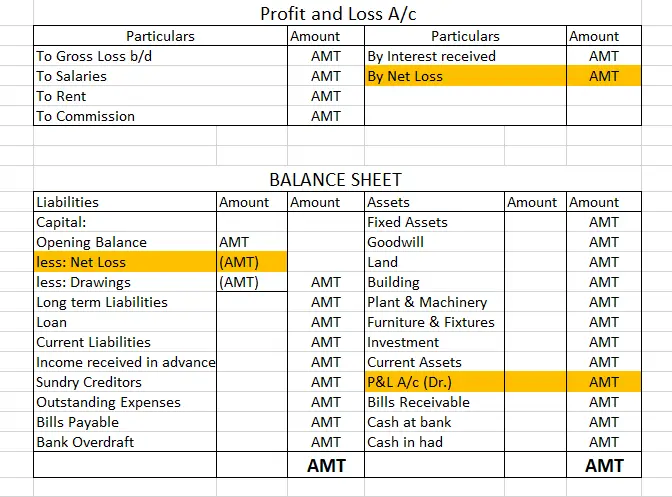

This approach is generally used by sole traders and partnerships firms. The following is the format of Balance sheet in order of liquidity:

Order of Permanence

Under this method, while preparing a balance sheet by a company assets are listed according to their permanency. Permanent assets are shown at first and then less permanent assets are shown afterward. On the assets side of the balance sheet starts with more fixed and permanent assets i.e. it begins with goodwill, building, machinery, furniture, then investments and ends with cash in hand as the last item.

The fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. On the liabilities side, we start from capital, Reserve and surplus, Long term loans and end with outstanding expenses.

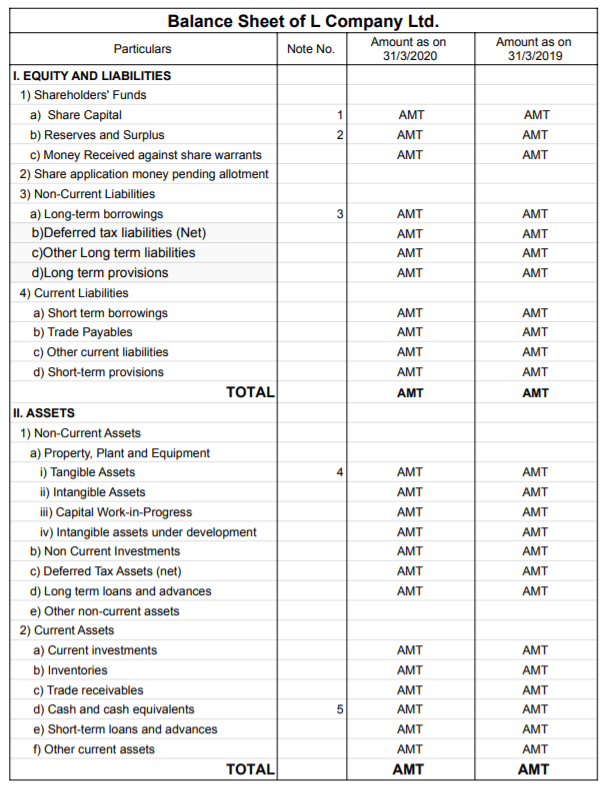

The following is the format of the Balance sheet in order of permanence:

Such order or arrangement of balance sheet items are refer as ‘Marshalling of Balance Sheet’.

See less

Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Bad debts will be treated in the following ways : On the debit side of the profit and loss account. In the curreRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Bad debts will be treated in the following ways :

On the debit side of the profit and loss account.

In the current assets side of the balance sheet, these are deducted from sundry debtors.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

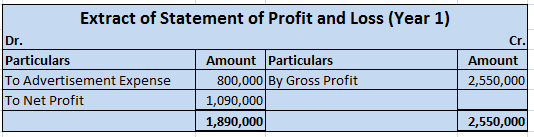

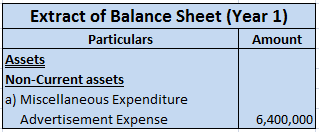

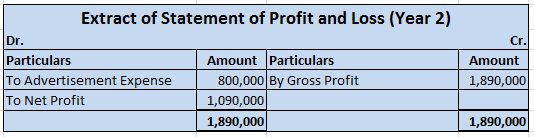

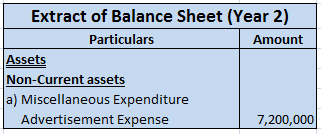

Now I will show you an extract of the profit and loss account and balance sheet

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or the rendering of services in the ordinary course of business.

For example, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Current liabilities are defined as liabilities that are payable normally within 12 months from the end of the accounting period or in other words which fall due for payment in a relatively short period.

For example bills payable, short-term loans, etc.

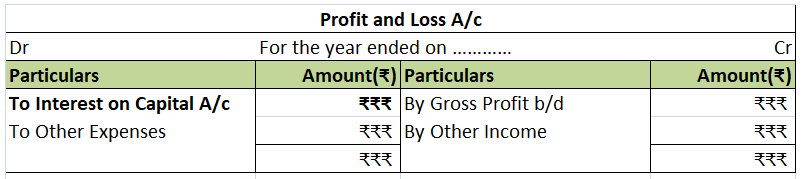

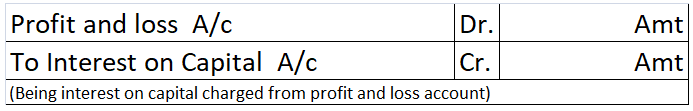

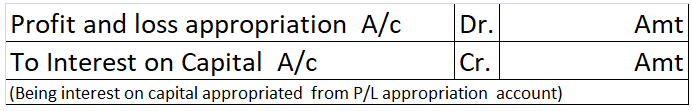

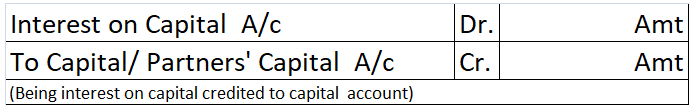

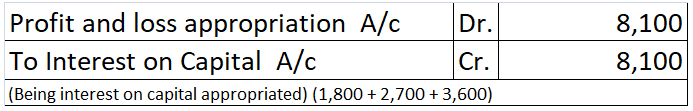

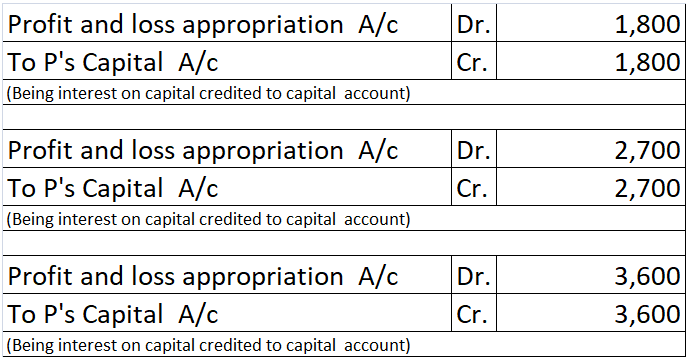

Accounting treatment

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

Reasons for bad debts

There are several reasons why businesses may have bad debts some of them are as follows:-

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

Related terms

So there are a few related terms whose meanings you should know

See less