Non-debt capital receipts As we're aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are thoseRead more

Non-debt capital receipts

As we’re aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are those money receipts of the government that either create a liability for a government or cause a reduction in assets.

Revenue receipts comprise both tax and non-tax revenues while capital receipts consist of capital receipts and non-debt capital receipts. Non-debt capital receipt is a part of capital receipt.

Definition

Non-debt capital receipts, also known as NDCR, are the taxes and duties levied by the government forming the biggest source of its income. Those receipts of the government lead to a decrease in assets, and not an increase in liabilities. It accounts for just 3% of the central government’s total receipts.

The union government usually lists non-debt capital receipts in two categories:

- Recovery of loans – Recovery of loans means the amount recovered when a loan defaults.

- Other receipts – Other receipts basically mean disinvestment proceeds from the sale of the government’s share in public-sector companies.

- Money accrued to the union government from the listing of central government companies and the issue of bonus shares.

For Example – Disinvestment and recovery of loans are non-debt creating capital receipts.

See less

Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’. Accounting Equation Accounting Equation depicts the relationship between the following items of a business: Assets, Liabilities and Owner’s Equity ( Capital ) It is a simple fRead more

Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’.

Accounting Equation

Accounting Equation depicts the relationship between the following items of a business:

It is a simple formula that implies that the total assets of a business are always equal to the sum of its liabilities and Owner’s Equity (Capital).

ASSETS = LIABILITIES + CAPITAL OR A = L + E

It is also known as the balance sheet equation.

This equation always holds good due to the double-entry system of accounting i.e. every event has a dual effect on items of the balance sheet.

Outstanding Rent

We know rent is an expense for a business and rent outstanding means that rent is due, not paid which implies it is a liability which the business has to settle.

Hence Rent Outstanding is subtracted from the capital balance and added to liabilities.

Let’s take an example to see how rent outstanding affects the accounting equation. Suppose a business has the following figures:

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000

Liabilities – Rs: 1,00,000

Assets = Liabilities + Capital

3,00,000 = 1,00,000 + 2,00,000

Now if Rent outstanding of Rs: 20,000 arises, this will happen:-

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000 – Rs: 20,000 = Rs: 2,80,000

Liabilities – Rs: 1,00,000 + Rs: 20,000 = Rs: 1,20,000

Assets = Liabilities + Capital

3,00,000 = 1,20,000 + 2,80,000.

Hence, when rent outstanding arises, it increases the liability and decreases the Capital by the same amount. Therefore both the sides tally and the accounting equations holds good.

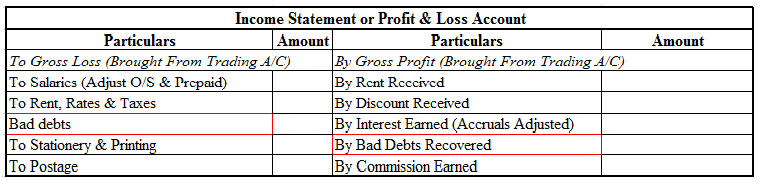

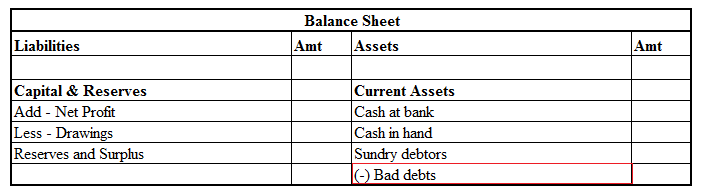

Rent Outstanding is shown on the liabilities side of the balance sheet. Also, the rent outstanding of the current year is shown in the debit side profit and loss account and we know the balance of the P/L account if profit, is added to Capital and in case of loss it is subtracted from Capital. Hence, the rent outstanding is subtracted from the capital.

I hope my answer was useful to you.

See less